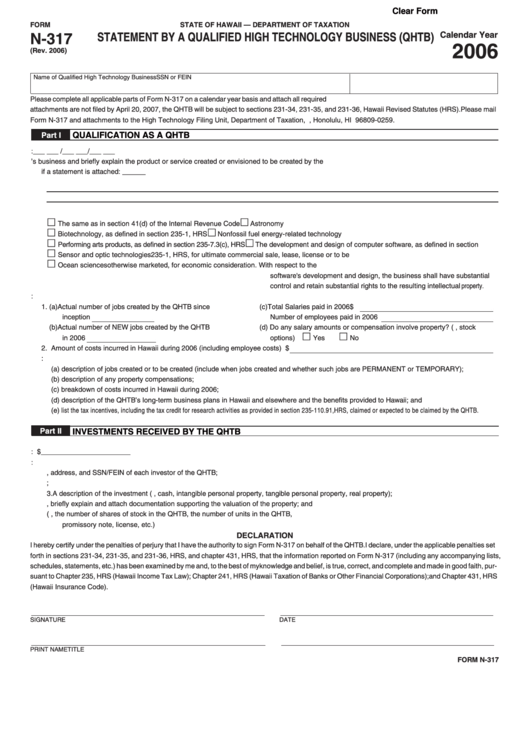

Clear Form

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

Calendar Year

STATEMENT BY A QUALIFIED HIGH TECHNOLOGY BUSINESS (QHTB)

N-317

2006

(Rev. 2006)

Name of Qualified High Technology Business

SSN or FEIN

Please complete all applicable parts of Form N-317 on a calendar year basis and attach all required information. If a completed Form N-317 and the required

attachments are not filed by April 20, 2007, the QHTB will be subject to sections 231-34, 231-35, and 231-36, Hawaii Revised Statutes (HRS). Please mail

Form N-317 and attachments to the High Technology Filing Unit, Department of Taxation, P.O. Box 259, Honolulu, HI 96809-0259.

Part I

QUALIFICATION AS A QHTB

A. Enter the date the QHTB began doing business:

___ ___ /___ ___/___ ___

B. Describe the nature of the QHTB’s business and briefly explain the product or service created or envisioned to be created by the QHTB. Check here

if a statement is attached: ______

C. Check the boxes that describe the qualified research activities performed by the QHTB in calendar year 2006.

£

£

The same as in section 41(d) of the Internal Revenue Code

Astronomy

£

£

Biotechnology, as defined in section 235-1, HRS

Nonfossil fuel energy-related technology

£

£

Performing arts products, as defined in section 235-7.3(c), HRS

The development and design of computer software, as defined in section

£

Sensor and optic technologies

235-1, HRS, for ultimate commercial sale, lease, license or to be

£

Ocean sciences

otherwise marketed, for economic consideration. With respect to the

software's development and design, the business shall have substantial

control and retain substantial rights to the resulting intellectual property.

D. Please provide the following information:

1. (a) Actual number of jobs created by the QHTB since

(c) Total Salaries paid in 2006 $

inception

Number of employees paid in 2006

(b) Actual number of NEW jobs created by the QHTB

(d) Do any salary amounts or compensation involve property? (e.g., stock

£

£

in 2006

options)

Yes

No

2. Amount of costs incurred in Hawaii during 2006 (including employee costs) $

3. Separate sheets must be attached providing the following information:

(a) description of jobs created or to be created (include when jobs created and whether such jobs are PERMANENT or TEMPORARY);

(b) description of any property compensations;

(c) breakdown of costs incurred in Hawaii during 2006;

(d) description of the QHTB’s long-term business plans in Hawaii and elsewhere and the benefits provided to Hawaii; and

(e) list the tax incentives, including the tax credit for research activities as provided in section 235-110.91, HRS, claimed or expected to be claimed by the QHTB.

Part II

INVESTMENTS RECEIVED BY THE QHTB

A. Enter the total amount of investments received by the QHTB from investors in calendar year 2006: $_______________________

B. Attach a list containing the following information about each investor:

1.

Name, address, and SSN/FEIN of each investor of the QHTB;

2.

The amount of the investment and the date the investment was received;

3.

A description of the investment (e.g., cash, intangible personal property, tangible personal property, real property);

4.

If the investment is property, briefly explain and attach documentation supporting the valuation of the property; and

5.

What the investor received in return for this investment (e.g., the number of shares of stock in the QHTB, the number of units in the QHTB,

promissory note, license, etc.)

DECLARATION

I hereby certify under the penalties of perjury that I have the authority to sign Form N-317 on behalf of the QHTB. I declare, under the applicable penalties set

forth in sections 231-34, 231-35, and 231-36, HRS, and chapter 431, HRS, that the information reported on Form N-317 (including any accompanying lists,

schedules, statements, etc.) has been examined by me and, to the best of my knowledge and belief, is true, correct, and complete and made in good faith, pur-

suant to Chapter 235, HRS (Hawaii Income Tax Law); Chapter 241, HRS (Hawaii Taxation of Banks or Other Financial Corporations); and Chapter 431, HRS

(Hawaii Insurance Code).

SIGNATURE

DATE

PRINT NAME

TITLE

FORM N-317

1

1