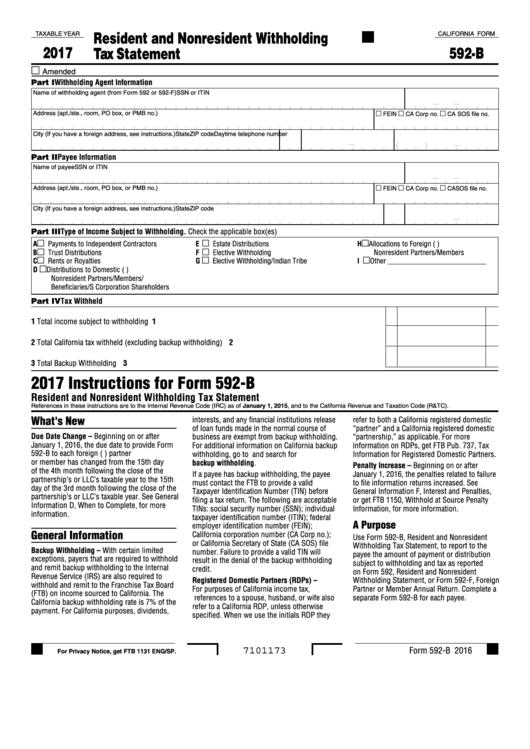

Resident and Nonresident Withholding

TAXABLE YEAR

CALIFORNIA FORM

2017

592-B

Tax Statement

m

Amended

Part I Withholding Agent Information

Name of withholding agent (from Form 592 or 592-F)

SSN or ITIN

m

m

m

Address (apt./ste., room, PO box, or PMB no.)

FEIN

CA Corp no.

CA SOS file no.

City (If you have a foreign address, see instructions.)

State

ZIP code

Daytime telephone number

(

(

)

)

Part II Payee Information

Name of payee

SSN or ITIN

m

m

m

Address (apt./ste., room, PO box, or PMB no.)

FEIN

CA Corp no.

CA SOS file no.

City (If you have a foreign address, see instructions.)

State

ZIP code

Part III Type of Income Subject to Withholding. Check the applicable box(es)

m

m

m

A

Payments to Independent Contractors

E

Estate Distributions

H

Allocations to Foreign (non-U.S.)

m

m

B

Trust Distributions

F

Elective Withholding

Nonresident Partners/Members

m

m

m

C

Rents or Royalties

G

Elective Withholding/Indian Tribe

I

Other ___________________________

m

D

Distributions to Domestic (U.S.)

Nonresident Partners/Members/

Beneficiaries/S Corporation Shareholders

Part IV Tax Withheld

1 Total income subject to withholding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Total California tax withheld (excluding backup withholding). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Total Backup Withholding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

2017 Instructions for Form 592-B

Resident and Nonresident Withholding Tax Statement

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

What's New

interests, and any financial institutions release

refer to both a California registered domestic

of loan funds made in the normal course of

“partner” and a California registered domestic

Due Date Change – Beginning on or after

business are exempt from backup withholding.

“partnership,” as applicable. For more

January 1, 2016, the due date to provide Form

For additional information on California backup

information on RDPs, get FTB Pub. 737, Tax

592-B to each foreign (non-U.S.) partner

withholding, go to ftb.ca.gov and search for

Information for Registered Domestic Partners.

or member has changed from the 15th day

backup withholding.

Penalty Increase – Beginning on or after

of the 4th month following the close of the

If a payee has backup withholding, the payee

January 1, 2016, the penalties related to failure

partnership’s or LLC’s taxable year to the 15th

must contact the FTB to provide a valid

to file information returns increased. See

day of the 3rd month following the close of the

Taxpayer Identification Number (TIN) before

General Information F, Interest and Penalties,

partnership’s or LLC’s taxable year. See General

filing a tax return. The following are acceptable

or get FTB 1150, Withhold at Source Penalty

Information D, When to Complete, for more

TINs: social security number (SSN); individual

Information, for more information.

information.

taxpayer identification number (ITIN); federal

A

Purpose

employer identification number (FEIN);

General Information

California corporation number (CA Corp no.);

Use Form 592-B, Resident and Nonresident

or California Secretary of State (CA SOS) file

Withholding Tax Statement, to report to the

Backup Withholding – With certain limited

number. Failure to provide a valid TIN will

payee the amount of payment or distribution

exceptions, payers that are required to withhold

result in the denial of the backup withholding

subject to withholding and tax as reported

and remit backup withholding to the Internal

credit.

on Form 592, Resident and Nonresident

Revenue Service (IRS) are also required to

Registered Domestic Partners (RDPs) –

Withholding Statement, or Form 592-F, Foreign

withhold and remit to the Franchise Tax Board

For purposes of California income tax,

Partner or Member Annual Return. Complete a

(FTB) on income sourced to California. The

references to a spouse, husband, or wife also

separate Form 592-B for each payee.

California backup withholding rate is 7% of the

refer to a California RDP, unless otherwise

payment. For California purposes, dividends,

specified. When we use the initials RDP they

Form 592-B 2016

7101173

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2