Form W-2 - Claim For Refund Of Tax Withheld For The Time Spent Outside The City

ADVERTISEMENT

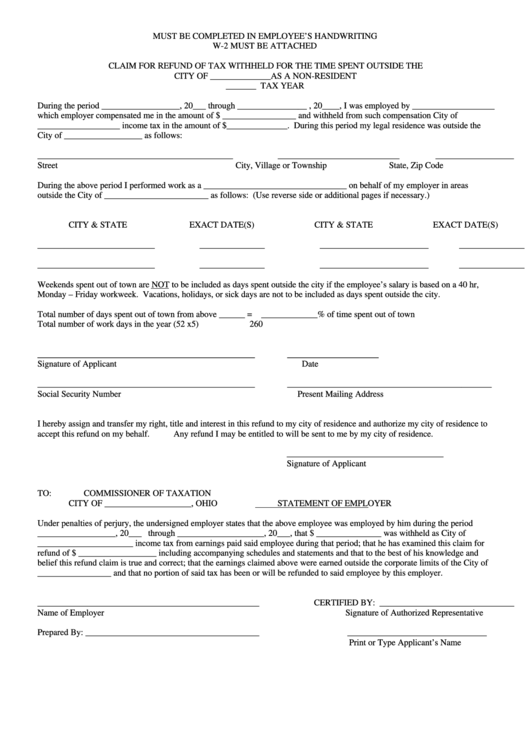

MUST BE COMPLETED IN EMPLOYEE’S HANDWRITING

W-2 MUST BE ATTACHED

CLAIM FOR REFUND OF TAX WITHHELD FOR THE TIME SPENT OUTSIDE THE

CITY OF ______________AS A NON-RESIDENT

_______ TAX YEAR

During the period __________________, 20___ through ________________ , 20____, I was employed by ___________________

which employer compensated me in the amount of $ _________________ and withheld from such compensation City of

___________________ income tax in the amount of $______________. During this period my legal residence was outside the

City of __________________ as follows:

_____________________________________________

____________________________

__________________

Street

City, Village or Township

State, Zip Code

During the above period I performed work as a _________________________________ on behalf of my employer in areas

outside the City of ________________________ as follows: (Use reverse side or additional pages if necessary.)

CITY & STATE

EXACT DATE(S)

CITY & STATE

EXACT DATE(S)

___________________________

_______________

_________________________

_______________

___________________________

_______________

_________________________

_______________

Weekends spent out of town are NOT to be included as days spent outside the city if the employee’s salary is based on a 40 hr,

Monday – Friday workweek. Vacations, holidays, or sick days are not to be included as days spent outside the city.

Total number of days spent out of town from above ______ = _____________% of time spent out of town

Total number of work days in the year (52 x5)

260

__________________________________________________

_____________________

Signature of Applicant

Date

__________________________________________________

_______________________________________________

Social Security Number

Present Mailing Address

I hereby assign and transfer my right, title and interest in this refund to my city of residence and authorize my city of residence to

accept this refund on my behalf.

Any refund I may be entitled to will be sent to me by my city of residence.

____________________________________

Signature of Applicant

TO:

COMMISSIONER OF TAXATION

CITY OF ____________________, OHIO

STATEMENT OF EMPLOYER

Under penalties of perjury, the undersigned employer states that the above employee was employed by him during the period

__________________, 20___ through ____________________, 20___, that $ _______________ was withheld as City of

______________________ income tax from earnings paid said employee during that period; that he has examined this claim for

refund of $ __________________ including accompanying schedules and statements and that to the best of his knowledge and

belief this refund claim is true and correct; that the earnings claimed above were earned outside the corporate limits of the City of

_________________ and that no portion of said tax has been or will be refunded to said employee by this employer.

___________________________________________________

CERTIFIED BY: _______________________________

Name of Employer

Signature of Authorized Representative

Prepared By: ________________________________________

________________________________

Print or Type Applicant’s Name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1