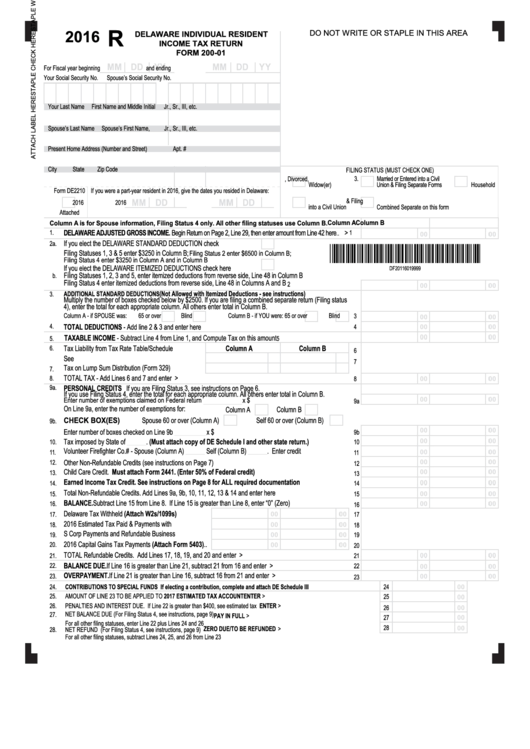

R

2016

DO NOT WRITE OR STAPLE IN THIS AREA

DELAWARE INDIVIDUAL RESIDENT

INCOME TAX RETURN

FORM 200-01

Reset

For Fiscal year beginning

and ending

Your Social Security No.

Spouse’s Social Security No.

Print Form

Your Last Name

First Name and Middle Initial

Jr., Sr., III, etc.

Spouse’s Last Name

Spouse’s First Name,

Jr., Sr., III, etc.

Present Home Address (Number and Street)

Apt. #

City

State

Zip Code

FILING STATUS (MUST CHECK ONE)

1.

Single, Divorced,

3.

Married or Entered into a Civil

5.

Head of

Widow(er)

Union & Filing Separate Forms

Household

Form DE2210 If you were a part-year resident in 2016, give the dates you resided in Delaware:

2.

Joint or Entered

4.

Married or Entered into a Civil Union & Filing

2016

2016

into a Civil Union

Combined Separate on this form

Attached

Column A

Column B

Column A is for Spouse information, Filing Status 4 only. All other filing statuses use Column B.

DELAWARE ADJUSTED GROSS INCOME. Begin Return on Page 2, Line 29, then enter amount from Line 42 here

>

1.

1

..

If you elect the DELAWARE STANDARD DEDUCTION check here..............

2a.

*DF20116019999*

Filing Statuses 1, 3 & 5 enter $3250 in Column B;

Filing Status 2 enter $6500 in Column B;

Filing Status 4 enter $3250 in Column A and in Column B

If you elect the DELAWARE ITEMIZED DEDUCTIONS check here

...............

DF20116019999

Filing Statuses 1, 2, 3 and 5, enter itemized deductions from reverse side, Line 48 in Column B

b.

Filing Status 4 enter itemized deductions from reverse side, Line 48 in Columns A and B

2

(Not Allowed with Itemized Deductions - see instructions)

ADDITIONAL STANDARD DEDUCTIONS

3.

Multiply the number of boxes checked below by $2500. If you are filing a combined separate return (Filing status

4), enter the total for each appropriate column. All others enter total in Column B.

Column A - if SPOUSE was:

65 or over

Blind

Column B - if YOU were: 65 or over

Blind

3

TOTAL DEDUCTIONS - Add line 2 & 3 and enter here

4.

4

......................................................................................................

TAXABLE INCOME - Subtract Line 4 from Line 1, and Compute Tax on this amount

5.

................................................

5

Tax Liability from Tax Rate Table/Schedule

Column A

Column B

6.

6

See Instructions..........................................................

7

Tax on Lump Sum Distribution (Form 329).................

7.

TOTAL TAX - Add Lines 6 and 7 and enter here......................................................................................................>

8.

8

PERSONAL CREDITS If you are Filing Status 3, see instructions on Page 6.

9a.

If you use Filing Status 4, enter the total for each appropriate column. All others enter total in Column B.

Enter number of exemptions claimed on Federal return

____________

x $110....................................................

9a

On Line 9a, enter the number of exemptions for:

Column A

Column B

Spouse 60 or over (Column A)

Self 60 or over (Column B)

CHECK BOX(ES)

9b.

Enter number of boxes checked on Line 9b

__________

x $110...........................................................................

9b

Tax imposed by State of ______. (Must attach copy of DE Schedule I and other state return.) .....................

10.

10

Volunteer Firefighter Co.# - Spouse (Column A)

______

Self (Column B) ______. Enter credit amount..............

11.

11

12.

Other Non-Refundable Credits (see instructions on Page 7) .................................................................................

12

Child Care Credit. Must attach Form 2441. (Enter 50% of Federal credit) .......................................................

13.

13

Earned Income Tax Credit. See instructions on Page 8 for ALL required documentation.............................

14.

14

Total Non-Refundable Credits. Add Lines 9a, 9b, 10, 11, 12, 13 & 14 and enter here ...........................................

15.

15

BALANCE. Subtract Line 15 from Line 8. If Line 15 is greater than Line 8, enter “0” (Zero)................................

16.

16

Delaware Tax Withheld (Attach W2s/1099s)...................

17.

17

2016 Estimated Tax Paid & Payments with Extensions...

18.

18

S Corp Payments and Refundable Business Credits.......

19.

19

2016 Capital Gains Tax Payments (Attach Form 5403)..

20.

20

TOTAL Refundable Credits. Add Lines 17, 18, 19, and 20 and enter here.............................................................>

21.

21

BALANCE DUE. If Line 16 is greater than Line 21, subtract 21 from 16 and enter here........................................>

22.

22

OVERPAYMENT. If Line 21 is greater than Line 16, subtract 16 from 21 and enter here.......................................>

23.

23

24.

CONTRIBUTIONS TO SPECIAL FUNDS If electing a contribution, complete and attach DE Schedule III................................................

24

25.

AMOUNT OF LINE 23 TO BE APPLIED TO 2017 ESTIMATED TAX ACCOUNT.................................................................................ENTER >

25

26.

PENALTIES AND INTEREST DUE. If Line 22 is greater than $400, see estimated tax instructions....................................................ENTER >

26

27.

NET BALANCE DUE (For Filing Status 4, see instructions, page 9) ............................................................................................PAY IN FULL >

27

For all other filing statuses, enter Line 22 plus Lines 24 and 26

28

NET REFUND (For Filing Status 4, see instructions, page 9) ...................................................................... ZERO DUE/TO BE REFUNDED >

28.

For all other filing statuses, subtract Lines 24, 25, and 26 from Line 23

1

1 2

2 3

3