Form R-6466 - Application For Extension Of Time To File Partnership (Form It-565) Or Fiduciary (Form It-541) Return - 2007

ADVERTISEMENT

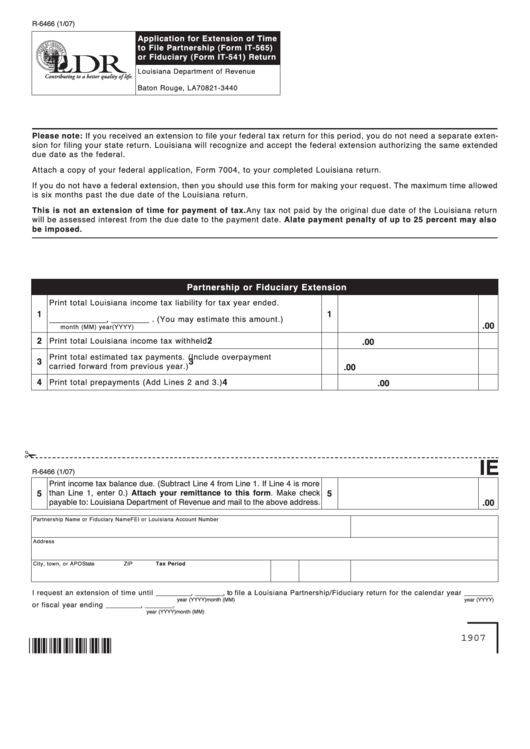

R-6466 (1/07)

Application for Extension of Time

to File Partnership (Form IT-565)

or Fiduciary (Form IT-541) Return

Louisiana Department of Revenue

Contributing to a better quality of life.

P.O. Box 3440

Baton Rouge, LA 70821-3440

Please note: If you received an extension to file your federal tax return for this period, you do not need a separate exten-

sion for filing your state return. Louisiana will recognize and accept the federal extension authorizing the same extended

due date as the federal.

Attach a copy of your federal application, Form 7004, to your completed Louisiana return.

If you do not have a federal extension, then you should use this form for making your request. The maximum time allowed

is six months past the due date of the Louisiana return.

This is not an extension of time for payment of tax. Any tax not paid by the original due date of the Louisiana return

will be assessed interest from the due date to the payment date. A late payment penalty of up to 25 percent may also

be imposed.

Partnership or Fiduciary Extension

Print total Louisiana income tax liability for tax year ended.

1

1

____________, ________ .

(You may estimate this amount.)

.00

month (MM)

year(YYYY)

2

2

Print total Louisiana income tax withheld

.00

Print total estimated tax payments. (Include overpayment

3

3

carried forward from previous year.)

.00

4

4

Print total prepayments (Add Lines 2 and 3.)

.00

✁

IE

R-6466 (1/07)

Print income tax balance due. (Subtract Line 4 from Line 1. If Line 4 is more

than Line 1, enter 0.) Attach your remittance to this form. Make check

5

5

payable to: Louisiana Department of Revenue and mail to the above address.

.00

Partnership Name or Fiduciary Name

FEI or Louisiana Account Number

Address

City, town, or APO

State

ZIP

Tax Period

I request an extension of time until __________, ________, to file a Louisiana Partnership/Fiduciary return for the calendar year ________

month (MM)

year (YYYY)

year (YYYY)

or fiscal year ending __________, ________.

month (MM)

year (YYYY)

1907

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1