Form Cd-3 - West Virginia State

ADVERTISEMENT

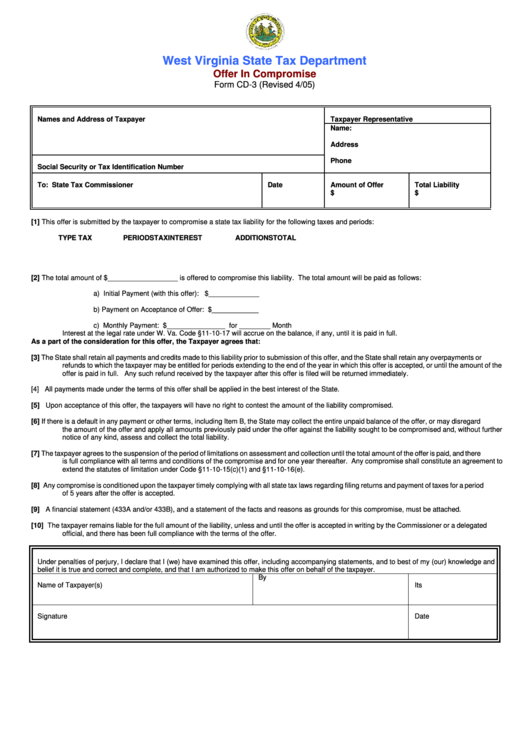

West Virginia State Tax Department

Offer In Compromise

Form CD-3 (Revised 4/05)

Names and Address of Taxpayer

Taxpayer Representative

Name:

Address

Phone

Social Security or Tax Identification Number

To: State Tax Commissioner

Date

Amount of Offer

Total Liability

$

$

[1]

This offer is submitted by the taxpayer to compromise a state tax liability for the following taxes and periods:

TYPE TAX

PERIODS

TAX

INTEREST

ADDITIONS

TOTAL

[2]

The total amount of $__________________ is offered to compromise this liability. The total amount will be paid as follows:

a) Initial Payment (with this offer): $_____________

b) Payment on Acceptance of Offer: $____________

c) Monthly Payment: $_______________ for ________ Month

Interest at the legal rate under W. Va. Code §11-10-17 will accrue on the balance, if any, until it is paid in full.

As a part of the consideration for this offer, the Taxpayer agrees that:

[3]

The State shall retain all payments and credits made to this liability prior to submission of this offer, and the State shall retain any overpayments or

refunds to which the taxpayer may be entitled for periods extending to the end of the year in which this offer is accepted, or until the amount of the

offer is paid in full. Any such refund received by the taxpayer after this offer is filed will be returned immediately.

[4]

All payments made under the terms of this offer shall be applied in the best interest of the State.

[5]

Upon acceptance of this offer, the taxpayers will have no right to contest the amount of the liability compromised.

[6]

If there is a default in any payment or other terms, including Item B, the State may collect the entire unpaid balance of the offer, or may disregard

the amount of the offer and apply all amounts previously paid under the offer against the liability sought to be compromised and, without further

notice of any kind, assess and collect the total liability.

[7]

The taxpayer agrees to the suspension of the period of limitations on assessment and collection until the total amount of the offer is paid, and there

is full compliance with all terms and conditions of the compromise and for one year thereafter. Any compromise shall constitute an agreement to

extend the statutes of limitation under Code §11-10-15(c)(1) and §11-10-16(e).

[8]

Any compromise is conditioned upon the taxpayer timely complying with all state tax laws regarding filing returns and payment of taxes for a period

of 5 years after the offer is accepted.

[9]

A financial statement (433A and/or 433B), and a statement of the facts and reasons as grounds for this compromise, must be attached.

[10]

The taxpayer remains liable for the full amount of the liability, unless and until the offer is accepted in writing by the Commissioner or a delegated

official, and there has been full compliance with the terms of the offer.

Under penalties of perjury, I declare that I (we) have examined this offer, including accompanying statements, and to best of my (our) knowledge and

belief it is true and correct and complete, and that I am authorized to make this offer on behalf of the taxpayer.

Name of Taxpayer(s)

By

Its

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1