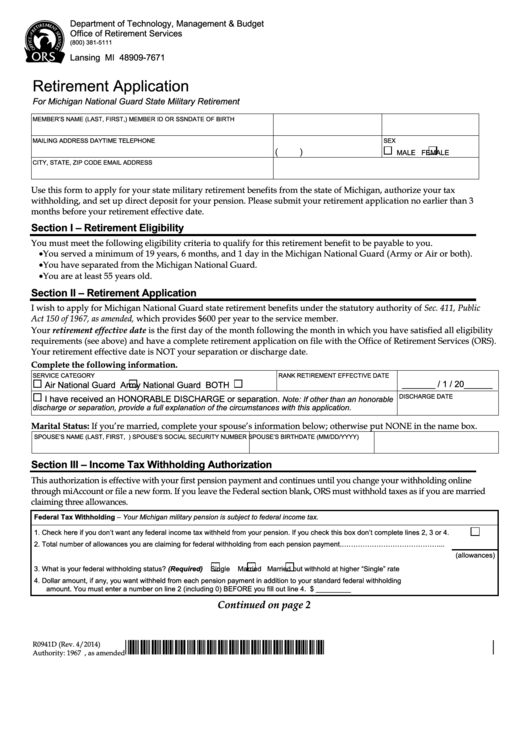

Form R0941d - Retirement Application

ADVERTISEMENT

Department of Technology, Management & Budget

Office of Retirement Services

(800) 381-5111

P.O. Box 30171

Lansing MI 48909-7671

Retirement Application

For Michigan National Guard State Military Retirement

MEMBER’S NAME (LAST, FIRST, M.I.)

MEMBER ID OR SSN

DATE OF BIRTH

MAILING ADDRESS

DAYTIME TELEPHONE

SEX

(

)

MALE

FEMALE

CITY, STATE, ZIP CODE

EMAIL ADDRESS

Use this form to apply for your state military retirement benefits from the state of Michigan, authorize your tax

withholding, and set up direct deposit for your pension. Please submit your retirement application no earlier than 3

months before your retirement effective date.

Section I – Retirement Eligibility

You must meet the following eligibility criteria to qualify for this retirement benefit to be payable to you.

• You served a minimum of 19 years, 6 months, and 1 day in the Michigan National Guard (Army or Air or both).

• You have separated from the Michigan National Guard.

• You are at least 55 years old.

Section II – Retirement Application

I wish to apply for Michigan National Guard state retirement benefits under the statutory authority of Sec. 411, Public

Act 150 of 1967, as amended, which provides $600 per year to the service member.

Your retirement effective date is the first day of the month following the month in which you have satisfied all eligibility

requirements (see above) and have a complete retirement application on file with the Office of Retirement Services (ORS).

Your retirement effective date is NOT your separation or discharge date.

Complete the following information.

SERVICE CATEGORY

RANK

RETIREMENT EFFECTIVE DATE

_______ / 1 / 20______

Air National Guard

Army National Guard

BOTH

DISCHARGE DATE

I have received an HONORABLE DISCHARGE or separation.

Note: If other than an honorable

discharge or separation, provide a full explanation of the circumstances with this application.

Marital Status: If you’re married, complete your spouse’s information below; otherwise put NONE in the name box.

SPOUSE’S NAME (LAST, FIRST, M.I.)

SPOUSE’S SOCIAL SECURITY NUMBER

SPOUSE’S BIRTHDATE (MM/DD/YYYY)

Section III – Income Tax Withholding Authorization

This authorization is effective with your first pension payment and continues until you change your withholding online

through miAccount or file a new form. If you leave the Federal section blank, ORS must withhold taxes as if you are married

claiming three allowances.

Federal Tax Withholding – Your Michigan military pension is subject to federal income tax.

1. Check here if you don’t want any federal income tax withheld from your pension. If you check this box don’t complete lines 2, 3 or 4.

2. Total number of allowances you are claiming for federal withholding from each pension payment.……………………………………...

(allowances)

3. What is your federal withholding status? (Required)

Single

Married

Married but withhold at higher “Single” rate

4. Dollar amount, if any, you want withheld from each pension payment in addition to your standard federal withholding

amount. You must enter a number on line 2 (including 0) BEFORE you fill out line 4.

$ _________

Continued on page 2

*000539000000000H*

R0941D (Rev. 4/2014)

Authority: 1967 P.A. 150, as amended

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2