Form I884 - Incomplete Withholding Of Emst

ADVERTISEMENT

I884 2/05

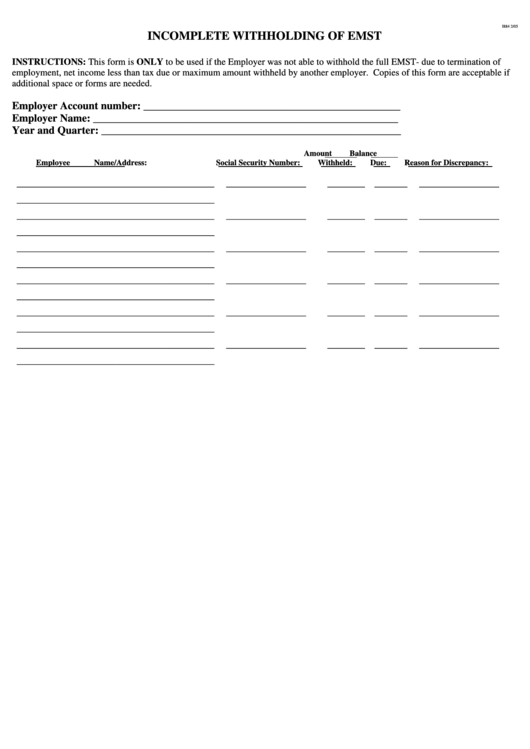

INCOMPLETE WITHHOLDING OF EMST

INSTRUCTIONS: This form is ONLY to be used if the Employer was not able to withhold the full EMST- due to termination of

employment, net income less than tax due or maximum amount withheld by another employer. Copies of this form are acceptable if

additional space or forms are needed.

Employer Account number: ________________________________________________

Employer Name: _________________________________________________________

Year and Quarter: ________________________________________________________

Amount

Balance

Employee Name/Address:

Social Security Number:

Withheld:

Due:

Reason for Discrepancy:

__________________________________________

_________________

________ _______

_________________

__________________________________________

__________________________________________

_________________

________ _______

_________________

__________________________________________

__________________________________________

_________________

________ _______

_________________

__________________________________________

__________________________________________

_________________

________ _______

_________________

__________________________________________

__________________________________________

_________________

________ _______

_________________

__________________________________________

__________________________________________

_________________

________ _______

_________________

__________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1