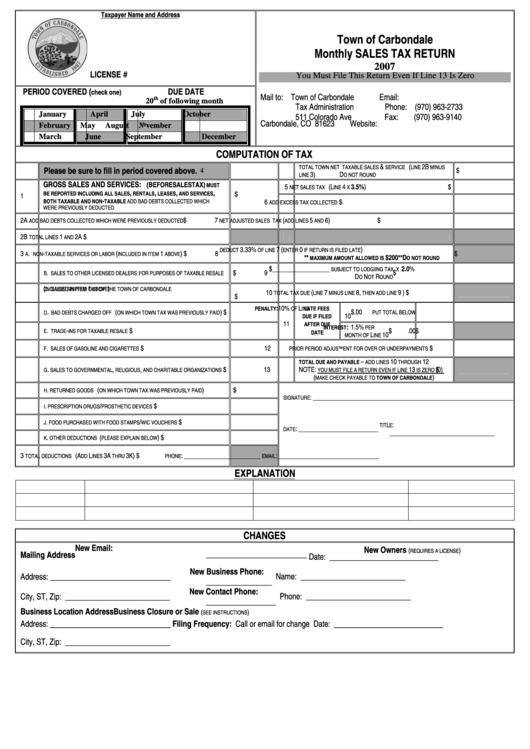

Monthly Sales Tax Return Form - Town Of Carbondale - 2007

ADVERTISEMENT

Taxpayer Name and Address

Town of Carbondale

Monthly SALES TAX RETURN

2007

LICENSE #

You Must File This Return Even If Line 13 Is Zero

PERIOD COVERED (

DUE DATE

check one)

Mail to: Town of Carbondale

Email:

tax@carbondaleco.net

th

20

of following month

Tax Administration

Phone: (970) 963-2733

January

April

July

October

511 Colorado Ave

Fax:

(970) 963-9140

Carbondale, CO 81623

Website:

February

May

August

November

March

June

September

December

COMPUTATION OF TAX

&

(

2B

TOTAL TOWN NET TAXABLE SALES

SERVICE

LINE

MINUS

Please be sure to fill in period covered above.

4

$

3)

D

LINE

O NOT ROUND

GROSS SALES AND SERVICES:

(BEFORE SALES TAX)

MUST

5

(L

4

3.5%)

$

NET SALES TAX

INE

X

,

,

,

,

BE REPORTED INCLUDING ALL SALES

RENTALS

LEASES

AND SERVICES

1

$

-

BOTH TAXABLE AND NON

TAXABLE ADD BAD DEBTS COLLECTED WHICH

6

$

ADD EXCESS TAX COLLECTED

WERE PREVIOUSLY DEDUCTED

2A

$

7

(

5

6)

$

ADD BAD DEBTS COLLECTED WHICH WERE PREVIOUSLY DEDUCTED

NET ADJUSTED SALES TAX

ADD LINES

AND

2B

1

2A

$

TOTAL LINES

AND

3.33%

7 (

0

)

DEDUCT

OF LINE

ENTER

IF RETURN IS FILED LATE

3

.

-

(

1

)

$

8

$

A

NON

TAXABLE SERVICES OR LABOR

INCLUDED IN ITEM

ABOVE

**

$200 ** D

MAXIMUM AMOUNT ALLOWED IS

O NOT ROUND

$__________________

2.0%

SUBJECT TO LODGIING TAX X

.

$

9

$

B

SALES TO OTHER LICENSED DEALERS FOR PURPOSES OF TAXABLE RESALE

D

N

R

O

OT

OUND

.

C

SALES SHIPPED OUT OF THE TOWN OF CARBONDALE

10

(

7

8,

9 )

$

TOTAL TAX DUE

LINE

MINUS LINE

THEN ADD LINE

(

1

)

$

INCLUDED IN ITEM

ABOVE

: 10%

L

LATE FEES

PENALTY

OF

INE

.

(

)

$

$

.00

D

BAD DEBTS CHARGED OFF

ON WHICH TOWN TAX WAS PREVIOUSLY PAID

PUT TOTAL BELOW

10

DUE IF FILED

11

AFTER DUE

: 1.5%

INTEREST

PER

.

-

$

$

.00

$

E

TRADE

INS FOR TAXABLE RESALE

DATE

L

10

MONTH OF

INE

.

$

12

$

F

SALES OF GASOLINE AND CIGARETTES

PRIOR PERIOD ADJUSTMENT FOR OVER OR UNDERPAYMENTS

–

10

12

TOTAL DUE AND PAYABLE

ADD LINES

THROUGH

.

,

,

$

13

NOTE:

13

(0)

$

G

SALES TO GOVERNMENTAL

RELIGIOUS

AND CHARITABLE ORGANIZATIONS

YOU MUST FILE A RETURN EVEN IF LINE

IS ZERO

(

)

MAKE CHECK PAYABLE TO TOWN OF CARBONDALE

.

(

)

$

H

RETURNED GOODS

ON WHICH TOWN TAX WAS PREVIOUSLY PAID

: _______________________________________________________________

SIGNATURE

.

/

$

I

PRESCRIPTION DRUGS

PROSTHETIC DEVICES

.

/

$

J

FOOD PURCHASED WITH FOOD STAMPS

WIC VOUCHERS

:

TITLE

: _________________________

DATE

_________________________________

.

(

)

$

K

OTHER DEDUCTIONS

PLEASE EXPLAIN BELOW

3

(A

L

3A

3K)

$

: ________________________

: ________________________________

TOTAL DEDUCTIONS

DD

INES

THRU

PHONE

EMAIL

EXPLANATION

CHANGES

New Email:

New Owners

(

)

REQUIRES A LICENSE

Mailing Address

__________________________

Date: ____________________________

New Business Phone:

Address: _______________________________

Name: ___________________________

_________________

New Contact Phone:

City, ST, Zip: ___________________________

Phone: ___________________________

__________________

Business Location Address

Business Closure or Sale

(

)

SEE INSTRUCTIONS

Address: _______________________________

Filing Frequency: Call or email for change

Date: ____________________________

City, ST, Zip: ___________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2