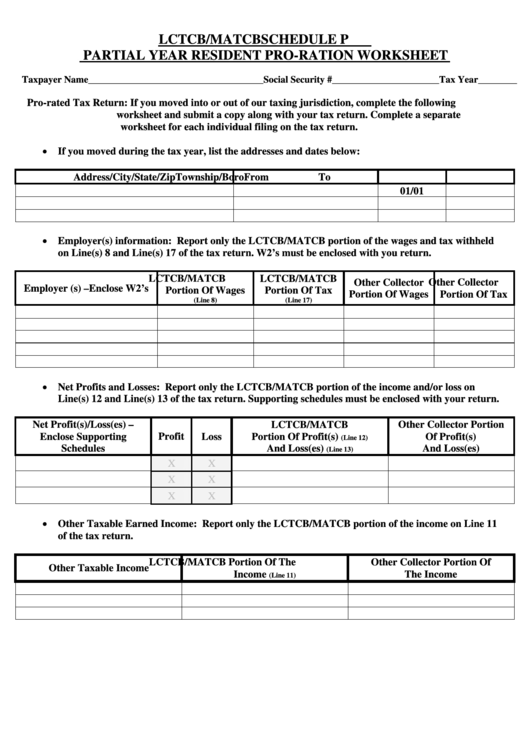

Partial Year Resident Pro-Ration Worksheet - Lctcb/matcb Schedule P

ADVERTISEMENT

LCTCB/MATCB

SCHEDULE P

PARTIAL YEAR RESIDENT PRO-RATION WORKSHEET

Taxpayer Name____________________________________Social Security #______________________Tax Year________

Pro-rated Tax Return:

If you moved into or out of our taxing jurisdiction, complete the following

worksheet and submit a copy along with your tax return. Complete a separate

worksheet for each individual filing on the tax return.

If you moved during the tax year, list the addresses and dates below:

Address/City/State/Zip

Township/Boro

From

To

01/01

Employer(s) information: Report only the LCTCB/MATCB portion of the wages and tax withheld

on Line(s) 8 and Line(s) 17 of the tax return. W2’s must be enclosed with you return.

LCTCB/MATCB

LCTCB/MATCB

Other Collector

Other Collector

Employer (s) –Enclose W2’s

Portion Of Wages

Portion Of Tax

Portion Of Wages

Portion Of Tax

(Line 8)

(Line 17)

Net Profits and Losses: Report only the LCTCB/MATCB portion of the income and/or loss on

Line(s) 12 and Line(s) 13 of the tax return. Supporting schedules must be enclosed with your return.

Net Profit(s)/Loss(es) –

LCTCB/MATCB

Other Collector Portion

Enclose Supporting

Profit

Loss

Portion Of Profit(s)

Of Profit(s)

(Line 12)

Schedules

And Loss(es)

And Loss(es)

(Line 13)

X

X

X

X

X

X

Other Taxable Earned Income: Report only the LCTCB/MATCB portion of the income on Line 11

of the tax return.

LCTCB/MATCB Portion Of The

Other Collector Portion Of

Other Taxable Income

Income

The Income

(Line 11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1