Form Rpd-41227 - Renewable Energy Production Tax Credit Claim Form

ADVERTISEMENT

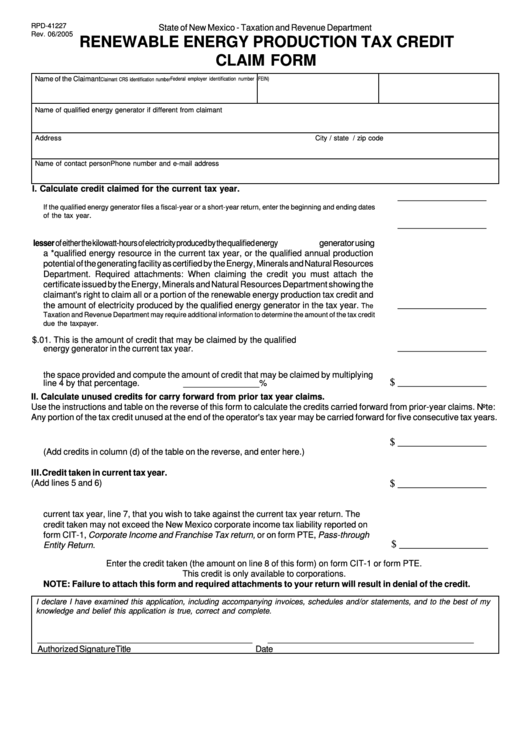

RPD-41227

State of New Mexico - Taxation and Revenue Department

Rev. 06/2005

RENEWABLE ENERGY PRODUCTION TAX CREDIT

CLAIM FORM

Federal employer identification number (FEIN)

Name of the Claimant

Claimant CRS identification number

Name of qualified energy generator if different from claimant

Address

City / state / zip code

Name of contact person

Phone number and e-mail address

I. Calculate credit claimed for the current tax year.

_________________

1. Enter the tax year of the qualified energy generator for which you are taking the credit.

If the qualified energy generator files a fiscal-year or a short-year return, enter the beginning and ending dates

.

of the tax year

_________________

2. Enter the date the qualified energy generator began producing electricity.

3. Enter the lesser of either the kilowatt-hours of electricity produced by the qualified energy generator using

a *qualified energy resource in the current tax year, or the qualified annual production

potential of the generating facility as certified by the Energy, Minerals and Natural Resources

Department. Required attachments: When claiming the credit you must attach the

certificate issued by the Energy, Minerals and Natural Resources Department showing the

claimant's right to claim all or a portion of the renewable energy production tax credit and

_________________

the amount of electricity produced by the qualified energy generator in the tax year.

The

Taxation and Revenue Department may require additional information to determine the amount of the tax credit

due the taxpayer.

4. Multiply line 3 by $.01. This is the amount of credit that may be claimed by the qualified

_________________

energy generator in the current tax year.

5. Enter the percentage of the renewable energy production tax credit that may be claimed in

the space provided and compute the amount of credit that may be claimed by multiplying

$ _________________

line 4 by that percentage.

________________%

II. Calculate unused credits for carry forward from prior tax year claims.

Use the instructions and table on the reverse of this form to calculate the credits carried forward from prior-year claims. Note:

Any portion of the tax credit unused at the end of the operator's tax year may be carried forward for five consecutive tax years.

6. Total unused credits for carry forward from prior claims.

$ _________________

(Add credits in column (d) of the table on the reverse, and enter here.)

III. Credit taken in current tax year.

7. Total credits available in the current tax year (Add lines 5 and 6)

$ _________________

8. Credit taken in the current tax year. Enter the portion of total credit available in the

current tax year, line 7, that you wish to take against the current tax year return. The

credit taken may not exceed the New Mexico corporate income tax liability reported on

form CIT-1, Corporate Income and Franchise Tax return, or on form PTE, Pass-through

$ _________________

Entity Return.

Enter the credit taken (the amount on line 8 of this form) on form CIT-1 or form PTE.

This credit is only available to corporations.

NOTE: Failure to attach this form and required attachments to your return will result in denial of the credit.

I declare I have examined this application, including accompanying invoices, schedules and/or statements, and to the best of my

knowledge and belief this application is true, correct and complete.

________________________________________________

___________________________

___________________

Authorized Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1