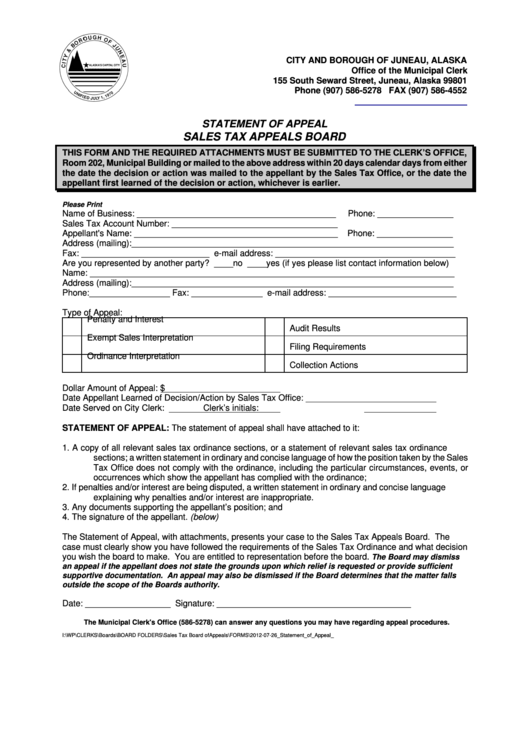

Statement Of Appeal - Sales Tax Appeals Board

ADVERTISEMENT

CITY AND BOROUGH OF JUNEAU, ALASKA

Office of the Municipal Clerk

155 South Seward Street, Juneau, Alaska 99801

Phone (907) 586-5278 FAX (907) 586-4552

City_Clerk@ci.juneau.ak.us

STATEMENT OF APPEAL

SALES TAX APPEALS BOARD

THIS FORM AND THE REQUIRED ATTACHMENTS MUST BE SUBMITTED TO THE CLERK’S OFFICE,

Room 202, Municipal Building or mailed to the above address within 20 days calendar days from either

the date the decision or action was mailed to the appellant by the Sales Tax Office, or the date the

appellant first learned of the decision or action, whichever is earlier.

Please Print

Name of Business: __________________________________________

Phone: ________________

Sales Tax Account Number: ___________________________________

Appellant's Name: ___________________________________________

Phone: ________________

Address (mailing):____________________________________________________________________

Fax: ___________________________ e-mail address: ______________________________________

Are you represented by another party? ____no ____yes (if yes please list contact information below)

Name: _____________________________________________________________________________

Address (mailing):____________________________________________________________________

Phone:_________________ Fax: _______________ e-mail address: ___________________________

Type of Appeal:

Penalty and Interest

Audit Results

Exempt Sales Interpretation

Filing Requirements

Ordinance Interpretation

Collection Actions

Dollar Amount of Appeal: $

Date Appellant Learned of Decision/Action by Sales Tax Office:

Date Served on City Clerk:

Clerk’s initials:

STATEMENT OF APPEAL: The statement of appeal shall have attached to it:

1.

A copy of all relevant sales tax ordinance sections, or a statement of relevant sales tax ordinance

sections; a written statement in ordinary and concise language of how the position taken by the Sales

Tax Office does not comply with the ordinance, including the particular circumstances, events, or

occurrences which show the appellant has complied with the ordinance;

2.

If penalties and/or interest are being disputed, a written statement in ordinary and concise language

explaining why penalties and/or interest are inappropriate.

3.

Any documents supporting the appellant’s position; and

4.

The signature of the appellant. (below)

The Statement of Appeal, with attachments, presents your case to the Sales Tax Appeals Board. The

case must clearly show you have followed the requirements of the Sales Tax Ordinance and what decision

you wish the board to make. You are entitled to representation before the board.

The Board may dismiss

an appeal if the appellant does not state the grounds upon which relief is requested or provide sufficient

supportive documentation. An appeal may also be dismissed if the Board determines that the matter falls

outside the scope of the Boards authority.

Date: __________________

Signature: _________________________________________

The Municipal Clerk's Office (586-5278) can answer any questions you may have regarding appeal procedures.

I:\WP\CLERKS\Boards\BOARD FOLDERS\Sales Tax Board of Appeals\FORMS\2012-07-26_Statement_of_Appeal_Form.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1