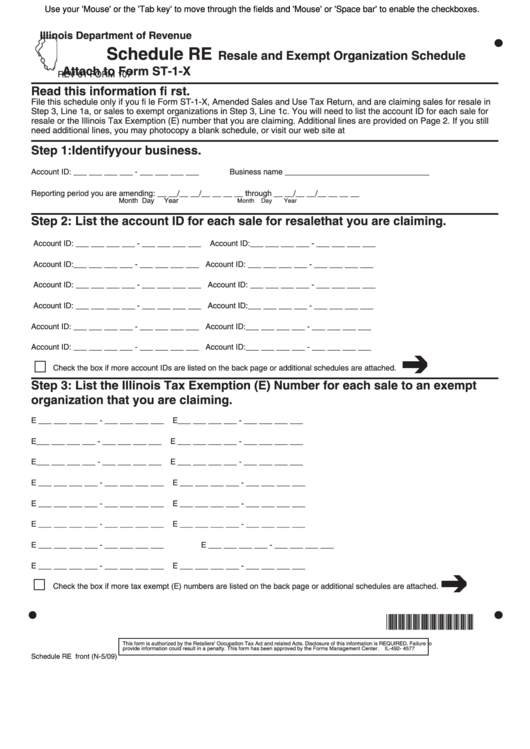

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

Schedule RE

Resale and Exempt Organization Schedule

Attach to Form ST-1-X

REV 01 FORM 107

Read this information fi rst.

File this schedule only if you fi le Form ST-1-X, Amended Sales and Use Tax Return, and are claiming sales for resale in

Step 3, Line 1a, or sales to exempt organizations in Step 3, Line 1c. You will need to list the account ID for each sale for

resale or the Illinois Tax Exemption (E) number that you are claiming. Additional lines are provided on Page 2. If you still

need additional lines, you may photocopy a blank schedule, or visit our web site at tax.illinois.gov.

Step 1: Identify your business.

Account ID: ___ ___ ___ ___ - ___ ___ ___ ___

Business name _________________________________

Reporting period you are amending: __ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Month Day

Year

Month

Day

Year

Step 2: List the account ID for each sale for resale that you are claiming.

Account ID: ___ ___ ___ ___ - ___ ___ ___ ___

Account ID:___ ___ ___ ___ - ___ ___ ___ ___

Account ID:___ ___ ___ ___ - ___ ___ ___ ___

Account ID: ___ ___ ___ ___ - ___ ___ ___ ___

Account ID: ___ ___ ___ ___ - ___ ___ ___ ___

Account ID: ___ ___ ___ ___ - ___ ___ ___ ___

Account ID: ___ ___ ___ ___ - ___ ___ ___ ___

Account ID:___ ___ ___ ___ - ___ ___ ___ ___

Account ID: ___ ___ ___ ___ - ___ ___ ___ ___

Account ID:___ ___ ___ ___ - ___ ___ ___ ___

Account ID: ___ ___ ___ ___ - ___ ___ ___ ___

Account ID:___ ___ ___ ___ - ___ ___ ___ ___

Check the box if more account IDs are listed on the back page or additional schedules are attached.

Step 3: List the Illinois Tax Exemption (E) Number for each sale to an exempt

organization that you are claiming.

E ___ ___ ___ ___ - ___ ___ ___ ___

E___ ___ ___ ___ - ___ ___ ___ ___

E___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

E ___ ___ ___ ___ - ___ ___ ___ ___

Check the box if more tax exempt (E) numbers are listed on the back page or additional schedules are attached.

*910711110*

This form is authorized by the Retailers’ Occupation Tax Act and related Acts. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492- 4577

Schedule RE front (N-5/09)

1

1 2

2