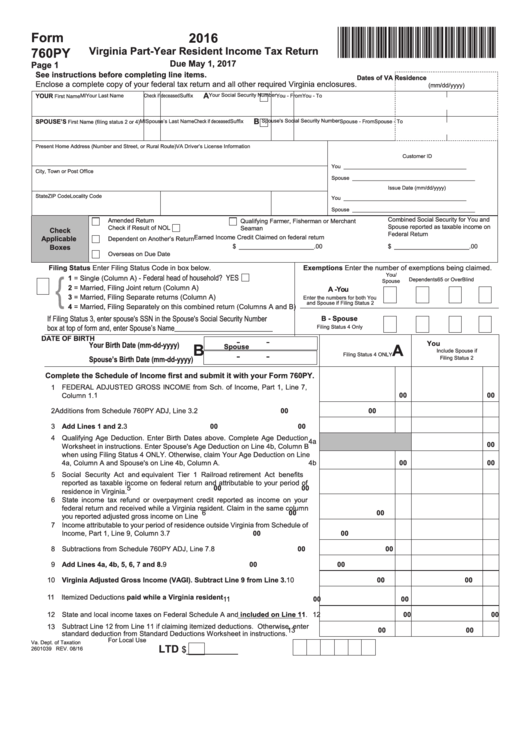

*VA760P116888*

Form

2016

Virginia Part-Year Resident Income Tax Return

760PY

Due May 1, 2017

Page 1

See instructions before completing line items.

Dates of VA Residence

Enclose a complete copy of your federal tax return and all other required Virginia enclosures.

(mm/dd/yyyy)

A

Check if deceased

Your Social Security Number

YOUR

MI

Your Last Name

Suffix

You - From

You - To

First Name

B

Spouse's Social Security Number

SPOUSE’S

Check if deceased

MI

Spouse’s Last Name

Suffix

Spouse - From

Spouse - To

First Name (filing status 2 or 4)

Present Home Address (Number and Street, or Rural Route)

VA Driver’s License Information

Customer ID

You

__________________________________________

City, Town or Post Office

Spouse

__________________________________________

Issue Date (mm/dd/yyyy)

State

ZIP Code

Locality Code

You

__________________________________________

Spouse

__________________________________________

Combined Social Security for You and

Amended Return

Qualifying Farmer, Fisherman or Merchant

Spouse reported as taxable income on

Check if Result of NOL

Seaman

Check

Federal Return

Earned Income Credit Claimed on federal return

Applicable

Dependent on Another’s Return

Boxes

$ ______________________.00

$ ______________________.00

Overseas on Due Date

Filing Status Enter Filing Status Code in box below.

Exemptions Enter the number of exemptions being claimed.

{

You/

Federal head of household? YES

1 = Single (Column A) -

Dependents

65 or Over

Blind

Spouse

2 = Married, Filing Joint return (Column A)

A - You

3 = Married, Filing Separate returns (Column A)

Enter the numbers for both You

and Spouse if Filing Status 2

4 = Married, Filing Separately on this combined return (Columns A and B)

If Filing Status 3, enter spouse's SSN in the Spouse's Social Security Number

B - Spouse

box at top of form and, enter Spouse’s Name

_______________________________

Filing Status 4 Only

DATE OF BIRTH

-

-

You

B

A

Your Birth Date (mm-dd-yyyy)

Spouse

Include Spouse if

-

-

Filing Status 4 ONLY

Filing Status 2

Spouse’s Birth Date (mm-dd-yyyy)

Complete the Schedule of Income first and submit it with your Form 760PY.

1 FEDERAL ADJUSTED GROSS INCOME from Sch. of Income, Part 1, Line 7,

1

00

00

Column 1.

2 Additions from Schedule 760PY ADJ, Line 3. .................................................

2

00

00

3 Add Lines 1 and 2. .........................................................................................

3

00

00

4 Qualifying Age Deduction. Enter Birth Dates above. Complete Age Deduction

4a

00

Worksheet in instructions. Enter Spouse's Age Deduction on Line 4b, Column B

when using Filing Status 4 ONLY. Otherwise, claim Your Age Deduction on Line

4a, Column A and Spouse's on Line 4b, Column A. ........................................

4b

00

00

5 Social Security Act and equivalent Tier 1 Railroad retirement Act benefits

reported as taxable income on federal return and attributable to your period of

5

00

00

residence in Virginia. .......................................................................................

6 State income tax refund or overpayment credit reported as income on your

federal return and received while a Virginia resident. Claim in the same column

6

00

00

you reported adjusted gross income on Line 1................................................

7 Income attributable to your period of residence outside Virginia from Schedule of

00

00

Income, Part 1, Line 9, Column 3. ...................................................................

7

8 Subtractions from Schedule 760PY ADJ, Line 7. ............................................

8

00

00

9 Add Lines 4a, 4b, 5, 6, 7 and 8......................................................................

9

00

00

10 Virginia Adjusted Gross Income (VAGI). Subtract Line 9 from Line 3. .....

00

00

10

11 Itemized Deductions paid while a Virginia resident .....................................

11

00

00

12 State and local income taxes on Federal Schedule A and included on Line 11. 12

00

00

13 Subtract Line 12 from Line 11 if claiming itemized deductions. Otherwise, enter

13

00

00

standard deduction from Standard Deductions Worksheet in instructions. .....

For Local Use

Va. Dept. of Taxation

LTD

_________

$

2601039 REV. 08/16

1

1 2

2