Reset Form

Print Form

Change Tax Year if Necessary

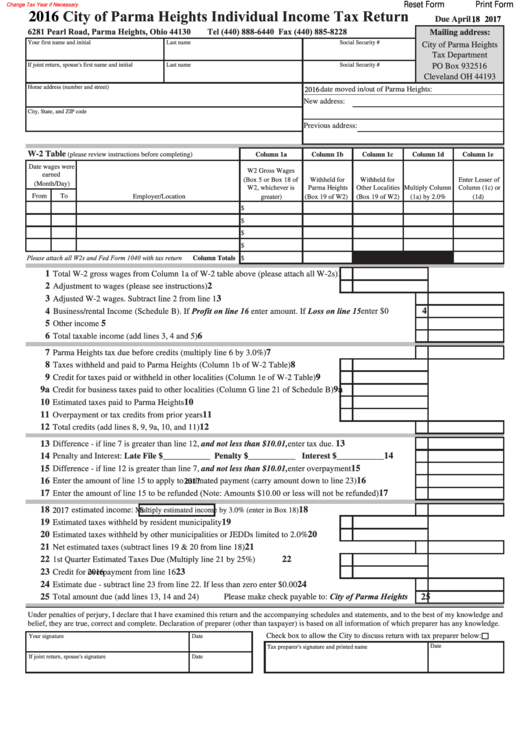

City of Parma Heights Individual Income Tax Return

2016

Due April

18

,

2017

6281 Pearl Road, Parma Heights, Ohio 44130

Tel (440) 888-6440 Fax (440) 885-8228

Mailing address:

Your first name and initial

Last name

Social Security #

City of Parma Heights

Tax Department

If joint return, spouse's first name and initial

Last name

Social Security #

PO Box 932516

Cleveland OH 44193

Home address (number and street)

2016

date moved in/out of Parma Heights:

New address:

City, State, and ZIP code

Previous address:

W-2 Table

(please review instructions before completing)

Column 1a

Column 1b

Column 1c

Column 1d

Column 1e

Date wages were

W2 Gross Wages

earned

(Box 5 or Box 18 of

Withheld for

Withheld for

Enter Lesser of

(Month/Day)

W2, whichever is

Parma Heights

Other Localities

Multiply Column

Column (1c) or

From

To

Employer/Location

greater)

(Box 19 of W2)

(Box 19 of W2)

(1a) by 2.0%

(1d)

$

$

$

$

Please attach all W2s and Fed Form 1040 with tax return

Column Totals

$

1

1

Total W-2 gross wages from Column 1a of W-2 table above (please attach all W-2s)

2

2

Adjustment to wages (please see instructions)

3

3

Adjusted W-2 wages. Subtract line 2 from line 1

Business/rental Income (Schedule B). If Profit on line 16 enter amount. If Loss on line 15 enter $0

4

4

5

5

Other income

6

6

Total taxable income (add lines 3, 4 and 5)

7

7

Parma Heights tax due before credits (multiply line 6 by 3.0%)

8

8

Taxes withheld and paid to Parma Heights (Column 1b of W-2 Table)

9

9

Credit for taxes paid or withheld in other localities (Column 1e of W-2 Table)

9a

9a

Credit for business taxes paid to other localities (Column G line 21 of Schedule B)

10

10

Estimated taxes paid to Parma Heights

11

11

Overpayment or tax credits from prior years

12

12

Total credits (add lines 8, 9, 9a, 10, and 11)

13

13

Difference - if line 7 is greater than line 12, and not less than $10.01, enter tax due.

14

14

Penalty and Interest: Late File $___________ Penalty $___________ Interest $___________

15

15

Difference - if line 12 is greater than line 7, and not less than $10.01, enter overpayment

16

16

Enter the amount of line 15 to apply to

2017

estimated payment (carry amount down to line 23)

Enter the amount of line 15 to be refunded (Note: Amounts $10.00 or less will not be refunded)

17

17

18

18

2017

estimated income:

$

Multiply estimated income by 3.0% (enter in Box 18)

19

19

Estimated taxes withheld by resident municipality

20

20

Estimated taxes withheld by other municipalities or JEDDs limited to 2.0%

21

21

Net estimated taxes (subtract lines 19 & 20 from line 18)

22

22

1st Quarter Estimated Taxes Due (Multiply line 21 by 25%)

23

23

Credit for

overpayment from line 16

2016

24

24

Estimate due - subtract line 23 from line 22. If less than zero enter $0.00

Please make check payable to: City of Parma Heights

25

25

Total amount due (add lines 13, 14 and 24)

Under penalties of perjury, I declare that I have examined this return and the accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Check box to allow the City to discuss return with tax preparer below:

Your signature

Date

Date

Tax preparer's signature and printed name

If joint return, spouse's signature

Date

1

1 2

2