Form Cd-418 - Cooperative Or Mutual Association - 2016

ADVERTISEMENT

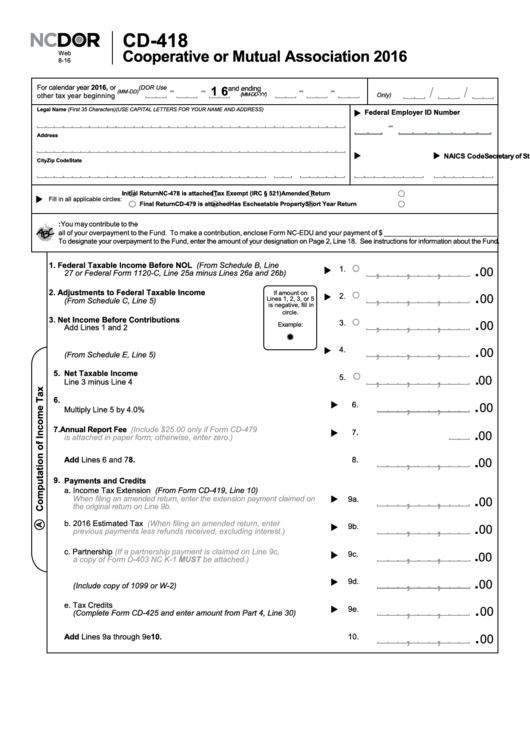

CD-418

Cooperative or Mutual Association 2016

Web

8-16

For calendar year 2016, or

1 6

(DOR Use

and ending

(MM-DD)

(MM-DD-YY)

Only)

other tax year beginning

Legal Name (First 35 Characters)(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Federal Employer ID Number

Address

Secretary of State ID

NAICS Code

City

State

Zip Code

Initial Return

Amended Return

NC-478 is attached

Tax Exempt (IRC § 521)

Fill in all applicable circles:

Final Return

Short Year Return

CD-479 is attached

Has Escheatable Property

N.C. Education Endowment Fund: You may contribute to the N.C. Education Endowment Fund by making a contribution or designating some or

all of your overpayment to the Fund. To make a contribution, enclose Form NC-EDU and your payment of $ _____________________________.

To designate your overpayment to the Fund, enter the amount of your designation on Page 2, Line 18. See instructions for information about the Fund.

.

,

,

,

1. Federal Taxable Income Before NOL (From Schedule B, Line

1.

00

27 or Federal Form 1120-C, Line 25a minus Lines 26a and 26b)

,

,

,

.

2. Adjustments to Federal Taxable Income

If amount on

2.

00

Lines 1, 2, 3, or 5

(From Schedule C, Line 5)

is negative, fill in

circle.

.

,

,

,

3. Net Income Before Contributions

3.

00

Example:

Add Lines 1 and 2

,

,

,

.

4. Contributions

4.

00

(From Schedule E, Line 5)

.

,

,

,

5.

Net Taxable Income

5.

00

Line 3 minus Line 4

.

,

,

6.

N.C. Net Income Tax

6.

00

Multiply Line 5 by 4.0%

.

(Include $25.00 only if Form CD-479

7. Annual Report Fee

7.

00

is attached in paper form; otherwise, enter zero.)

,

,

.

8.

Add Lines 6 and 7

8.

00

9.

Payments and Credits

a. Income Tax Extension (From Form CD-419, Line 10)

,

,

.

When filing an amended return, enter the extension payment claimed on

9a.

00

the original return on Line 9b.

,

,

.

(When filing an amended return, enter

b. 2016 Estimated Tax

9b.

00

previous payments less refunds received, excluding interest.)

.

,

,

c. Partnership

(If a partnership payment is claimed on Line 9c,

9c.

00

a copy of Form D-403 NC K-1 MUST be attached.)

,

,

.

d. Nonresident Withholding

9d.

00

(Include copy of 1099 or W-2)

.

,

,

e. Tax Credits

9e.

00

(Complete Form CD-425 and enter amount from Part 4, Line 30)

.

,

,

10.

Add Lines 9a through 9e

10.

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4