Form Br - City Of Fairfield Business Income Tax Return - 2016

ADVERTISEMENT

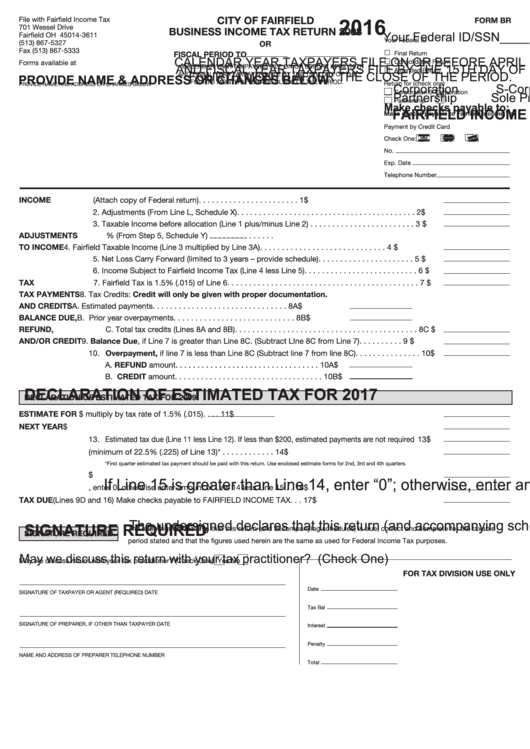

CITY OF FAIRFIELD

File with Fairfield Income Tax

FORM BR

701 Wessel Drive

2016

BUSINESS INCOME TAX RETURN 2008

Fairfield OH 45014-3611

Your Federal ID/SSN_____________________

Your Federal ID

(513) 867-5327

OR

Fax (513) 867-5333

FISCAL PERIOD

TO

Final Return

Consolidated Return

Forms available at

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 18TH

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15TH

Amended Return

AND FISCAL YEAR TAXPAYERS FILE BY THE 15TH DAY OF THE

AND FISCAL YEAR TAXPAYERS FILE BY THE 15TH DAY OF THE

FOURTH MONTH AFTER THE CLOSE OF THE PERIOD.

PROVIDE NAME & ADDRESS OR CHANGES BELOW

FOURTH MONTH AFTER THE CLOSE OF THE PERIOD.

Return for (check one)

PROVIDE NAME AND ADDRESS OR CHANGES BELOW

Corporation

S-Corporation

Corporation

S-Corporation

Partnership

Sole Prop (non resident)

Partnership

Make checks payable to:

Make checks payable to Fairfield Income Tax

FAIRFIELD INCOME TAX

Payment by Credit Card

i

[

r

Check One:

No.

Exp. Date

Telephone Number

INCOME

1. Adjusted Federal Taxable Income (Attach copy of Federal return) . . . . . . . . . . . . . . . . . . . . . . . 1

$

2. Adjustments (From Line L, Schedule X) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

$

3. Taxable Income before allocation (Line 1 plus/minus Line 2) . . . . . . . . . . . . . . . . . . . . . . . . 3

$

ADJUSTMENTS

A. Apportionment percentage

% (From Step 5, Schedule Y) . . . . . . . . . . . . . . .

TO INCOME

4. Fairfield Taxable Income (Line 3 multiplied by Line 3A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

$

5. Net Loss Carry Forward (limited to 3 years – provide schedule) . . . . . . . . . . . . . . . . . . . . . . 5

$

6. Income Subject to Fairfield Income Tax (Line 4 less Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . 6

$

TAX

7. Fairfield Tax is 1.5% (.015) of Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

$

TAX PAYMENTS

8. Tax Credits: Credit will only be given with proper documentation.

AND CREDITS

A. Estimated payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8A

$

BALANCE DUE,

B. Prior year overpayments . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8B

$

REFUND,

C. Total tax credits (Lines 8A and 8B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8C

$

AND/OR CREDIT

9. Balance Due, if Line 7 is greater than Line 8C. (Subtract LIne 8C from Line 7) . . . . . . . . . . 9

$

10. Overpayment, if line 7 is less than Line 8C (Subtract line 7 from line 8C) . . . . . . . . . . . . . . . 10

$

A. REFUND amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10A $

B. CREDIT amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10B $

DECLARATION OF ESTIMATED TAX FOR 2017

DECLARATION OF ESTIMATED TAX FOR 2009

ESTIMATE FOR

11. Total income subject to tax $

multiply by tax rate of 1.5% (.015) . . . . 11

$

NEXT YEAR

12. Operating Loss Carryforward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

$

13. Estimated tax due (Line 11 less Line 12). If less than $200, estimated payments are not required 13

$

14. First quarter estimated tax payment (minimum of 22.5% (.225) of Line 13)* . . . . . . . . . . . . 14

$

*First quarter estimated tax payment should be paid with this return. Use enclosed estimate forms for 2nd, 3rd and 4th quarters.

15. Prior year tax credit from Line 10B above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

$

If Line 15 is greater than Line 14, enter “0”; otherwise, enter amount of Line 14 less Line 15

16. If Line 15 is greater than Line 14, enter 0, otherwise enter amount of Line 14 less Line 15 . . 16

$

TAX DUE

17. TOTAL TAX DUE (Lines 9D and 16) Make checks payable to FAIRFIELD INCOME TAX . . . 17

$

The undersigned declares that this return (and accompanying schedules) are true, correct and complete for the taxable

The undersigned declares that this return (and accompanying schedules) is true, correct and complete for the taxable

SIGNATURE REQUIRED

SIGNATURE REQUIRED

period stated and that the figures used herein are the same as used for Federal Income Tax purposes.

May we discuss return with your tax practitioner? (Check One)

Yes

No

May we discuss this return with your tax practitioner? (Check One)

FOR TAX DIVISION USE ONLY

Date

SIGNATURE OF TAXPAYER OR AGENT (REQUIRED)

DATE

Tax Bal

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER

DATE

Interest

Penalty

NAME AND ADDRESS OF PREPARER

TELEPHONE NUMBER

Total

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2