Income Tax Form - City Of Brook Park - 2016

ADVERTISEMENT

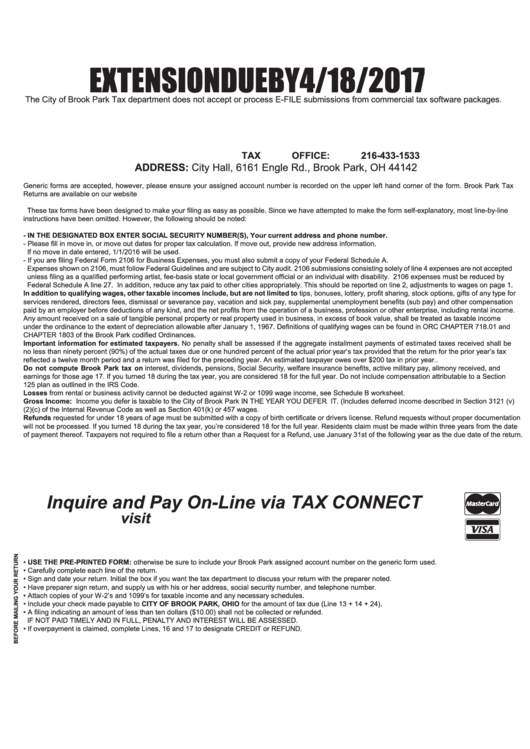

EXTENSION DUE BY 4/18/2017

The City of Brook Park Tax department does not accept or process E-FILE submissions from commercial tax software packages

.

TAX OFFICE: 216-433-1533

ADDRESS: City Hall, 6161 Engle Rd., Brook Park, OH 44142

Generic forms are accepted, however, please ensure your assigned account number is recorded on the upper left hand corner of the form. Brook Park Tax

Returns are available on our website

T hesetaxformshavebeendesignedtomakeyourfilingaseasyaspossible.Sincewehaveattemptedtomaketheformself-explanatory,mostline-by-line

instructions have been omitted. However, the following should be noted:

- IN THE DESIGNATED BOX ENTER SOCIAL SECURITY NUMBER(S), Your current address and phone number.

-Pleasefillinmovein,ormoveoutdatesforpropertaxcalculation.Ifmoveout,providenewaddressinformation.

If no move in date entered, 1/1/2016 will be used.

-IfyouarefilingFederalForm2106forBusinessExpenses,youmustalsosubmitacopyofyourFederalScheduleA.

Expenses shown on 2106, must follow Federal Guidelines and are subject to City audit. 2106 submissions consisting solely of line 4 expenses are not accepted

unlessfilingasaqualifiedperformingartist,fee-basisstateorlocalgovernmentofficialoranindividualwithdisability.2106expensesmustbereducedby

FederalScheduleAline27.Inaddition,reduceanytaxpaidtoothercitiesappropriately.Thisshouldbereportedonline2,adjustmentstowagesonpage1.

In addition to qualifying wages, other taxable incomes include, but are not limited totips,bonuses,lottery,profitsharing,stockoptions,giftsofanytypefor

servicesrendered,directorsfees,dismissalorseverancepay,vacationandsickpay,supplementalunemploymentbenefits(subpay)andothercompensation

paidbyanemployerbeforedeductionsofanykind,andthenetprofitsfromtheoperationofabusiness,professionorotherenterprise,includingrentalincome.

Anyamountreceivedonasaleoftangiblepersonalpropertyorrealpropertyusedinbusiness,inexcessofbookvalue,shallbetreatedastaxableincome

undertheordinancetotheextentofdepreciationallowableafterJanuary1,1967.DefinitionsofqualifyingwagescanbefoundinORCCHAPTER718.01and

CHAPTER1803oftheBrookParkcodifiedOrdinances.

Important information for estimated taxpayers. No penalty shall be assessed if the aggregate installment payments of estimated taxes received shall be

nolessthanninetypercent(90%)oftheactualtaxesdueoronehundredpercentoftheactualprioryear’staxprovidedthatthereturnfortheprioryear’stax

reflectedatwelvemonthperiodandareturnwasfiledfortheprecedingyear.Anestimatedtaxpayerowesover$200taxinprioryear..

Do not compute Brook Park tax on interest, dividends, pensions, Social Security, welfare insurance benefits, active military pay, alimony received, and

earningsforthoseage17.Ifyouturned18duringthetaxyear,youareconsidered18forthefullyear.DonotincludecompensationattributabletoaSection

125planasoutlinedintheIRSCode.

LossesfromrentalorbusinessactivitycannotbedeductedagainstW-2or1099wageincome,seeScheduleBworksheet.

Gross Income:IncomeyoudeferistaxabletotheCityofBrookParkINTHEYEARYOUDEFERIT.(IncludesdeferredincomedescribedinSection3121(v)

(2)(c)oftheInternalRevenueCodeaswellasSection401(k)or457wages.

Refundsrequestedforunder18yearsofagemustbesubmittedwithacopyofbirthcertificateordriverslicense.Refundrequestswithoutproperdocumentation

willnotbeprocessed.Ifyouturned18duringthetaxyear,you’reconsidered18forthefullyear.Residentsclaimmustbemadewithinthreeyearsfromthedate

ofpaymentthereof.TaxpayersnotrequiredtofileareturnotherthanaRequestforaRefund,useJanuary31stofthefollowingyearastheduedateofthereturn.

Inquire and Pay On-Line via TAX CONNECT

visit

• USE THE PRE-PRINTED FORM: otherwise be sure to include your Brook Park assigned account number on the generic form used.

• Carefully complete each line of the return.

•Signanddateyourreturn.Initialtheboxifyouwantthetaxdepartmenttodiscussyourreturnwiththepreparernoted.

• Have preparer sign return, and supply us with his or her address, social security number, and telephone number.

•AttachcopiesofyourW-2’sand1099’sfortaxableincomeandanynecessaryschedules.

• Include your check made payable to CITY OF BROOK PARK, OHIOfortheamountoftaxdue(Line13+14+24).

•Afilingindicatinganamountoflessthantendollars($10.00)shallnotbecollectedorrefunded.

IFNOTPAIDTIMELYANDINFULL,PENALTYANDINTERESTWILLBEASSESSED.

•Ifoverpaymentisclaimed,completeLines,16and17todesignateCREDITorREFUND.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2