Sample Registration Of Charitable Organizations Form - Tennessee Secretary Of State

ADVERTISEMENT

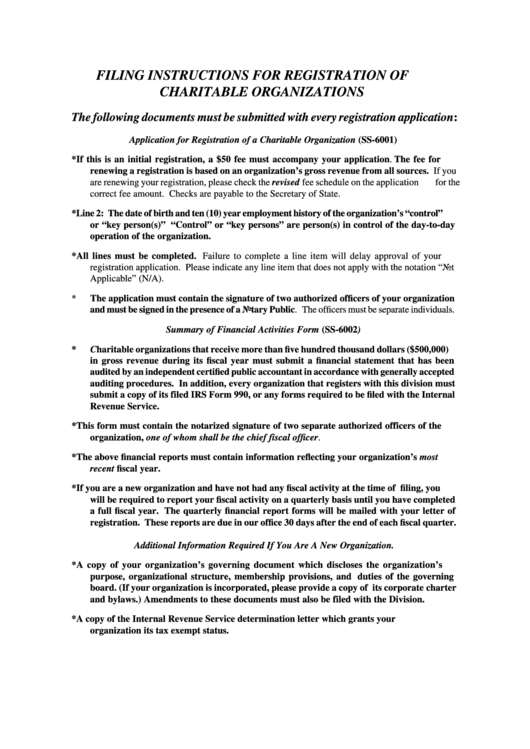

FILING INSTRUCTIONS FOR REGISTRATION OF

CHARITABLE ORGANIZATIONS

The following documents must be submitted with every registration application:

Application for Registration of a Charitable Organization (SS-6001)

*

If this is an initial registration, a $50 fee must accompany your application. The fee for

renewing a registration is based on an organization’s gross revenue from all sources. If you

are renewing your registration, please check the revised fee schedule on the application

for the

correct fee amount. Checks are payable to the Secretary of State.

*

Line 2: The date of birth and ten (10) year employment history of the organization’s “control”

or “key person(s)” “Control” or “key persons” are person(s) in control of the day-to-day

operation of the organization.

*

All lines must be completed. Failure to complete a line item will delay approval of your

registration application. Please indicate any line item that does not apply with the notation “Not

Applicable” (N/A).

*

The application must contain the signature of two authorized officers of your organization

and must be signed in the presence of a Notary Public. The officers must be separate individuals.

Summary of Financial Activities Form (SS-6002)

*

Charitable organizations that receive more than five hundred thousand dollars ($500,000)

in gross revenue during its fiscal year must submit a financial statement that has been

audited by an independent certified public accountant in accordance with generally accepted

auditing procedures. In addition, every organization that registers with this division must

submit a copy of its filed IRS Form 990, or any forms required to be filed with the Internal

Revenue Service.

*

This form must contain the notarized signature of two separate authorized officers of the

organization, one of whom shall be the chief fiscal officer.

*

The above financial reports must contain information reflecting your organization’s most

recent fiscal year.

*

If you are a new organization and have not had any fiscal activity at the time of filing, you

will be required to report your fiscal activity on a quarterly basis until you have completed

a full fiscal year. The quarterly financial report forms will be mailed with your letter of

registration. These reports are due in our office 30 days after the end of each fiscal quarter.

Additional Information Required If You Are A New Organization.

*

A copy of your organization’s governing document which discloses the organization’s

purpose, organizational structure, membership provisions, and duties of the governing

board. (If your organization is incorporated, please provide a copy of its corporate charter

and bylaws.) Amendments to these documents must also be filed with the Division.

*

A copy of the Internal Revenue Service determination letter which grants your

organization its tax exempt status.

The Department of State is committed to principles of equal opportu-

Department of State, Authorization No.305225, 500 cop-

nity, equal access, and affirmative action. Contact the Department of

ies, July 2001. This public document was promulgated

State EEO/AA Coordinator at (615) 741-7411, Tennessee Relay Cen-

at a cost of $0.04 per copy

ter TDD 1-800-848-0298 for further information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2