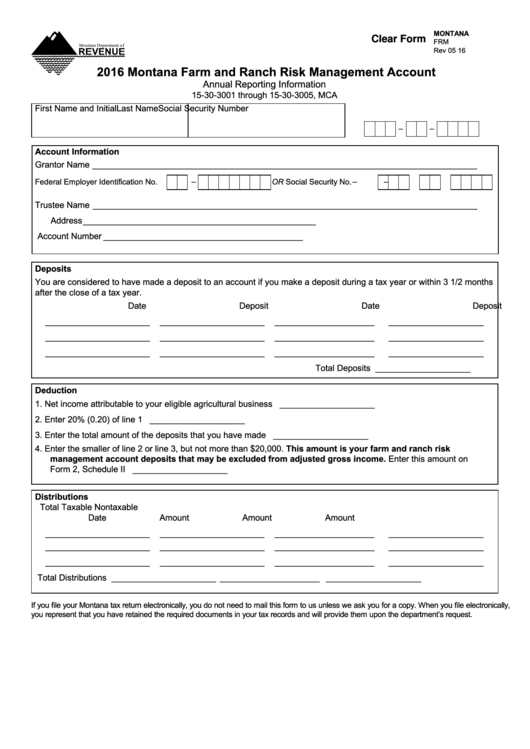

MONTANA

Clear Form

FRM

Rev 05 16

2016 Montana Farm and Ranch Risk Management Account

Annual Reporting Information

15-30-3001 through 15-30-3005, MCA

First Name and Initial

Last Name

Social Security Number

-

-

Account Information

Grantor Name _________________________________________________________________________________

-

-

-

Federal Employer Identification No.

OR

Social Security No.

Trustee Name _________________________________________________________________________________

Address _________________________________________________

Account Number __________________________________________

Deposits

You are considered to have made a deposit to an account if you make a deposit during a tax year or within 3 1/2 months

after the close of a tax year.

Date

Deposit

Date

Deposit

______________________

______________________

_____________________

____________________

______________________

______________________

_____________________

____________________

______________________

______________________

_____________________

____________________

Total Deposits

____________________

Deduction

1. Net income attributable to your eligible agricultural business ............................................ 1. ____________________

2. Enter 20% (0.20) of line 1 .................................................................................................. 2. ____________________

3. Enter the total amount of the deposits that you have made ............................................... 3. ____________________

4. Enter the smaller of line 2 or line 3, but not more than $20,000. This amount is your farm and ranch risk

management account deposits that may be excluded from adjusted gross income. Enter this amount on

Form 2, Schedule II ............................................................................................................ 4. ____________________

Distributions

Total

Taxable

Nontaxable

Date

Amount

Amount

Amount

______________________

______________________

_____________________

____________________

______________________

______________________

_____________________

____________________

______________________

______________________

_____________________

____________________

Total Distributions

______________________

_____________________

____________________

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically,

you represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

1

1 2

2