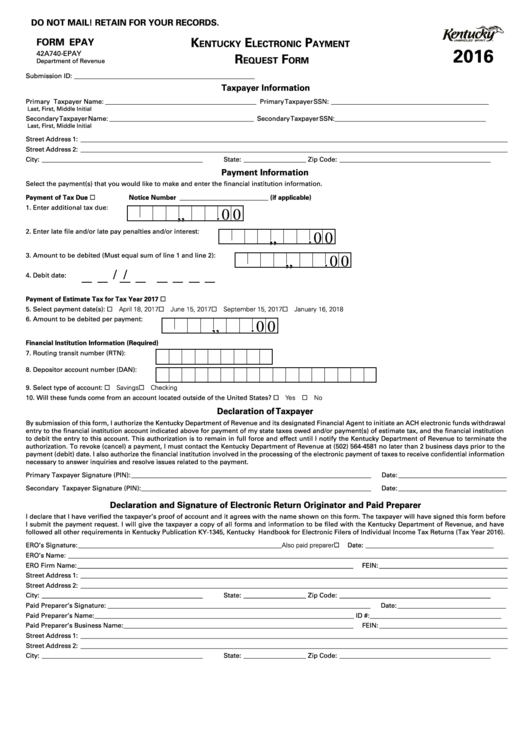

Form 42a740-Epay - Electronic Payment Request Form - Department Of Revenue - 2016

ADVERTISEMENT

DO NOT MAIL! RETAIN FOR YOUR RECORDS.

K

e

P

FORM EPAY

entucKy

lectronic

AyMent

2016

42A740-EPAY

r

F

eQueSt

orM

Department of Revenue

Submission ID: _______________________________________________________

Taxpayer Information

Primary Taxpayer Name: ______________________________________________

Primary Taxpayer SSN: ________________________________________________

Last, First, Middle Initial

Secondary Taxpayer Name: ____________________________________________

Secondary Taxpayer SSN: ______________________________________________

Last, First, Middle Initial

Street Address 1: __________________________________________________________________________________________________________________________________

Street Address 2: __________________________________________________________________________________________________________________________________

City: _________________________________________________

State: ___________________

Zip Code: ______________________________________________

Payment Information

Select the payment(s) that you would like to make and enter the financial institution information.

Payment of Tax Due ¨

Notice Number

___________________________ (if applicable)

1.

Enter additional tax due:

. 0 0

,

,

2.

Enter late file and/or late pay penalties and/or interest:

,

,

. 0 0

3.

Amount to be debited (Must equal sum of line 1 and line 2):

,

,

. 0 0

/

/

4.

Debit date:

Payment of Estimate Tax for Tax Year 2017 ¨

5.

Select payment date(s): ¨ April 18, 2017 ¨ June 15, 2017 ¨ September 15, 2017 ¨ January 16, 2018

6.

Amount to be debited per payment:

. 0 0

,

,

Financial Institution Information (Required)

7.

Routing transit number (RTN):

8.

Depositor account number (DAN):

9.

Select type of account: ¨ Savings ¨ Checking

10.

Will these funds come from an account located outside of the United States? ¨ Yes ¨ No

Declaration of Taxpayer

By submission of this form, I authorize the Kentucky Department of Revenue and its designated Financial Agent to initiate an ACH electronic funds withdrawal

entry to the financial institution account indicated above for payment of my state taxes owed and/or payment(s) of estimate tax, and the financial institution

to debit the entry to this account. This authorization is to remain in full force and effect until I notify the Kentucky Department of Revenue to terminate the

authorization. To revoke (cancel) a payment, I must contact the Kentucky Department of Revenue at (502) 564-4581 no later than 2 business days prior to the

payment (debit) date. I also authorize the financial institution involved in the processing of the electronic payment of taxes to receive confidential information

necessary to answer inquiries and resolve issues related to the payment.

Primary Taxpayer Signature (PIN): _________________________________________________________________________

Date: _________________________________

Secondary Taxpayer Signature (PIN): ______________________________________________________________________

Date: _________________________________

Declaration and Signature of Electronic Return Originator and Paid Preparer

I declare that I have verified the taxpayer’s proof of account and it agrees with the name shown on this form. The taxpayer will have signed this form before

I submit the payment request. I will give the taxpayer a copy of all forms and information to be filed with the Kentucky Department of Revenue, and have

followed all other requirements in Kentucky Publication KY-1345, Kentucky Handbook for Electronic Filers of Individual Income Tax Returns (Tax Year 2016).

ERO’s Signature: ______________________________________________________________ Also paid preparer ¨

Date: _______________________________________

ERO’s Name: ______________________________________________________________________________________________________________________________________

ERO Firm Name: ____________________________________________________________________________________

FEIN: _______________________________________

Street Address 1: __________________________________________________________________________________________________________________________________

Street Address 2: __________________________________________________________________________________________________________________________________

City: _________________________________________________

State: ___________________

Zip Code: ______________________________________________

Paid Preparer’s Signature: ________________________________________________________________________________

Date: _________________________________

Paid Preparer’s Name: _______________________________________________________________________________

ID #: ________________________________________

Paid Preparer’s Business Name: ______________________________________________________________________

FEIN: _______________________________________

Street Address 1: __________________________________________________________________________________________________________________________________

Street Address 2: __________________________________________________________________________________________________________________________________

City: _________________________________________________

State: ___________________

Zip Code: ______________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2