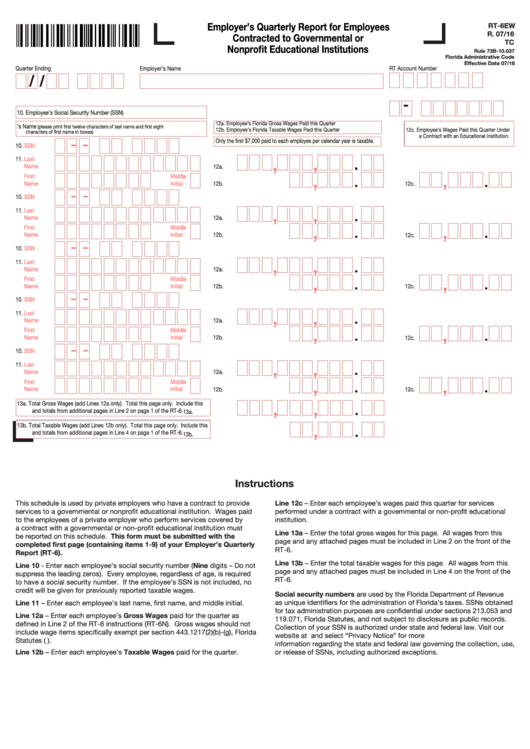

Form Rt-6ew - Employer'S Quarterly Report For Employees - Contracted To Governmental Or Nonprofit Educational Institutions

ADVERTISEMENT

Employer’s Quarterly Report for Employees

RT-6EW

R. 07/16

Contracted to Governmental or

TC

Nonprofit Educational Institutions

Rule 73B-10.037

Florida Administrative Code

Effective Date 07/16

Quarter Ending

RT Account Number

Employer’s Name

/

/

F.E.I. Number

-

10. Employee’s Social Security Number (SSN)

12a. Employee’s Florida Gross Wages Paid this Quarter

11.Employee’s Name

(please print first twelve characters of last name and first eight

12b. Employee’s Florida Taxable Wages Paid this Quarter

12c. Employee’s Wages Paid this Quarter Under

characters of first name in boxes)

a Contract with an Educational Institution.

-

-

Only the first $7,000 paid to each employee per calendar year is taxable.

10.

SSN

11. Last

Name

12a.

First

Middle

Name

Initial

12b.

12c.

-

-

10.

SSN

11.

Last

Name

12a.

First

Middle

Name

Initial

12b.

12c.

-

-

10.

SSN

11.

Last

Name

12a.

First

Middle

Name

Initial

12b.

12c.

-

-

10.

SSN

11.

Last

Name

12a.

First

Middle

Name

Initial

12b.

12c.

-

-

10.

SSN

11.

Last

Name

12a.

First

Middle

Name

Initial

12b.

12c.

13a. Total Gross Wages (add Lines 12a only). Total this page only. Include this

and totals from additional pages in Line 2 on page 1 of the RT-6.

13a.

13b. Total Taxable Wages (add Lines 12b only). Total this page only. Include this

and totals from additional pages in Line 4 on page 1 of the RT-6.

13b.

Instructions

Line 12c – Enter each employee’s wages paid this quarter for services

This schedule is used by private employers who have a contract to provide

services to a governmental or nonprofit educational institution. Wages paid

performed under a contract with a governmental or non-profit educational

to the employees of a private employer who perform services covered by

institution.

a contract with a governmental or non-profit educational institution must

Line 13a – Enter the total gross wages for this page. All wages from this

be reported on this schedule. This form must be submitted with the

page and any attached pages must be included in Line 2 on the front of the

completed first page (containing items 1-9) of your Employer’s Quarterly

RT-6.

Report (RT-6).

Line 13b – Enter the total taxable wages for this page. All wages from this

Line 10 - Enter each employee’s social security number (Nine digits – Do not

page and any attached pages must be included in Line 4 on the front of the

suppress the leading zeros). Every employee, regardless of age, is required

RT-6.

to have a social security number. If the employee’s SSN is not included, no

credit will be given for previously reported taxable wages.

Social security numbers are used by the Florida Department of Revenue

Line 11 – Enter each employee’s last name, first name, and middle initial.

as unique identifiers for the administration of Florida’s taxes. SSNs obtained

for tax administration purposes are confidential under sections 213.053 and

Line 12a – Enter each employee’s Gross Wages paid for the quarter as

119.071, Florida Statutes, and not subject to disclosure as public records.

defined in Line 2 of the RT-6 instructions (RT-6N). Gross wages should not

Collection of your SSN is authorized under state and federal law. Visit our

include wage items specifically exempt per section 443.1217(2)(b)-(g), Florida

website at and select “Privacy Notice” for more

Statutes (F.S.).

information regarding the state and federal law governing the collection, use,

Line 12b – Enter each employee’s Taxable Wages paid for the quarter.

or release of SSNs, including authorized exceptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1