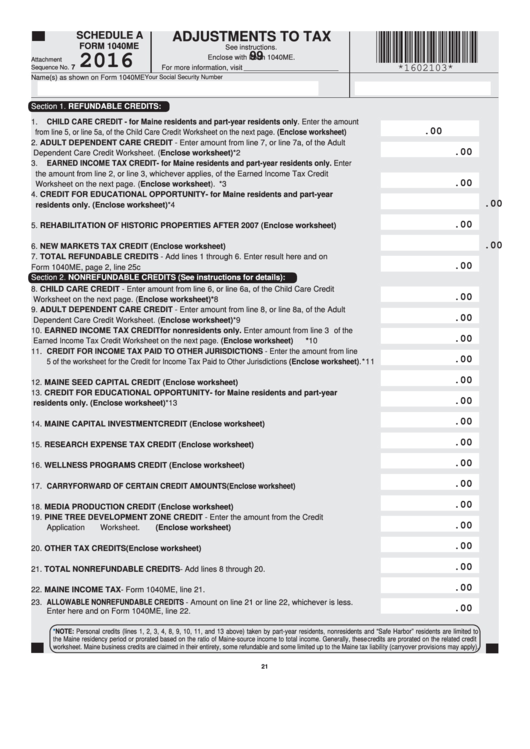

Form 1040me - Adjustments To Tax - 2016

ADVERTISEMENT

SCHEDULE A

ADJUSTMENTS TO TAX

FORM 1040ME

See instructions.

99

2016

Enclose with Form 1040ME.

Attachment

7

*1602103*

For more information, visit

Sequence No.

Name(s) as shown on Form 1040ME

Your Social Security Number

Section 1. REFUNDABLE CREDITS:

1.

CHILD CARE CREDIT - for Maine residents and part-year residents only. Enter the amount

.00

from line 5, or line 5a, of the Child Care Credit Worksheet on the next page. (Enclose worksheet) ..... 1

2.

ADULT DEPENDENT CARE CREDIT - Enter amount from line 7, or line 7a, of the Adult

.00

Dependent Care Credit Worksheet. (Enclose worksheet) .......................................................*2

3.

EARNED INCOME TAX CREDIT - for Maine residents and part-year residents only. Enter

the amount from line 2, or line 3, whichever applies, of the Earned Income Tax Credit

.00

Worksheet on the next page. (Enclose worksheet). ................................................................*3

4.

CREDIT FOR EDUCATIONAL OPPORTUNITY- for Maine residents and part-year

.00

residents only. (Enclose worksheet) .....................................................................................*4

.00

5.

REHABILITATION OF HISTORIC PROPERTIES AFTER 2007 (Enclose worksheet) ............ 5

.00

6.

NEW MARKETS TAX CREDIT (Enclose worksheet) .............................................................. 6

7.

TOTAL REFUNDABLE CREDITS - Add lines 1 through 6. Enter result here and on

.00

Form 1040ME, page 2, line 25c .................................................................................................. 7

Section 2. NONREFUNDABLE CREDITS (See instructions for details):

8.

CHILD CARE CREDIT - Enter amount from line 6, or line 6a, of the Child Care Credit

.00

Worksheet on the next page. (Enclose worksheet) .................................................................*8

9.

ADULT DEPENDENT CARE CREDIT - Enter amount from line 8, or line 8a, of the Adult

.00

Dependent Care Credit Worksheet. (Enclose worksheet) .......................................................*9

10. EARNED INCOME TAX CREDIT for nonresidents only. Enter amount from line 3 of the

.00

Earned Income Tax Credit Worksheet on the next page. (Enclose worksheet) ..........................*10

11. CREDIT FOR INCOME TAX PAID TO OTHER JURISDICTIONS - Enter the amount from line

.00

5 of the worksheet for the Credit for Income Tax Paid to Other Jurisdictions (Enclose worksheet) .*11

.00

12. MAINE SEED CAPITAL CREDIT (Enclose worksheet) ........................................................ 12

13. CREDIT FOR EDUCATIONAL OPPORTUNITY- for Maine residents and part-year

.00

residents only. (Enclose worksheet) ...................................................................................*13

.00

14. MAINE CAPITAL INVESTMENT CREDIT (Enclose worksheet) ............................................ 14

.00

15. RESEARCH EXPENSE TAX CREDIT (Enclose worksheet) ................................................. 15

.00

16. WELLNESS PROGRAMS CREDIT (Enclose worksheet) ..................................................... 16

.00

17. CARRYFORWARD OF CERTAIN CREDIT AMOUNTS (Enclose worksheet) .............................. 17

.00

18. MEDIA PRODUCTION CREDIT (Enclose worksheet) .......................................................... 18

19. PINE TREE DEVELOPMENT ZONE CREDIT - Enter the amount from the Credit

.00

Application Worksheet. (Enclose worksheet) ......................................................................... 19

.00

20. OTHER TAX CREDITS (Enclose worksheet) ......................................................................... 20

.00

21. TOTAL NONREFUNDABLE CREDITS - Add lines 8 through 20. ............................................ 21

.00

22. MAINE INCOME TAX - Form 1040ME, line 21. ....................................................................... 22

23. ALLOWABLE NONREFUNDABLE CREDITS - Amount on line 21 or line 22, whichever is less.

.00

Enter here and on Form 1040ME, line 22. ................................................................................ 23

*NOTE: Personal credits (lines 1, 2, 3, 4, 8, 9, 10, 11, and 13 above) taken by part-year residents, nonresidents and “Safe Harbor” residents are limited to

the Maine residency period or prorated based on the ratio of Maine-source income to total income. Generally, these credits are prorated on the related credit

worksheet. Maine business credits are claimed in their entirety, some refundable and some limited up to the Maine tax liability (carryover provisions may apply).

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2