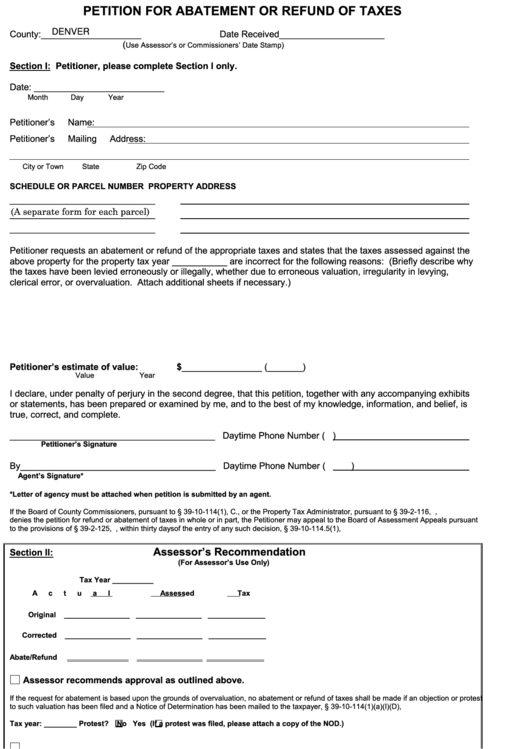

PETITION FOR ABATEMENT OR REFUND OF TAXES

DENVER

County:____________________

Date Received_____________________

(

Use Assessor’s or Commissioners’ Date Stamp)

Section I: Petitioner, please complete Section I only.

Date: __________________________

Month

Day

Year

Petitioner’s Name:

Petitioner’s Mailing Address:

City or Town

State

Zip Code

SCHEDULE OR PARCEL NUMBER

PROPERTY ADDRESS

_____________________________

(A separate form for each parcel)

_____________________________

_____________________________

Petitioner requests an abatement or refund of the appropriate taxes and states that the taxes assessed against the

above property for the property tax year ___________ are incorrect for the following reasons: (Briefly describe why

the taxes have been levied erroneously or illegally, whether due to erroneous valuation, irregularity in levying,

clerical error, or overvaluation. Attach additional sheets if necessary.)

Petitioner’s estimate of value:

$________________ (_______)

Value

Year

I declare, under penalty of perjury in the second degree, that this petition, together with any accompanying exhibits

or statements, has been prepared or examined by me, and to the best of my knowledge, information, and belief, is

true, correct, and complete.

_________________________________________

Daytime Phone Number (

)

Petitioner’s Signature

By_______________________________________

Daytime Phone Number (

)

Agent’s Signature*

*Letter of agency must be attached when petition is submitted by an agent.

If the Board of County Commissioners, pursuant to § 39-10-114(1), C.R.S., or the Property Tax Administrator, pursuant to § 39-2-116, C.R.S.,

denies the petition for refund or abatement of taxes in whole or in part, the Petitioner may appeal to the Board of Assessment Appeals pursuant

to the provisions of § 39-2-125, C.R.S., within thirty days of the entry of any such decision, § 39-10-114.5(1), C.R.S.

Assessor’s Recommendation

Section II:

(For Assessor’s Use Only)

Tax Year __________

Actual

Assessed

Tax

Original

________________ ________________ ______________

Corrected

________________ ________________ ______________

Abate/Refund

Assessor recommends approval as outlined above.

If the request for abatement is based upon the grounds of overvaluation, no abatement or refund of taxes shall be made if an objection or protest

to such valuation has been filed and a Notice of Determination has been mailed to the taxpayer, § 39-10-114(1)(a)(I)(D), C.R.S.

Tax year: ________ Protest?

No

Yes (If a protest was filed, please attach a copy of the NOD.)

Assessor recommends denial for the following reason(s):

Assessor’s or Deputy Assessor’s Signature

15-DPT-AR No. 920-66/11

1

1 2

2