Form Tr-579-Wt - New York State E-File Signature Authorization For Tax Year 2013 For Form(S) Nys-1 And Nys-45

ADVERTISEMENT

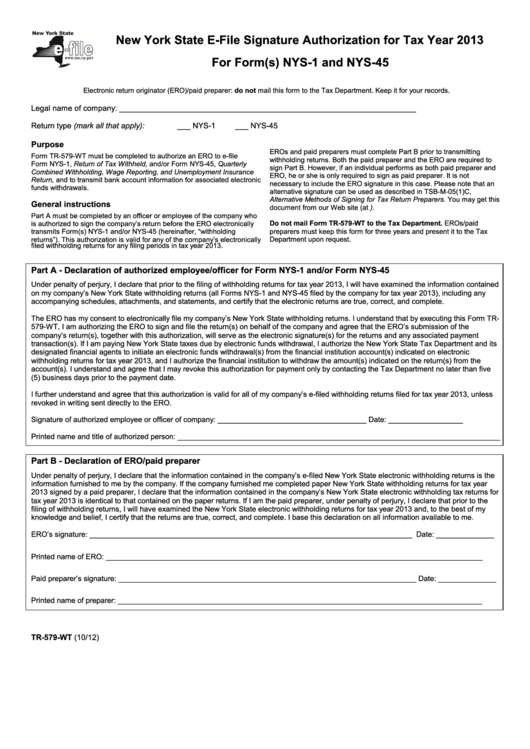

New York State E-File Signature Authorization for Tax Year 2013

For Form(s) NYS-1 and NYS-45

.

Electronic return originator (ERO)/paid preparer: do not mail this form to the Tax Department. Keep it for your records

Legal name of company: ____________________________________________________________________

Return type (mark all that apply):

___ NYS-1

___ NYS-45

Purpose

EROs and paid preparers must complete Part B prior to transmitting

Form TR-579-WT must be completed to authorize an ERO to e-file

withholding returns. Both the paid preparer and the ERO are required to

Form NYS-1, Return of Tax Withheld, and/or Form NYS-45, Quarterly

sign Part B. However, if an individual performs as both paid preparer and

Combined Withholding, Wage Reporting, and Unemployment Insurance

ERO, he or she is only required to sign as paid preparer. It is not

Return, and to transmit bank account information for associated electronic

necessary to include the ERO signature in this case. Please note that an

funds withdrawals.

alternative signature can be used as described in TSB-M-05(1)C,

Alternative Methods of Signing for Tax Return Preparers. You may get this

General instructions

document from our Web site (at ).

Part A must be completed by an officer or employee of the company who

Do not mail Form TR-579-WT to the Tax Department. EROs/paid

is authorized to sign the company’s return before the ERO electronically

transmits Form(s) NYS-1 and/or NYS-45 (hereinafter, “withholding

preparers must keep this form for three years and present it to the Tax

Department upon request.

returns”). This authorization is valid for any of the company’s electronically

filed withholding returns for any filing periods in tax year 2013.

Part A - Declaration of authorized employee/officer for Form NYS-1 and/or Form NYS-45

Under penalty of perjury, I declare that prior to the filing of withholding returns for tax year 2013, I will have examined the information contained

on my company’s New York State withholding returns (all Forms NYS-1 and NYS-45 filed by the company for tax year 2013), including any

accompanying schedules, attachments, and statements, and certify that the electronic returns are true, correct, and complete.

The ERO has my consent to electronically file my company’s New York State withholding returns. I understand that by executing this Form TR-

579-WT, I am authorizing the ERO to sign and file the return(s) on behalf of the company and agree that the ERO’s submission of the

company’s return(s), together with this authorization, will serve as the electronic signature(s) for the returns and any associated payment

transaction(s). If I am paying New York State taxes due by electronic funds withdrawal, I authorize the New York State Tax Department and its

designated financial agents to initiate an electronic funds withdrawal(s) from the financial institution account(s) indicated on electronic

withholding returns for tax year 2013, and I authorize the financial institution to withdraw the amount(s) indicated on the return(s) from the

account(s). I understand and agree that I may revoke this authorization for payment only by contacting the Tax Department no later than five

(5) business days prior to the payment date.

I further understand and agree that this authorization is valid for all of my company’s e-filed withholding returns filed for tax year 2013, unless

revoked in writing sent directly to the ERO.

Signature of authorized employee or officer of company: ____________________________________ Date: __________________

Printed name and title of authorized person: ______________________________________________________________________________

Part B - Declaration of ERO/paid preparer

Under penalty of perjury, I declare that the information contained in the company’s e-filed New York State electronic withholding returns is the

information furnished to me by the company. If the company furnished me completed paper New York State withholding returns for tax year

2013 signed by a paid preparer, I declare that the information contained in the company’s New York State electronic withholding tax returns for

tax year 2013 is identical to that contained on the paper returns. If I am the paid preparer, under penalty of perjury, I declare that prior to the

filing of withholding returns, I will have examined the New York State electronic withholding returns for tax year 2013 and, to the best of my

knowledge and belief, I certify that the returns are true, correct, and complete. I base this declaration on all information available to me.

ERO’s signature: ______________________________________________________________________________ Date: ______________

Printed name of ERO: ___________________________________________________________________________________________

Paid preparer’s signature: ________________________________________________________________________ Date: ______________

Printed name of preparer: ________________________________________________________________________________________

TR-579-WT (10/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1