Solar Energy Systems And Components Exempted From Sales And Use Tax Repeal

ADVERTISEMENT

TIP # 00A01-27

DATE ISSUED: : 09/20/00

Solar Energy Systems And Components Exempted From Sales

And Use Tax Repeal Date Extended To July 1, 2005

Beginning July 1, 1997, solar energy systems, or any component thereof,

became exempt from sales and use tax. The exemption was initially mandated to

be repealed July 1, 2002, but the repeal date has been extended to July 1, 2005.

The term "solar energy system" means the equipment and requisite hardware

that provide and are used for collecting, transferring, converting, storing, or using

incidental solar energy for water heating, space heating and cooling, or other

applications that would otherwise require the use of a conventional source of

energy such as petroleum products, natural gas, manufactured gas, or electricity.

A list of equipment and requisite hardware considered to be a solar energy

system or component thereof is included for your reference.

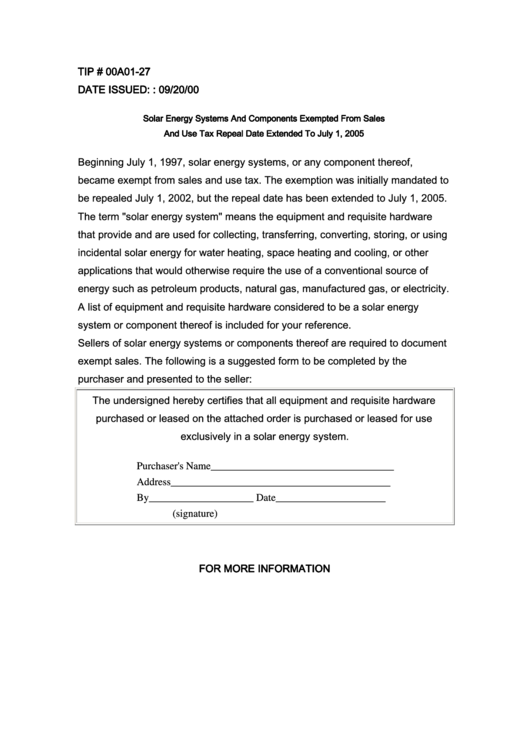

Sellers of solar energy systems or components thereof are required to document

exempt sales. The following is a suggested form to be completed by the

purchaser and presented to the seller:

The undersigned hereby certifies that all equipment and requisite hardware

purchased or leased on the attached order is purchased or leased for use

exclusively in a solar energy system.

Purchaser's Name___________________________________

Address__________________________________________

By____________________ Date_____________________

(signature)

FOR MORE INFORMATION

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4