Recurring Day Care Claim Form

Download a blank fillable Recurring Day Care Claim Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Recurring Day Care Claim Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

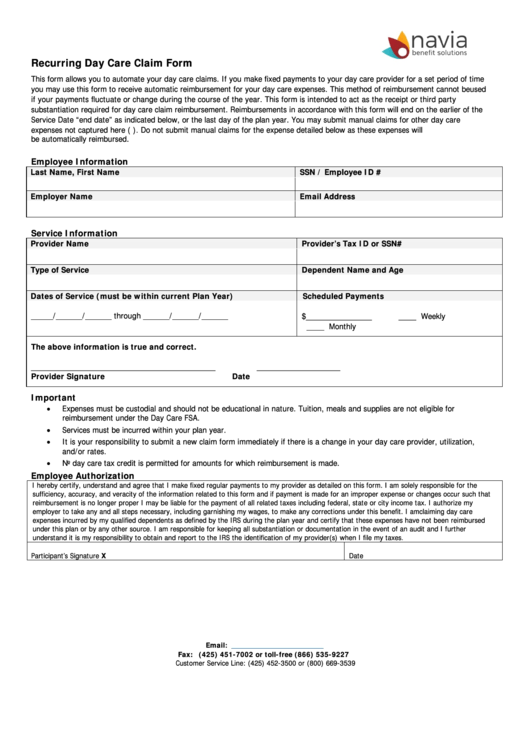

Recurring Day Care Claim Form

This form allows you to automate your day care claims. If you make fixed payments to your day care provider for a set period of time

you may use this form to receive automatic reimbursement for your day care expenses. This method of reimbursement cannot be used

if your payments fluctuate or change during the course of the year. This form is intended to act as the receipt or third party

substantiation required for day care claim reimbursement. Reimbursements in accordance with this form will end on the earlier of the

Service Date “end date” as indicated below, or the last day of the plan year. You may submit manual claims for other day care

expenses not captured here (i.e. summer camps). Do not submit manual claims for the expense detailed below as these expenses will

be automatically reimbursed.

Employee Information

Last Name, First Name

SSN / Employee ID #

Employer Name

Email Address

Service Information

Provider Name

Provider’s Tax ID or SSN#

Type of Service

Dependent Name and Age

Dates of Service (must be within current Plan Year)

Scheduled Payments

_____/______/______ through ______/______/______

$_______________

____ Weekly

____ Monthly

The above information is true and correct.

__________________________________________

___________________

Provider Signature

Date

Important

•

Expenses must be custodial and should not be educational in nature. Tuition, meals and supplies are not eligible for

reimbursement under the Day Care FSA.

Services must be incurred within your plan year.

•

It is your responsibility to submit a new claim form immediately if there is a change in your day care provider, utilization,

•

and/or rates.

No day care tax credit is permitted for amounts for which reimbursement is made.

•

Employee Authorization

I hereby certify, understand and agree that I make fixed regular payments to my provider as detailed on this form. I am solely responsible for the

sufficiency, accuracy, and veracity of the information related to this form and if payment is made for an improper expense or changes occur such that

reimbursement is no longer proper I may be liable for the payment of all related taxes including federal, state or city income tax. I authorize my

employer to take any and all steps necessary, including garnishing my wages, to make any corrections under this benefit. I am claiming day care

expenses incurred by my qualified dependents as defined by the IRS during the plan year and certify that these expenses have not been reimbursed

under this plan or by any other source. I am responsible for keeping all substantiation or documentation in the event of an audit and I further

understand it is my responsibility to obtain and report to the IRS the identification of my provider(s) when I file my taxes.

Participant’s Signature X

Date

Email:

Fax: (425) 451-7002 or toll-free (866) 535-9227

Customer Service Line: (425) 452-3500 or (800) 669-3539

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1