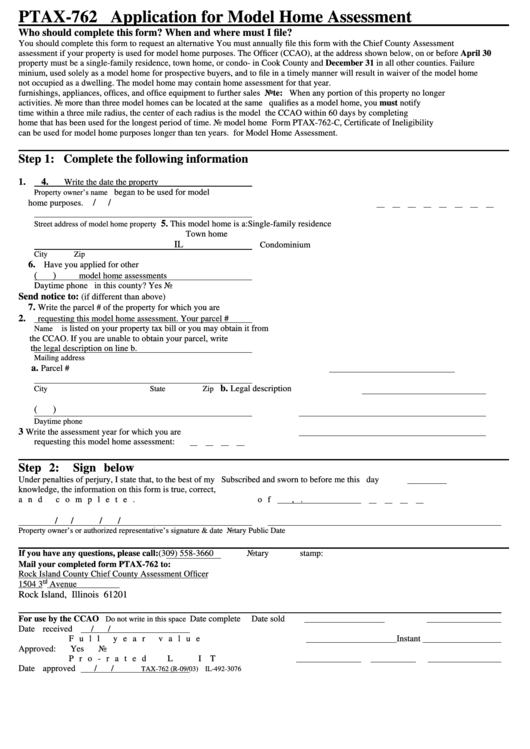

PTAX-762 Application for Model Home Assessment

Who should complete this form?

When and where must I file?

You should complete this form to request an alternative

You must annually file this form with the Chief County Assessment

assessment if your property is used for model home purposes. The

Officer (CCAO), at the address shown below, on or before April 30

property must be a single-family residence, town home, or condo-

in Cook County and December 31 in all other counties. Failure

minium, used solely as a model home for prospective buyers, and

to file in a timely manner will result in waiver of the model home

not occupied as a dwelling. The model home may contain home

assessment for that year.

furnishings, appliances, offices, and office equipment to further sales

Note:

When any portion of this property no longer

activities. No more than three model homes can be located at the same

qualifies as a model home, you must notify

time within a three mile radius, the center of each radius is the model

the CCAO within 60 days by completing

home that has been used for the longest period of time. No model home

Form PTAX-762-C, Certificate of Ineligibility

can be used for model home purposes longer than ten years.

for Model Home Assessment.

Step 1: Complete the following information

1.

4.

Write the date the property

began to be used for model

Property owner’s name

/

/

home purposes.

5

. This model home is a:

Single-family residence

Street address of model home property

Town home

IL

Condominium

City

Zip

6.

Have you applied for other

(

)

model home assessments

Daytime phone

in this county?

Yes

No

Send notice to:

(if different than above)

7.

Write the parcel # of the property for which you are

2.

requesting this model home assessment. Your parcel #

is listed on your property tax bill or you may obtain it from

Name

the CCAO. If you are unable to obtain your parcel, write

the legal description on line b.

Mailing address

a.

Parcel #

b.

Legal description

City

State

Zip

(

)

Daytime phone

3

Write the assessment year for which you are

requesting this model home assessment:

Step 2: Sign below

Under penalties of perjury, I state that, to the best of my

Subscribed and sworn to before me this

day

knowledge, the information on this form is true, correct,

and complete.

of

,

.

/

/

/

/

Property owner’s or authorized representative’s signature & date

Notary Public

Date

If you have any questions, please call: (309) 558-3660

Notary stamp:

Mail your completed form PTAX-762 to:

Rock Island County Chief County Assessment Officer

rd

1504 3

Avenue

Rock Island, Illinois 61201

For use by the CCAO

Date complete

Date sold

Do not write in this space

Date received

/

/

Full year value

Instant

Approved:

Yes

No

Pro-rated L

I

T

Date approved

/

/

TAX-762 (R-09/03) IL-492-3076

1

1 2

2