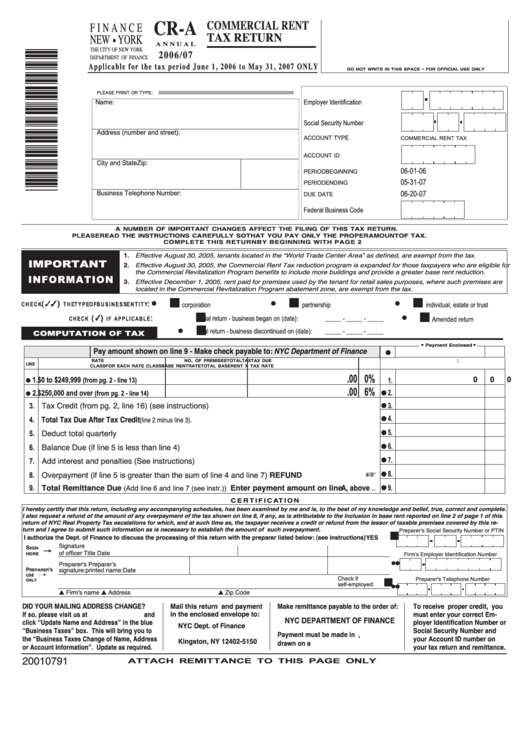

Form Cr-A - Commercial Rent Tax Return - 2006/07

ADVERTISEMENT

CR-A

COMMERCIAL RENT

F I N A N C E

T A X R E T U R N

NEW

YORK

A N N U A L

2006/07

G

THE CITY OF NEW YORK

nyc.gov/finance

DEPARTMENT OF FINANCE

Applicable for the tax period June 1, 2006 to May 31, 2007 ONLY

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

:

PLEASE PRINT OR TYPE

Employer Identification Number........

Name:

Social Security Number ..............

Address (number and street):

....................

ACCOUNT TYPE

COMMERCIAL RENT TAX

..........................

ACCOUNT ID

City and State

Zip:

06-01-06

..................

PERIOD BEGINNING

..................... 05-31-07

PERIOD ENDING

06-20-07

Business Telephone Number:

.................................

DUE DATE

...............

Federal Business Code

A NUMBER OF IMPORTANT CHANGES AFFECT THE FILING OF THIS TAX RETURN.

PLEASE READ THE INSTRUCTIONS CAREFULLY SO THAT YOU PAY ONLY THE PROPER AMOUNT OF TAX.

COMPLETE THIS RETURN BY BEGINNING WITH PAGE 2

1. Effective August 30, 2005, tenants located in the “World Trade Center Area” as defined, are exempt from the tax.

IMPORTANT

2. Effective August 30, 2005, the Commercial Rent Tax reduction program is expanded for those taxpayers who are eligible for

the Commercial Revitalization Program benefits to include more buildings and provide a greater base rent reduction.

INFORMATION

3. Effective December 1, 2005, rent paid for premises used by the tenant for retail sales purposes, where such premises are

located in the Commercial Revitalization Program abatement zone, are exempt from the tax.

I I

I I

I I

( )

:

corporation

partnership

individual, estate or trust

C H E C K

T H E T Y P E O F B U S I N E S S E N T I T Y

G

G

G

I I

I I

( )

:

initial return - business began on (date):

_____ - _____ - _____

Amended return

C H E C K

I F A P P L I C A B L E

G

I I

final return - business discontinued on (date):

_____ - _____ - _____

G

COMPUTATION OF TAX

Pay amount shown on line 9 - Make check payable to: NYC Department of Finance

A. Payment -

Payment Enclosed

M

M

M

M

G

.

:

RATE

NO

OF PREMISES

TOTAL

TAX

TAX DUE

LINE

TOTAL BASE RENT X TAX RATE

CLASS

FOR EACH RATE CLASS

BASE RENT

RATE

.00 0%

1. $0 to $249,999

0

0 0

1.

(from pg. 2 - line 13)

G

.00 6%

2.

2. $250,000 and over

(from pg. 2 - line 14)

G

G

3. Tax Credit (from pg. 2, line 16) (see instructions) .............................................................................

3.

G

4. Total Tax Due After Tax Credit

....................................................................................

(line 2 minus line 3).

4.

G

5. Deduct total quarterly payments ......................................................................................................

5.

G

6. Balance Due (if line 5 is less than line 4) .........................................................................................

6.

G

7. Add interest and penalties (See instructions) ...................................................................................

7.

G

8. Overpayment (if line 5 is greater than the sum of line 4 and line 7) .............................REFUND

8.

G

9. Total Remittance Due

Enter payment amount on line A, above ..

(Add line 6 and line 7 (see instr.))

9.

G

C E R T I F I C AT I O N

I hereby certify that this return, including any accompanying schedules, has been examined by me and is, to the best of my knowledge and belief, true, correct and complete.

I also request a refund of the amount of any overpayment of the tax shown on line 8, if any, as is attributable to the inclusion in base rent reported on line 2 of page 1 of this

return of NYC Real Property Tax escalations for which, and at such time as, the taxpayer receives a credit or refund from the lessor of taxable premises covered by this re-

turn and I agree to submit such information as is necessary to establish the amount of such overpayment.

Preparer's Social Security Number or PTIN

I I

I authorize the Dept. of Finance to discuss the processing of this return with the preparer listed below: (see instructions) YES

Signature

S

IGN

of officer

Title

Date

¡

¡

Firm's Employer Identification Number

HERE

Preparer's

Preparerʼs

G G

P

'

signature:

printed name:

Date

REPARER

S

¡

USE

Check if

I I

Preparer's Telephone Number

ONLY

self-employed:

L Firm's name

L Address

L Zip Code

G G

DID YOUR MAILING ADDRESS CHANGE?

Mail this return and payment

Make remittance payable to the order of:

To receive proper credit, you

If so, please visit us at nyc.gov/finance and

in the enclosed envelope to:

must enter your correct Em-

NYC DEPARTMENT OF FINANCE

click “Update Name and Address” in the blue

ployer Identification Number or

NYC Dept. of Finance

“Business Taxes” box. This will bring you to

Social Security Number and

P.O. Box 5150

Payment must be made in U.S. dollars,

the “Business Taxes Change of Name, Address

your Account ID number on

Kingston, NY 12402-5150

drawn on a U.S. bank.

or Account Information”. Update as required.

your tax return and remittance.

20010791

AT TA C H R E M I T TA N C E T O T H I S PA G E O N LY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2