Schedule Wv/srdtc-1 - Strategic Research And Development Tax Credit

ADVERTISEMENT

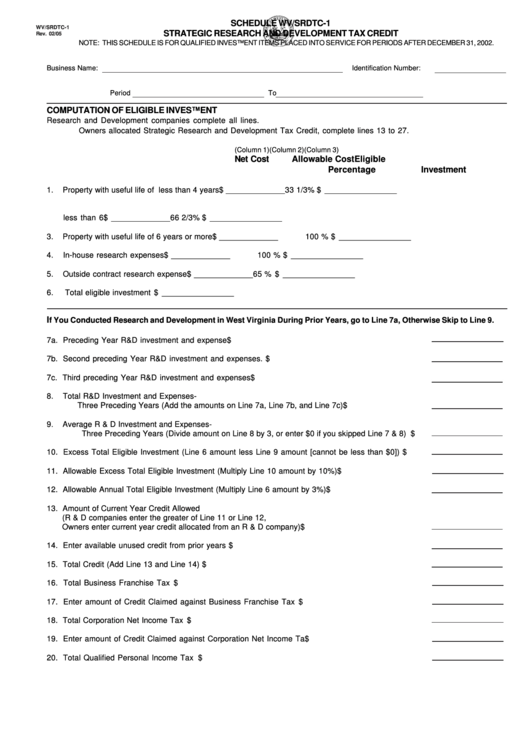

SCHEDULE WV/SRDTC-1

WV/SRDTC-1

STRATEGIC RESEARCH AND DEVELOPMENT TAX CREDIT

Rev. 02/05

NOTE: THIS SCHEDULE IS FOR QUALIFIED INVESTMENT ITEMS PLACED INTO SERVICE FOR PERIODS AFTER DECEMBER 31, 2002.

Business Name:

Identification Number:

Period

To

COMPUTATION OF ELIGIBLE INVESTMENT

Research and Development companies complete all lines.

Owners allocated Strategic Research and Development Tax Credit, complete lines 13 to 27.

(Column 1)

(Column 2)

(Column 3)

Net Cost

Allowable Cost

Eligible

Percentage

Investment

1.

Property with useful life of less than 4 years

$ _____________

33 1/3%

$ ________________

2.

Property with useful life of 4 years or more but

less than 6

$ _____________

66 2/3%

$ ________________

3.

Property with useful life of 6 years or more

$ _____________

100 %

$ ________________

4.

In-house research expenses

$ _____________

100 %

$ ________________

5.

Outside contract research expense

$ _____________

65 %

$ ________________

6.

Total eligible investment

$ ________________

I

f You Conducted Research and Development in West Virginia During Prior Years, go to Line 7a, Otherwise Skip to Line 9.

7a. Preceding Year R&D investment and expense ......................................................................................... $

7b. Second preceding Year R&D investment and expenses .......................................................................... $

7c. Third preceding Year R&D investment and expenses .............................................................................. $

8.

Total R&D Investment and Expenses-

Three Preceding Years (Add the amounts on Line 7a, Line 7b, and Line 7c) ................................... $

9.

Average R & D Investment and Expenses-

Three Preceding Years (Divide amount on Line 8 by 3, or enter $0 if you skipped Line 7 & 8) ...... $

10. Excess Total Eligible Investment (Line 6 amount less Line 9 amount [cannot be less than $0]) ......... $

11. Allowable Excess Total Eligible Investment (Multiply Line 10 amount by 10%) ....................................... $

12. Allowable Annual Total Eligible Investment (Multiply Line 6 amount by 3%) ............................................ $

13. Amount of Current Year Credit Allowed

(R & D companies enter the greater of Line 11 or Line 12,

Owners enter current year credit allocated from an R & D company) ...................................................... $

14. Enter available unused credit from prior years ......................................................................................... $

15. Total Credit (Add Line 13 and Line 14) ....................................................................................................... $

16. Total Business Franchise Tax .................................................................................................................... $

17. Enter amount of Credit Claimed against Business Franchise Tax .......................................................... $

18. Total Corporation Net Income Tax .............................................................................................................. $

19. Enter amount of Credit Claimed against Corporation Net Income Tax ................................................... $

20. Total Qualified Personal Income Tax ......................................................................................................... $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2