Form D-1 - Income Tax

ADVERTISEMENT

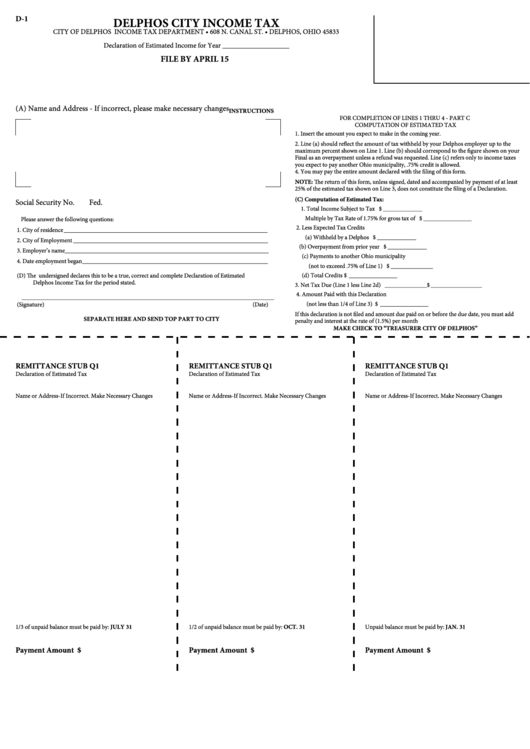

D-1

DELPHOS CITY INCOME TAX

CITY OF DELPHOS INCOME TAX DEPARTMENT • 608 N. CANAL ST. • DELPHOS, OHIO 45833

Declaration of Estimated Income for Year ___________________

FILE BY APRIL 15

(A) Name and Address - If incorrect, please make necessary changes

INSTRUCTIONS

FOR COMPLETION OF LINES 1 THRU 4 - PART C

COMPUTATION OF ESTIMATED TAX

1. Insert the amount you expect to make in the coming year.

2. Line (a) should reflect the amount of tax withheld by your Delphos employer up to the

maximum percent shown on Line 1. Line (b) should correspond to the figure shown on your

Final as an overpayment unless a refund was requested. Line (c) refers only to income taxes

you expect to pay another Ohio municipality, .75% credit is allowed.

4. You may pay the entire amount declared with the filing of this form.

NOTE: The return of this form, unless signed, dated and accompanied by payment of at least

25% of the estimated tax shown on Line 3, does not constitute the filing of a Declaration.

(C) Computation of Estimated Tax:

Social Security No.

Fed. I.D. No.

1. Total Income Subject to Tax ......................... $ _____________

1.

Multiple by Tax Rate of 1.75% for gross tax of ............................. $ ________________

Please answer the following questions:

2. Less Expected Tax Credits

1. City of residence ___________________________________________________________________

2.

(a) Withheld by a Delphos employer........... $ _____________

2. City of Employment ________________________________________________________________

2.

(b) Overpayment from prior year ................ $ _____________

3. Employer’s name___________________________________________________________________

2.

(c) Payments to another Ohio municipality

4. Date employment began _____________________________________________________________

2.

(a)

(not to exceeed .75% of Line 1) .............. $ ______________

(D) The undersigned declares this to be a true, correct and complete Declaration of Estimated

4.

(d) Total Credits ................................................................................$ ________________

Delphos Income Tax for the period stated.

3. Net Tax Due (Line 1 less Line 2d) ................ ______________ $ _________________

4. Amount Paid with this Declaration

___________________________________________________________________________________

4.

(not less than 1/4 of Line 3) ..............................................................$ ________________

(Signature)

____________________________________________________________________

(Date)

If this declaration is not filed and amount due paid on or before the due date, you must add

SEPARATE HERE AND SEND TOP PART TO CITY

penalty and interest at the rate of (1.5%) per month

MAKE CHECK TO “TREASURER CITY OF DELPHOS”

REMITTANCE STUB

Q1

REMITTANCE STUB

Q1

REMITTANCE STUB

Q1

Declaration of Estimated Tax

Declaration of Estimated Tax

Declaration of Estimated Tax

Name or Address-If Incorrect. Make Necessary Changes

Name or Address-If Incorrect. Make Necessary Changes

Name or Address-If Incorrect. Make Necessary Changes

1/3 of unpaid balance must be paid by:

JULY 31

1/2 of unpaid balance must be paid by:

OCT. 31

Unpaid balance must be paid by:

JAN. 31

Payment Amount $

Payment Amount $

Payment Amount $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1