Form Ir - Individual Tax Return

ADVERTISEMENT

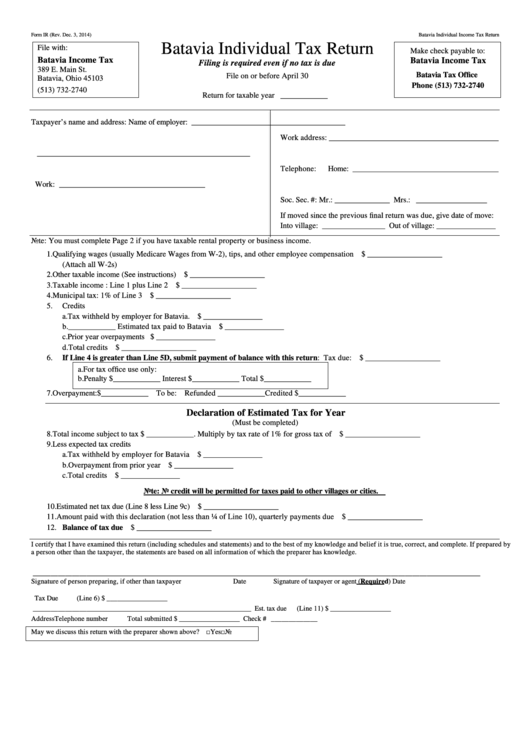

Form IR (Rev. Dec. 3, 2014)

Batavia Individual Income Tax Return

Batavia Individual Tax Return

File with:

Make check payable to:

Batavia Income Tax

Batavia Income Tax

Filing is required even if no tax is due

389 E. Main St.

Batavia Tax Office

File on or before April 30

Batavia, Ohio 45103

Phone (513) 732-2740

(513) 732-2740

Return for taxable year ____________

Taxpayer’s name and address:

Name of employer: _______________________________________

Work address: ___________________________________________

______________________________________________________

Telephone:

Home: _____________________________________

Work: _____________________________________

Soc. Sec. #:

Mr.: ______________ Mrs.: __________________

If moved since the previous final return was due, give date of move:

Into village: ________________ Out of village: _______________

Note: You must complete Page 2 if you have taxable rental property or business income.

1.

Qualifying wages (usually Medicare Wages from W-2), tips, and other employee compensation .......................... $ ___________________

(Attach all W-2s)

2.

Other taxable income (See instructions) .................................................................................................................. $ ___________________

3.

Taxable income : Line 1 plus Line 2 ........................................................................................................................ $ ___________________

4.

Municipal tax: 1% of Line 3 .................................................................................................................................... $ ___________________

5.

Credits

a.

Tax withheld by employer for Batavia. ............................................................................ $ _______________

b.

____________ Estimated tax paid to Batavia .................................................................. $ _______________

c.

Prior year overpayments ................................................................................................... $ _______________

d.

Total credits ..................................................................................................................................................... $ ___________________

6.

If Line 4 is greater than Line 5D, submit payment of balance with this return: .............................. Tax due: $ ___________________

a.

For tax office use only:

b.

Penalty $____________ Interest $____________ Total $____________

7.

Overpayment: $____________ To be: Refunded ____________ Credited $____________

Declaration of Estimated Tax for Year

(Must be completed)

8.

Total income subject to tax $ ____________. Multiply by tax rate of 1% for gross tax of ..................................... $ ___________________

9.

Less expected tax credits

a.

Tax withheld by employer for Batavia ............................................................................. $ _______________

b.

Overpayment from prior year .......................................................................................... $ _______________

c.

Total credits ..................................................................................................................... $ _______________

Note: No credit will be permitted for taxes paid to other villages or cities.

10. Estimated net tax due (Line 8 less Line 9c) ............................................................................................................. $ ___________________

11. Amount paid with this declaration (not less than ¼ of Line 10), quarterly payments due ....................................... $ ___________________

12. Balance of tax due .................................................................................................................................................. $ ___________________

I certify that I have examined this return (including schedules and statements) and to the best of my knowledge and belief it is true, correct, and complete. If prepared by

a person other than the taxpayer, the statements are based on all information of which the preparer has knowledge.

_____________________________________________________________

________________________________________________________________

Signature of person preparing, if other than taxpayer

Date

Signature of taxpayer or agent (Required)

Date

Tax Due

(Line 6)

$ _________________

_____________________________________________________________

Est. tax due

(Line 11)

$ _________________

Address

Telephone number

Total submitted

$ _________________

Check # _____________

□ Yes □ No

May we discuss this return with the preparer shown above?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2