Schedule A - Deductions Worksheet - Rds Arizona Transaction Privilege And Use Tax - 2013

ADVERTISEMENT

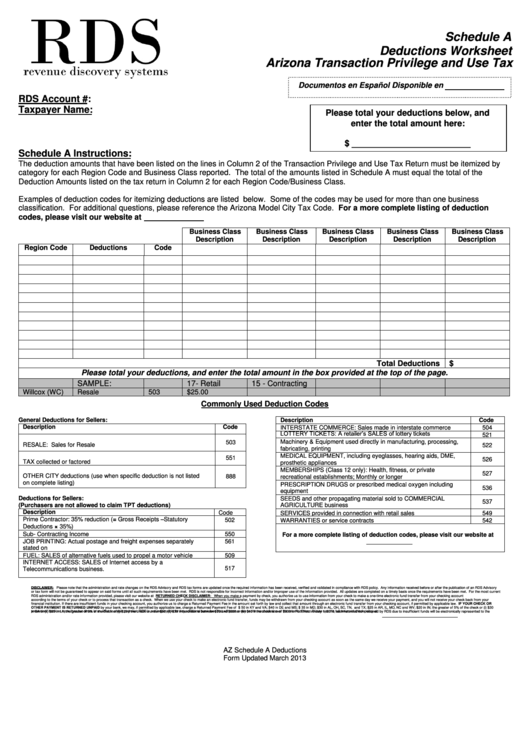

Schedule A

Deductions Worksheet

Arizona Transaction Privilege and Use Tax

Documentos en Español Disponible en

RDS Account #:

Taxpayer Name:

Please total your deductions below, and

enter the total amount here:

$ _________________________

Schedule A Instructions:

The deduction amounts that have been listed on the lines in Column 2 of the Transaction Privilege and Use Tax Return must be itemized by

category for each Region Code and Business Class reported. The total of the amounts listed in Schedule A must equal the total of the

Deduction Amounts listed on the tax return in Column 2 for each Region Code/Business Class.

Examples of deduction codes for itemizing deductions are listed below. Some of the codes may be used for more than one business

classification. For additional questions, please reference the Arizona Model City Tax Code. For a more complete listing of deduction

codes, please visit our website at .

Business Class

Business Class

Business Class

Business Class

Business Class

Description

Description

Description

Description

Description

Region Code

Deductions

Code

Total Deductions

$

Please total your deductions, and enter the total amount in the box provided at the top of the page.

SAMPLE:

17- Retail

15 - Contracting

Willcox (WC)

Resale

503

$25.00

Commonly Used Deduction Codes

General Deductions for Sellers:

Description

Code

Description

Code

INTERSTATE COMMERCE: Sales made in interstate commerce

504

LOTTERY TICKETS: A retailer’s SALES of lottery tickets

521

Machinery & Equipment used directly in manufacturing, processing,

503

RESALE: Sales for Resale

522

fabricating, printing

MEDICAL EQUIPMENT, including eyeglasses, hearing aids, DME,

551

526

TAX collected or factored

prosthetic appliances

MEMBERSHIPS (Class 12 only): Health, fitness, or private

527

OTHER CITY deductions (use when specific deduction is not listed

888

recreational establishments; Monthly or longer

on complete listing)

PRESCRIPTION DRUGS or prescribed medical oxygen including

536

equipment

Deductions for Sellers:

SEEDS and other propagating material sold to COMMERCIAL

537

(Purchasers are not allowed to claim TPT deductions)

AGRICULTURE business

Description

Code

SERVICES provided in connection with retail sales

549

Prime Contractor: 35% reduction (= Gross Receipts – Statutory

502

WARRANTIES or service contracts

542

Deductions × 35%)

Sub- Contracting Income

550

For a more complete listing of deduction codes, please visit our website at

JOB PRINTING: Actual postage and freight expenses separately

561

.

stated on

FUEL: SALES of alternative fuels used to propel a motor vehicle

509

INTERNET ACCESS: SALES of Internet access by a

517

Telecommunications business.

DISCLAIMER: Please note that the administration and rate changes on the RDS Advisory and RDS tax forms are updated once the required information has been received, verified and validated in compliance with RDS policy. Any information received before or after th e publication of an RDS Advisory

or tax form will not be guaranteed to appear on said forms until all such requirements have been met. RDS is not responsible for incorrect information and/or improper use of the information provided. All updates are completed on a timely basis once the requirements have been met. For the most current

RDS administration and/or rate information provided, please visit our website at . RETURNED CHECK DISCLAIMER:

When you make a payment by check, you authorize us to use information from your check to make a one-time electronic fund transfer from your checking account

according to the terms of your check or to process that transaction as a check. When we use your check to make an electronic fund transfer, funds may be withdrawn from your checking account as soon as the same day we receive your payment, and you will not receive your check back from your

financial institution. If there are insufficient funds in your checking account, you authorize us to charge a Returned Payment Fee in the amount set forth by law and collect that amount through an electronic fund transfer from your checking account, if permitted by applicable law. IF YOUR CHECK OR

OTHER PAYMENT IS RETURNED UNPAID by your bank, we may, if permitted by applicable law, charge a Returned Payment Fee of $ 50 in KY and VA; $40 in DE and MS; $ 35 in MD; $30 in AL, OH, SC, TN, and TX; $25 in AR, IL, MO, NC and WV; $20 in IN; the greater of 5% of the check or (i) $30

in GA or (ii) $25 in LA; the greater of 5% of the check or (i) $25 if the check is under $50, (ii) $30 if the check is between $50 and $300 or (iii) $40 if the check is over $300 in FL. Effective July 1, 2010, each returned item received by RDS due to insufficient funds will be electronically represented to the

presenters’ bank no more than two times in an effort to obtain payment. RDS is not responsible for any additional bank fees that will accrue due to the resubmission of the returned item. Please see the full returned check policy at /taxpayer/return-check-disclaimer.

AZ Schedule A Deductions

Form Updated March 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1