State Income Tax Deduction Addback Form

ADVERTISEMENT

TAXPAYER SERVICE DIVISION

FYI – For Your Information

State Income Tax Deduction Addback

DETERMINING YOUR ADDBACK

Individuals who itemize deductions on

AMOUNT

their federal returns, and estates and

trusts must add back on the Colorado

When to Use the State Income Tax

return any state income tax included in

Deduction from the Federal Schedule A

their federal deductions. Enter this

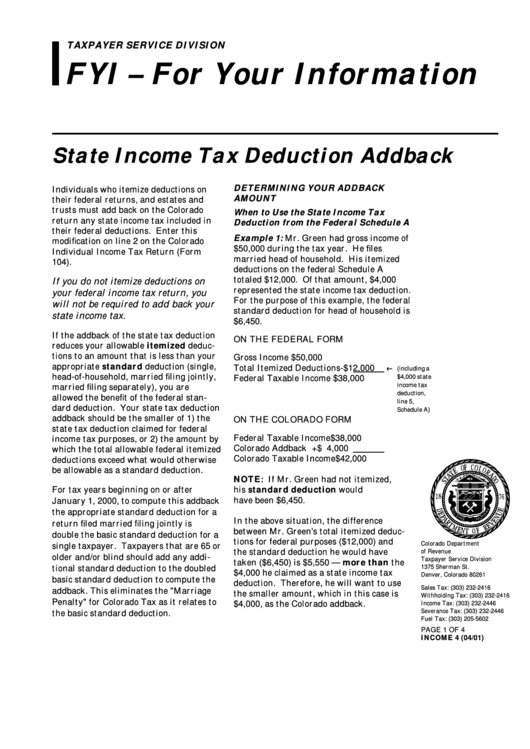

Example 1: Mr. Green had gross income of

modification on line 2 on the Colorado

$50,000 during the tax year. He files

Individual Income Tax Return (Form

married head of household. His itemized

104).

deductions on the federal Schedule A

totaled $12,000. Of that amount, $4,000

If you do not itemize deductions on

represented the state income tax deduction.

your federal income tax return, you

For the purpose of this example, the federal

will not be required to add back your

standard deduction for head of household is

state income tax.

$6,450.

If the addback of the state tax deduction

ON THE FEDERAL FORM

reduces your allowable itemized deduc-

tions to an amount that is less than your

Gross Income

$50,000

appropriate standard deduction (single,

Total Itemized Deductions

-$12,000

(including a

head-of-household, married filing jointly,

$4,000 state

Federal Taxable Income

$38,000

income tax

married filing separately), you are

deduction,

allowed the benefit of the federal stan-

line 5,

dard deduction. Your state tax deduction

Schedule A)

addback should be the smaller of 1) the

ON THE COLORADO FORM

state tax deduction claimed for federal

Federal Taxable Income

$38,000

income tax purposes, or 2) the amount by

Colorado Addback

+$ 4,000

which the total allowable federal itemized

Colorado Taxable Income

$42,000

deductions exceed what would otherwise

be allowable as a standard deduction.

NOTE: If Mr. Green had not itemized,

For tax years beginning on or after

his standard deduction would

have been $6,450.

January 1, 2000, to compute this addback

the appropriate standard deduction for a

In the above situation, the difference

return filed married filing jointly is

between Mr. Green's total itemized deduc-

double the basic standard deduction for a

tions for federal purposes ($12,000) and

Colorado Department

single taxpayer. Taxpayers that are 65 or

the standard deduction he would have

of Revenue

older and/or blind should add any addi-

Taxpayer Service Division

taken ($6,450) is $5,550 — more than the

1375 Sherman St.

tional standard deduction to the doubled

$4,000 he claimed as a state income tax

Denver, Colorado 80261

basic standard deduction to compute the

deduction. Therefore, he will want to use

Sales Tax: (303) 232-2416

addback. This eliminates the "Marriage

the smaller amount, which in this case is

Withholding Tax: (303) 232-2416

Penalty" for Colorado Tax as it relates to

$4,000, as the Colorado addback.

Income Tax: (303) 232-2446

Severance Tax: (303) 232-2446

the basic standard deduction.

Fuel Tax: (303) 205-5602

PAGE 1 OF 4

INCOME 4 (04/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4