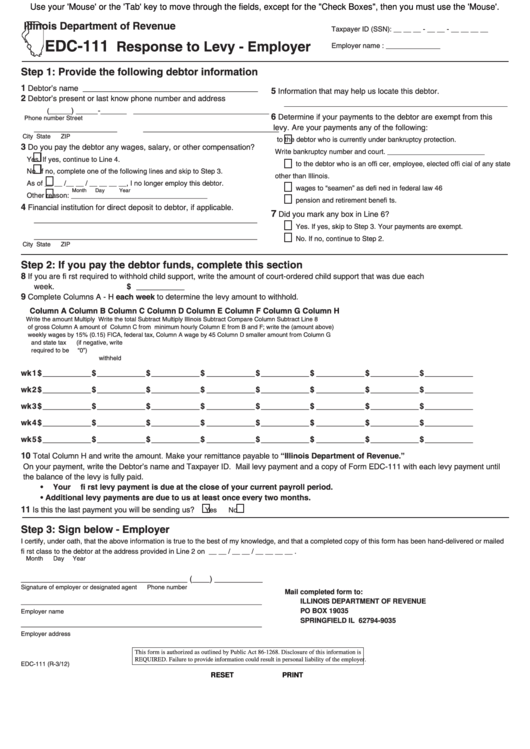

Use your 'Mouse' or the 'Tab' key to move through the fields, except for the "Check Boxes", then you must use the 'Mouse'.

Illinois Department of Revenue

Taxpayer ID (SSN): __ __ __ - __ __ - __ __ __ __

EDC-111

Response to Levy - Employer

Employer name : ______________

Step 1: Provide the following debtor information

1

Debtor’s name ________________________________________

5

Information that may help us locate this debtor.

2

Debtor’s present or last know phone number and address

___________________________________________________

_____) _____-______ _______________________________

(

6

Determine if your payments to the debtor are exempt from this

Phone number

Street

levy. Are your payments any of the following:

___________________ _______________________________

City

State

ZIP

to the debtor who is currently under bankruptcy protection.

3

Do you pay the debtor any wages, salary, or other compensation?

Write bankruptcy number and court. _________________________

Yes. If yes, continue to Line 4.

to the debtor who is an offi cer, employee, elected offi cial of any state

No. If no, complete one of the following lines and skip to Step 3.

other than Illinois.

As of __ __ /__ __ / __ __ __ __, I no longer employ this debtor.

wages to “seamen” as defi ned in federal law 46 U.S.C. 10101.

Month

Day

Year

Other reason: ___________________________________

pension and retirement benefi ts.

4

Financial institution for direct deposit to debtor, if applicable.

7

Did you mark any box in Line 6?

___________________________________________________

Yes. If yes, skip to Step 3. Your payments are exempt.

___________________________________________________

No. If no, continue to Step 2.

City

State

ZIP

Step 2: If you pay the debtor funds, complete this section

8

If you are fi rst required to withhold child support, write the amount of court-ordered child support that was due each

week.

$ ___________

9

Complete Columns A - H each week to determine the levy amount to withhold.

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

Write the amount

Multiply

Write the total

Subtract

Multiply Illinois

Subtract

Compare Column

Subtract Line 8

of gross

Column A

amount of

Column C from

minimum hourly

Column E from

B and F; write the

(amount above)

weekly wages

by 15% (0.15)

FICA, federal tax,

Column A

wage by 45

Column D

smaller amount

from Column G

and state tax

(if negative, write

required to be

“0”)

withheld

wk 1 $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________

wk 2 $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________

wk 3 $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________

wk 4 $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________

wk 5 $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________ $ ___________

10

Total Column H and write the amount. Make your remittance payable to “Illinois Department of Revenue.”

On your payment, write the Debtor’s name and Taxpayer ID. Mail levy payment and a copy of Form EDC-111 with each levy payment until

the balance of the levy is fully paid.

•

Your fi rst levy payment is due at the close of your current payroll period.

•

Additional levy payments are due to us at least once every two months.

11

Is this the last payment you will be sending us?

Yes

No

Step 3: Sign below - Employer

I certify, under oath, that the above information is true to the best of my knowledge, and that a completed copy of this form has been hand-delivered or mailed

fi rst class to the debtor at the address provided in Line 2 on __ __ / __ __ / __ __ __ __ .

Month

Day

Year

______________________________________ (____) ___________

Signature of employer or designated agent

Phone number

Mail completed form to:

_______________________________________________________

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19035

Employer name

SPRINGFIELD IL 62794-9035

_______________________________________________________

Employer address

This form is authorized as outlined by Public Act 86-1268. Disclosure of this information is

REQUIRED. Failure to provide information could result in personal liability of the employer.

EDC-111 (R-3/12)

RESET

PRINT

1

1 2

2