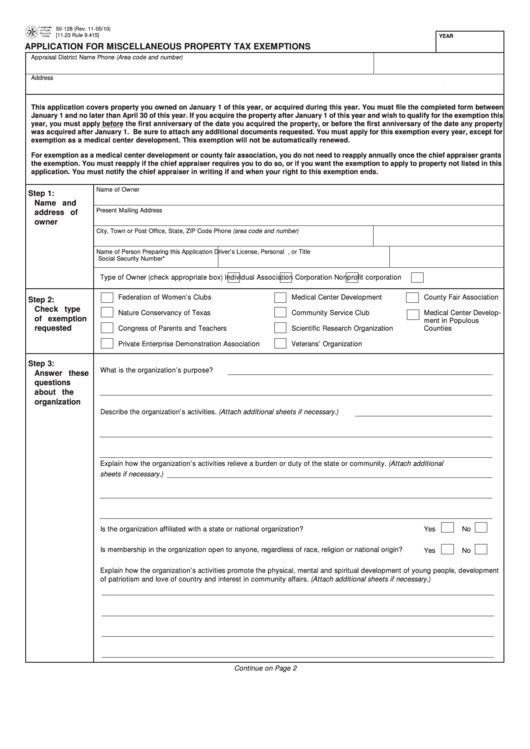

50-128 (Rev. 11-05/10)

[11.23 Rule 9.415]

YEAR

APPLICATION FOR MISCELLANEOUS PROPERTY TAX EXEMPTIONS

Appraisal District Name

Phone (Area code and number)

Address

This application covers property you owned on January 1 of this year, or acquired during this year. You must file the completed form between

January 1 and no later than April 30 of this year. If you acquire the property after January 1 of this year and wish to qualify for the exemption this

year, you must apply before the first anniversary of the date you acquired the property, or before the first anniversary of the date any property

was acquired after January 1. Be sure to attach any additional documents requested. You must apply for this exemption every year, except for

exemption as a medical center development. This exemption will not be automatically renewed.

For exemption as a medical center development or county fair association, you do not need to reapply annually once the chief appraiser grants

the exemption. You must reapply if the chief appraiser requires you to do so, or if you want the exemption to apply to property not listed in this

application. You must notify the chief appraiser in writing if and when your right to this exemption ends.

Name of Owner

Step 1:

Name and

Present Mailing Address

address of

owner

City, Town or Post Office, State, ZIP Code

Phone (area code and number)

Name of Person Preparing this Application

Driver’s License, Personal I.D. Certificate, or

Title

Social Security Number*

Type of Owner (check appropriate box)

Individual

Association

Corporation

Nonprofit corporation

Federation of Women’s Clubs

Medical Center Development

County Fair Association

Step 2:

Check type

Nature Conservancy of Texas

Community Service Club

Medical Center Develop-

of exemption

ment in Populous

requested

Congress of Parents and Teachers

Scientific Research Organization

Counties

Private Enterprise Demonstration Association

Veterans’ Organization

Step 3:

What is the organization’s purpose?

Answer these

questions

about the

organization

Describe the organization’s activities. (Attach additional sheets if necessary.)

Explain how the organization’s activities relieve a burden or duty of the state or community. (Attach additional

sheets if necessary.)

Is the organization affiliated with a state or national organization?

Yes

No

Is membership in the organization open to anyone, regardless of race, religion or national origin?

Yes

No

Explain how the organization’s activities promote the physical, mental and spiritual development of young people, development

of patriotism and love of country and interest in community affairs. (Attach additional sheets if necessary.)

Continue on Page 2

1

1 2

2 3

3 4

4