Purchases By Homes For The Aged Are No Longer Subject To Communications Services Tax Form

ADVERTISEMENT

TIP # 03A19-07

DATE ISSUED: July 24, 2003

PURCHASES BY HOMES FOR THE AGED ARE NO LONGER SUBJECT TO

COMMUNICATIONS SERVICES TAX

Sales of communications services are subject to communications services tax, except when

specifically exempt. Homes for the aged have been provided an exemption from this tax by the 2003

Legislature. The legislation has no effect on sales by homes for the aged.

As of July 1, 2003, purchases of communications services by a home for the aged that is exempt from

federal income tax under section 501(c)(3) of the Internal Revenue Code (I.R.C.) are exempt from

both the state and local communications services tax when the home for the aged is a nonprofit

corporation:

in which at least 75 percent of the occupants are 62 years of age or older or totally and

permanently disabled; that qualifies for an ad valorem property tax exemption under section

196.196, 196.197, or 196.1975, Florida Statutes (F.S.); and that is exempt from sales tax

imposed under Chapter 212, F.S.; or

that is licensed as a nursing home or an assisted living facility under Chapter 400, F.S., and is

exempt from sales tax imposed under Chapter 212, F.S.

In order to claim this exemption, the home for the aged must issue a certificate to the selling dealer at

the time of purchase. The certificate must be signed by an authorized representative and state that the

purchases are for a home for the aged, as defined by s. 202.125(4), F.S., that is exempt from federal

income tax under s. 501(c)(3), I.R.C. Dealers are not required to obtain copies of Internal Revenue

Service determination letters granting the home an exemption under s. 501(c)(3), I.R.C., and a home

for the aged does not need to provide a selling dealer with a copy of its determination letter.

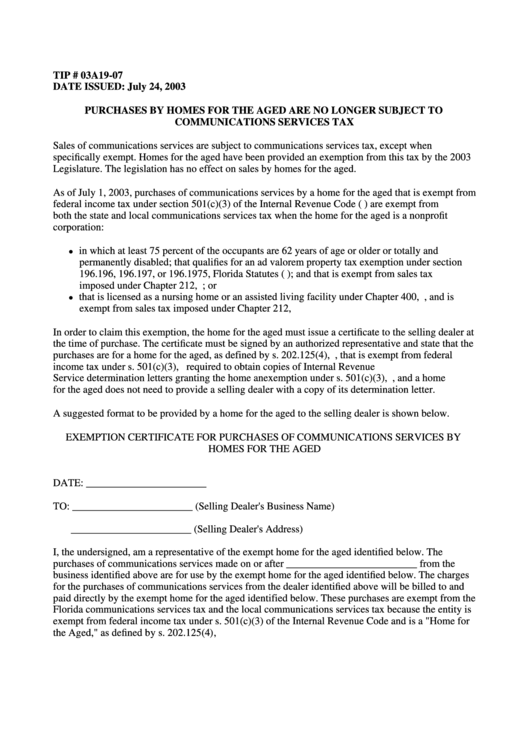

A suggested format to be provided by a home for the aged to the selling dealer is shown below.

EXEMPTION CERTIFICATE FOR PURCHASES OF COMMUNICATIONS SERVICES BY

HOMES FOR THE AGED

DATE: _______________________

TO: _______________________ (Selling Dealer's Business Name)

_______________________ (Selling Dealer's Address)

I, the undersigned, am a representative of the exempt home for the aged identified below. The

purchases of communications services made on or after _________________________ from the

business identified above are for use by the exempt home for the aged identified below. The charges

for the purchases of communications services from the dealer identified above will be billed to and

paid directly by the exempt home for the aged identified below. These purchases are exempt from the

Florida communications services tax and the local communications services tax because the entity is

exempt from federal income tax under s. 501(c)(3) of the Internal Revenue Code and is a "Home for

the Aged," as defined by s. 202.125(4), F.S.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2