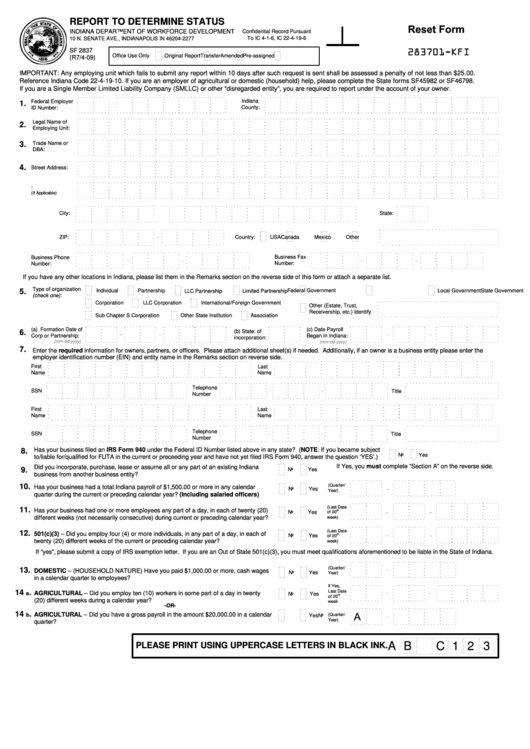

REPORT TO DETERMINE STATUS

Reset Form

INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT

Confidential Record Pursuant

To IC 4-1-6, IC 22-4-19-6

10 N. SENATE AVE., INDIANAPOLIS IN 46204-2277

283701-KFI

SF 2837

Office Use Only

Original Report

Transfer

Amended

Pre-assigned

(R7/4-09)

IMPORTANT: Any employing unit which fails to submit any report within 10 days after such request is sent shall be assessed a penalty of not less than $25.00.

Reference Indiana Code 22-4-19-10. If you are an employer of agricultural or domestic (household) help, please complete the State forms SF45982 or SF46798.

If you are a Single Member Limited Liability Company (SMLLC) or other “disregarded entity”, you are required to report under the account of your owner.

Indiana

Federal Employer

1.

County:

ID Number:

Legal Name of

2.

Employing Unit:

3.

Trade Name or

DBA:

4.

Street Address:

P.O. Box:

(If Applicable)

City:

State:

ZIP:

Country:

USA

Canada

Mexico

Other

Business Fax

Business Phone

Number:

Number:

If you have any other locations in Indiana, please list them in the Remarks section on the reverse side of this form or attach a separate list.

Type of organization

5.

Individual

Partnership

Federal Government

State Government

Local Government

LLC Partnership

Limited Partnership

(check one):

Corporation

LLC Corporation

International/Foreign Government

Other (Estate, Trust,

Receivership, etc.) Identify

Sub Chapter S Corporation

Other State Institution

Association

(a) Formation Date of

(c) Date Payroll

(b) State: of

6.

Corp or Partnership:

Began in Indiana:

incorporation:

(mm-dd-yyyy)

(mm-dd-yyyy)

7.

Enter the required information for owners, partners, or officers. Please attach additional sheet(s) if needed. Additionally, if an owner is a business entity please enter the

employer identification number (EIN) and entity name in the Remarks section on reverse side.

First

Last

Name

Name

Telephone

SSN

Title

Number

First

Last

Name

Name

Telephone

SSN

Title

Number

Has your business filed an IRS Form 940 under the Federal ID Number listed above in any state? (NOTE: If you became subject

8.

Yes

No

to/liable for/qualified for FUTA in the current or preceeding year and have not yet filed IRS Form 940, answer the question ‘YES’.)

If Yes, you must complete “Section A” on the reverse side.

Did you incorporate, purchase, lease or assume all or any part of an existing Indiana

9.

No

Yes

business from another business entity?

10.

(Quarter/

Has your business had a total Indiana payroll of $1,500.00 or more in any calendar

No

Yes

Year)

quarter during the current or preceding calendar year? (Including salaried officers)

(Last Date

11.

Has your business had one or more employees any part of a day, in each of twenty (20)

th

No

Yes

of 20

different weeks (not necessarily consecutive) during current or preceding calendar year?

week)

(Last Date

12.

501(c)(3) – Did you employ four (4) or more individuals, in any part of a day, in each of

th

No

Yes

of 20

twenty (20) different weeks of the current or preceding calendar year?

week)

If “yes”, please submit a copy of IRS exemption letter. If you are an Out of State 501(c)(3), you must meet qualifications aforementioned to be liable in the State of Indiana.

(Quarter/

13.

DOMESTIC – (HOUSEHOLD NATURE) Have you paid $1,000.00 or more, cash wages

No

Yes

Year)

in a calendar quarter to employees?

If Yes,

14

.

Last Date

AGRICULTURAL – Did you employ ten (10) workers in some part of a day in twenty

a

No

Yes

th

of 20

(20) different weeks during a calendar year?

week

-OR-

A

14

.

AGRICULTURAL – Did you have a gross payroll in the amount $20,000.00 in a calendar

b

(Quarter/

No

Yes

Year)

quarter?

A B

3

C 1 2

PLEASE PRINT USING UPPERCASE LETTERS IN BLACK INK.

1

1 2

2