Sales Tax Return Form - Jefferson City

ADVERTISEMENT

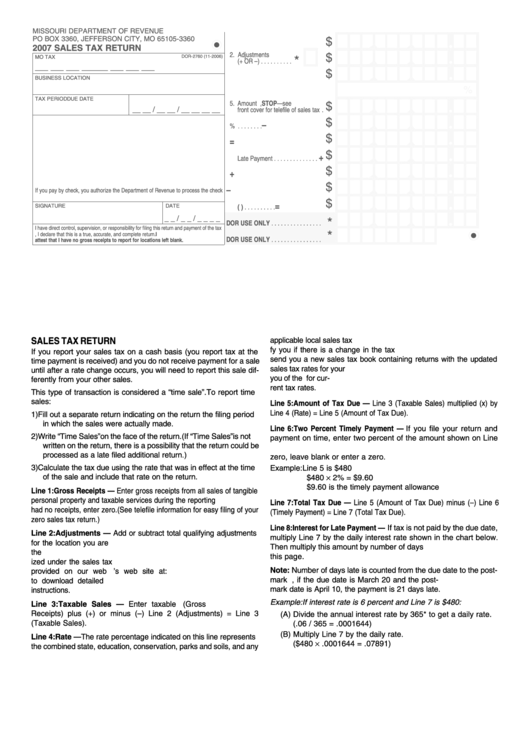

MISSOURI DEPARTMENT OF REVENUE

PO BOX 3360, JEFFERSON CITY, MO 65105-3360

$

1. Gross Receipts . . . . . . . . . . . . . .

•

2007 SALES TAX RETURN

2. Adjustments

$

DOR-2760 (11-2006)

MO TAX I.D. NUMBER

*

(+ OR –) . . . . . . . . . .

•

___ ___ ___ ___ ___ ___ ___ ___

$

3. Taxable Sales . . . . . . . . . . . . . . .

•

BUSINESS LOCATION

%

4. Rate . . . . . . . . . . . . . . . . . . . . . . .

TAX PERIOD

DUE DATE

5. Amount Due. If zero, STOP—see

$

__ __ / __ __ / __ __ __ __

front cover for telefile of sales tax .

•

$

–

6. Timely Payment 2% . . . . . . . .

•

$

=

7. Total Tax Due . . . . . . . . . . . . . .

•

8. Interest for

$

+

Late Payment . . . . . . . . . . . . . .

•

$

+

9. Additions to Tax . . . . . . . . . . . .

•

$

–

If you pay by check, you authorize the Department of Revenue to process the check

10. Approved Credit . . . . . . . . . . . .

•

electronically. Any check returned unpaid may be presented again electronically.

11. Pay This Amount

$

=

SIGNATURE

DATE

(U.S. Funds Only) . . . . . . . . . .

•

_ _ / _ _ / _ _ _ _

*

DOR USE ONLY . . . . . . . . . . . . . . . .

•

I have direct control, supervision, or responsibility for filing this return and payment of the tax

*

due. Under penalties of perjury, I declare that this is a true, accurate, and complete return. I

DOR USE ONLY . . . . . . . . . . . . . . . .

attest that I have no gross receipts to report for locations left blank.

SALES TAX RETURN

applicable local sales tax rates. The Department of Revenue will noti-

fy you if there is a change in the tax rate. The department will also

If you report your sales tax on a cash basis (you report tax at the

send you a new sales tax book containing returns with the updated

time payment is received) and you do not receive payment for a sale

sales tax rates for your location. Failure to be notified does not relieve

until after a rate change occurs, you will need to report this sale dif-

you of the tax. Access for cur-

ferently from your other sales.

rent tax rates.

This type of transaction is considered a “time sale”. To report time

sales:

Line 5: Amount of Tax Due — Line 3 (Taxable Sales) multiplied (x) by

Line 4 (Rate) = Line 5 (Amount of Tax Due).

1) Fill out a separate return indicating on the return the filing period

in which the sales were actually made.

Line 6: Two Percent Timely Payment — If you file your return and

2) Write “Time Sales” on the face of the return. (If “Time Sales” is not

payment on time, enter two percent of the amount shown on Line

written on the return, there is a possibility that the return could be

5. If not filed or paid by the due date or if Line 5 is not greater than

processed as a late filed additional return.)

zero, leave blank or enter a zero.

3) Calculate the tax due using the rate that was in effect at the time

Example: Line 5 is $480

$480 × 2% = $9.60

of the sale and include that rate on the return.

$9.60 is the timely payment allowance

Line 1: Gross Receipts — Enter gross receipts from all sales of tangible

personal property and taxable services during the reporting period. If you

Line 7: Total Tax Due — Line 5 (Amount of Tax Due) minus (–) Line 6

had no receipts, enter zero. (See telefile information for easy filing of your

(Timely Payment) = Line 7 (Total Tax Due).

zero sales tax return.)

Line 8: Interest for Late Payment — If tax is not paid by the due date,

Line 2: Adjustments — Add or subtract total qualifying adjustments

multiply Line 7 by the daily interest rate shown in the chart below.

for the location you are reporting. Indicate a plus or a minus sign for

Then multiply this amount by number of days late. See example on

the adjustments. Refer to detailed instructions for adjustments author-

this page.

ized under the sales tax law. Instructions are updated annually and

Note: Number of days late is counted from the due date to the post-

provided on our web site.

Visit the department’s web site at:

mark date. For example, if the due date is March 20 and the post-

forms/ to download detailed

mark date is April 10, the payment is 21 days late.

instructions.

Example: If interest rate is 6 percent and Line 7 is $480:

Line 3: Taxable Sales — Enter taxable sales. Line 1 (Gross

Receipts) plus (+) or minus (–) Line 2 (Adjustments) = Line 3

(A) Divide the annual interest rate by 365* to get a daily rate.

(Taxable Sales).

(.06 / 365 = .0001644)

(B) Multiply Line 7 by the daily rate.

Line 4: Rate — The rate percentage indicated on this line represents

($480 × .0001644 = .07891)

the combined state, education, conservation, parks and soils, and any

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2