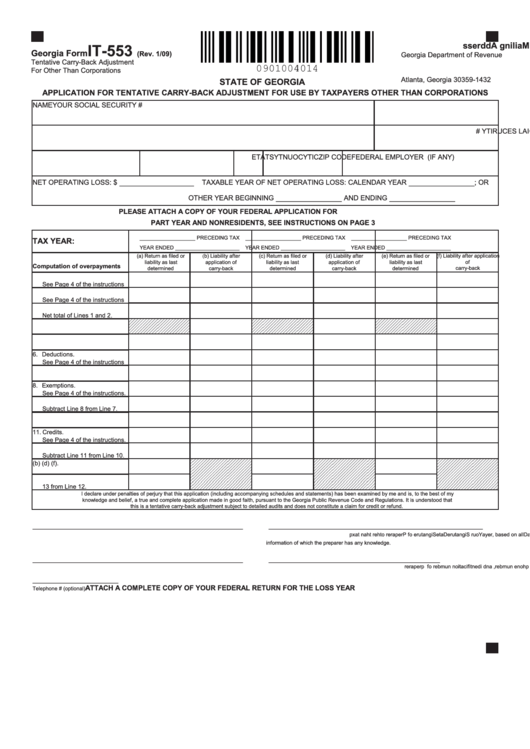

Georgia Form It-553 - Application For Tentative Carry-Back Adjustment For Use By Taxpayers Other Than Corporations - 2009

ADVERTISEMENT

IT-553

M

a

l i

n i

g

A

d

d

e r

s

s

Georgia Form

(Rev. 1/09)

Georgia Department of Revenue

Tentative Carry-Back Adjustment

N.O.L. Section

For Other Than Corporations

P.O. Box 49432

Atlanta, Georgia 30359-1432

STATE OF GEORGIA

APPLICATION FOR TENTATIVE CARRY-BACK ADJUSTMENT FOR USE BY TAXPAYERS OTHER THAN CORPORATIONS

NAME

YOUR SOCIAL SECURITY #

N

U

M

B

E

, R

S

T

R

E

E

, T

A

N

D

A

P

. T

O

R

S

U

T I

E

N

U

M

B

E

R

S

P

O

U

S

E

S ’

S

O

C

A I

L

S

E

C

U

R

T I

Y

#

C

T I

Y

C

O

U

N

T

Y

S

T

A

T

E

ZIP CODE

FEDERAL EMPLOYER I.D. NUMBER (IF ANY)

_________________

_______________

NET OPERATING LOSS: $

TAXABLE YEAR OF NET OPERATING LOSS: CALENDAR YEAR

; OR

_______________

_______________

OTHER YEAR BEGINNING

AND ENDING

PLEASE ATTACH A COPY OF YOUR FEDERAL APPLICATION FOR N.O.L. ADJUSTMENT

PART YEAR AND NONRESIDENTS, SEE INSTRUCTIONS ON PAGE 3

___________________ PRECEDING TAX

___________________ PRECEDING TAX

___________________ PRECEDING TAX

TAX YEAR:

YEAR ENDED ______________________

YEAR ENDED ______________________

YEAR ENDED ______________________

(a) Return as filed or

(b) Liability after

(c) Return as filed or

(d) Liability after

(e) Return as filed or

(f) Liability after application

of

liability as last

application of

liability as last

application of

liability as last

Computation of overpayments

determined

carry-back

determined

carry-back

determined

carry-back

1. Federal adjusted gross income

See Page 4 of the instructions

2. Georgia adjustments.

See Page 4 of the instructions

3. Georgia adjusted gross income

Net total of Lines 1 and 2.

4. Net operating loss.

5. Subtract Line 4 from Line 3

6. Deductions.

See Page 4 of the instructions

7. Subtract Line 6 from Line 5.

8. Exemptions.

See Page 4 of the instructions.

9. Taxable income.

Subtract Line 8 from Line 7.

10. Income Tax.

11. Credits.

See Page 4 of the instructions.

12. Tax after credits.

Subtract Line 11 from Line 10.

13. Less Line 12 (b) (d) (f).

14. Decrease in tax. Subtract Line

13 from Line 12.

I declare under penalties of perjury that this application (including accompanying schedules and statements) has been examined by me and is, to the best of my

knowledge and belief, a true and complete application made in good faith, pursuant to the Georgia Public Revenue Code and Regulations. It is understood that

this is a tentative carry-back adjustment subject to detailed audits and does not constitute a claim for credit or refund.

______________________________________________________

_______________________________________________________

Y

o

r u

S

g i

n

a

u t

e r

D

a

e t

S

g i

n

a

u t

e r

f o

P

e r

p

r a

r e

o

h t

r e

h t

a

n

a t

p x

ayer, based on all

Date

information of which the preparer has any knowledge.

______________________________________________________

____________________________________________

S

p

o

u

s

e

s ’

S

g i

n

a

u t

e r

D

a

e t

N

a

m

, e

p

h

o

n

e

n

u

m

b

e

, r

a

n

d

d i

e

n

i t

c i f

t a

o i

n

n

u

m

b

r e

f o

p

e r

p

r a

r e

______________________

ATTACH A COMPLETE COPY OF YOUR FEDERAL RETURN FOR THE LOSS YEAR

Telephone # (optional)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3