Instructions For Schedule 8812 - Child Tax Credit - 2012

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

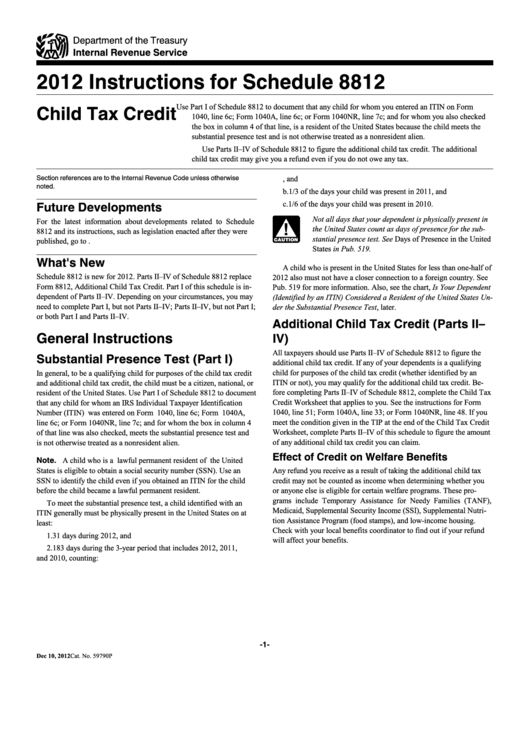

2012 Instructions for Schedule 8812

Child Tax Credit

Use Part I of Schedule 8812 to document that any child for whom you entered an ITIN on Form

1040, line 6c; Form 1040A, line 6c; or Form 1040NR, line 7c; and for whom you also checked

the box in column 4 of that line, is a resident of the United States because the child meets the

substantial presence test and is not otherwise treated as a nonresident alien.

Use Parts II–IV of Schedule 8812 to figure the additional child tax credit. The additional

child tax credit may give you a refund even if you do not owe any tax.

Section references are to the Internal Revenue Code unless otherwise

a. All the days your child was present in 2012, and

noted.

b. 1/3 of the days your child was present in 2011, and

Future Developments

c. 1/6 of the days your child was present in 2010.

Not all days that your dependent is physically present in

For the latest information about developments related to Schedule

!

the United States count as days of presence for the sub

8812 and its instructions, such as legislation enacted after they were

stantial presence test. See Days of Presence in the United

published, go to

CAUTION

States in Pub. 519.

What's New

A child who is present in the United States for less than one-half of

Schedule 8812 is new for 2012. Parts II–IV of Schedule 8812 replace

2012 also must not have a closer connection to a foreign country. See

Form 8812, Additional Child Tax Credit. Part I of this schedule is in-

Pub. 519 for more information. Also, see the chart, Is Your Dependent

dependent of Parts II–IV. Depending on your circumstances, you may

(Identified by an ITIN) Considered a Resident of the United States Un

need to complete Part I, but not Parts II–IV; Parts II–IV, but not Part I;

der the Substantial Presence Test, later.

or both Part I and Parts II–IV.

Additional Child Tax Credit (Parts II–

General Instructions

IV)

All taxpayers should use Parts II–IV of Schedule 8812 to figure the

Substantial Presence Test (Part I)

additional child tax credit. If any of your dependents is a qualifying

child for purposes of the child tax credit (whether identified by an

In general, to be a qualifying child for purposes of the child tax credit

ITIN or not), you may qualify for the additional child tax credit. Be-

and additional child tax credit, the child must be a citizen, national, or

fore completing Parts II–IV of Schedule 8812, complete the Child Tax

resident of the United States. Use Part I of Schedule 8812 to document

Credit Worksheet that applies to you. See the instructions for Form

that any child for whom an IRS Individual Taxpayer Identification

1040, line 51; Form 1040A, line 33; or Form 1040NR, line 48. If you

Number (ITIN) was entered on Form 1040, line 6c; Form 1040A,

meet the condition given in the TIP at the end of the Child Tax Credit

line 6c; or Form 1040NR, line 7c; and for whom the box in column 4

Worksheet, complete Parts II–IV of this schedule to figure the amount

of that line was also checked, meets the substantial presence test and

of any additional child tax credit you can claim.

is not otherwise treated as a nonresident alien.

Effect of Credit on Welfare Benefits

Note. A child who is a lawful permanent resident of the United

States is eligible to obtain a social security number (SSN). Use an

Any refund you receive as a result of taking the additional child tax

SSN to identify the child even if you obtained an ITIN for the child

credit may not be counted as income when determining whether you

before the child became a lawful permanent resident.

or anyone else is eligible for certain welfare programs. These pro-

grams include Temporary Assistance for Needy Families (TANF),

To meet the substantial presence test, a child identified with an

Medicaid, Supplemental Security Income (SSI), Supplemental Nutri-

ITIN generally must be physically present in the United States on at

tion Assistance Program (food stamps), and low-income housing.

least:

Check with your local benefits coordinator to find out if your refund

1. 31 days during 2012, and

will affect your benefits.

2. 183 days during the 3-year period that includes 2012, 2011,

and 2010, counting:

-1-

Dec 10, 2012

Cat. No. 59790P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3