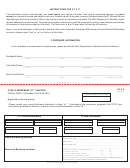

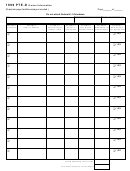

Form 51a205 - Account Maintenance Information

ADVERTISEMENT

51A205 (4-14)

KENTUCKY SALES AND

Commonwealth of Kentucky

USE TAX INSTRUCTIONS

DEPARTMENT OF REVENUE

Due Date—The return must be postmarked on or before the

will be $100. This includes zero tax due returns that are filed late

due date in order to be considered timely. If the due date falls

when a jeopardy or estimated assessment has been issued. In

on a weekend or legal holiday, the return must be postmarked

addition, criminal penalties for willful violations are provided

on the next business day. A timely return must be filed, even

by KRS 139.990.

if no sales were made or no tax is due. If during a filing period

Example: The August return is due September 20 but the

you did not make any sales and did not purchase any items

return was filed on October 28 (before a jeopardy or estimated

subject to tax on line 23(a) or 23(b), write (0) on lines 1 and 20

assessment was issued by the department). Tax due on the

and sign the signature block.

return was $1,000.

Itemized Deductions—To properly identify the specific

Computation of late filing penalty:

deductions claimed on the return, write in the applicable

Tax Due

$1,000.00

deduction codes from the top portion of the worksheet in lines

The return was 38 days late

2–19 of the return itself. For example, if resale certificates are

so the penalty is 4%

x .04

on file to cover a portion of the total receipts recorded in line 1,

(2% x two penalty periods)

label the resale portion of receipts as code 020 in the deduction

Late filing penalty (Computed penalty

section of the return.

is greater than the $10 minimum)

$

40.00

The return provides space for only 10 itemized deductions. If

Computation of late payment penalty:

more than 10 different deduction codes apply for a reporting

period, please contact the Division of Sales and Use Tax via

Tax Due

$1,000.00

telephone or e-mail for further instructions.

The payment was 38 days late

so the penalty is 4%

x .04

When using the Other Codes 170, 180 or 190, be sure to describe

(2% x two penalty periods)

the type of deduction(s) and amount(s) on the worksheet for

Late payment penalty (Computed penalty

your own records and in the description box on the reverse

is greater than the $10 minimum)

$

40.00

side of the return for Department of Revenue verification.

Penalty Amounts—The penalties are for (a) late filing of a return

Total penalties for the return are $80.

and (b) late payment of the tax due. Both of these penalties

Total Penalty and Interest—The combined penalty and interest

can apply to the same filing period.

totaled on line 32 of the worksheet is not carried down to the

These penalties are computed on the amount of tax due on the

return itself. The sales tax system automatically totals the

return. Each is 2 percent of the tax due on the return for each

amounts, so the line item sequence from line 31 to line 33 on

30 days or fraction thereof that the return or payment is late.

the return is by design. HB 704, effective May 1, 2008, requires

The minimum amount of each penalty is $10. The percentage

interest on underpayments to be computed at 2% above the

of each penalty will not exceed 20 percent of the total amount

annual rate per KRS 131.183. See the June 2008 Kentucky Sales

of tax due. Both penalties can apply to a return. Penalty Note:

Tax Facts for additional interest revisions.

For any jeopardy assessment or estimated assessment issued

(See Back for Further Information)

for periods after January 1, 2003, the minimum late file penalty

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2