Claim Form For Exemption Of Property

ADVERTISEMENT

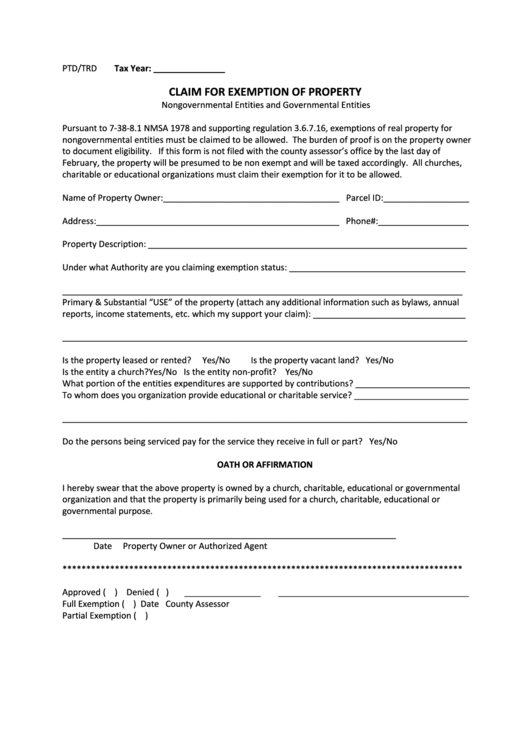

PTD/TRD

Tax Year: _______________

CLAIM FOR EXEMPTION OF PROPERTY

Nongovernmental Entities and Governmental Entities

Pursuant to 7-38-8.1 NMSA 1978 and supporting regulation 3.6.7.16, exemptions of real property for

nongovernmental entities must be claimed to be allowed. The burden of proof is on the property owner

to document eligibility. If this form is not filed with the county assessor’s office by the last day of

February, the property will be presumed to be non exempt and will be taxed accordingly. All churches,

charitable or educational organizations must claim their exemption for it to be allowed.

Name of Property Owner:_____________________________________ Parcel ID:__________________

Address:___________________________________________________ Phone#:___________________

Property Description: ___________________________________________________________________

Under what Authority are you claiming exemption status: _____________________________________

____________________________________________________________________________________

Primary & Substantial “USE” of the property (attach any additional information such as bylaws, annual

reports, income statements, etc. which my support your claim): ________________________________

_____________________________________________________________________________________

Is the property leased or rented?

Yes/No

Is the property vacant land? Yes/No

Is the entity a church? Yes/No

Is the entity non-profit? Yes/No

What portion of the entities expenditures are supported by contributions? ________________________

To whom does you organization provide educational or charitable service? ________________________

_____________________________________________________________________________________

Do the persons being serviced pay for the service they receive in full or part? Yes/No

OATH OR AFFIRMATION

I hereby swear that the above property is owned by a church, charitable, educational or governmental

organization and that the property is primarily being used for a church, charitable, educational or

governmental purpose.

_______________________

_______________________________________________

Date

Property Owner or Authorized Agent

************************************************************************************

Approved ( ) Denied ( )

________________

________________________________________

Full Exemption ( )

Date

County Assessor

Partial Exemption ( )

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1