Form Gr-1040es - Instructions For Grand Rapids Declaration Of Estimated Income Tax - 2011

ADVERTISEMENT

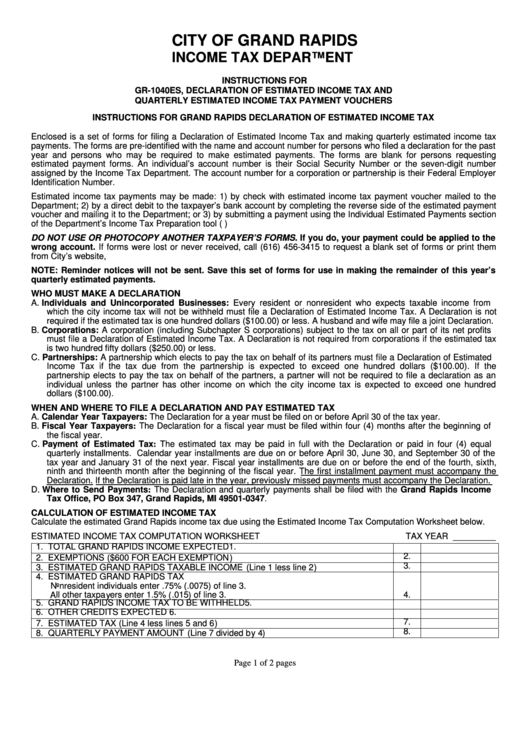

CITY OF GRAND RAPIDS

INCOME TAX DEPARTMENT

INSTRUCTIONS FOR

GR-1040ES, DECLARATION OF ESTIMATED INCOME TAX AND

QUARTERLY ESTIMATED INCOME TAX PAYMENT VOUCHERS

INSTRUCTIONS FOR GRAND RAPIDS DECLARATION OF ESTIMATED INCOME TAX

Enclosed is a set of forms for filing a Declaration of Estimated Income Tax and making quarterly estimated income tax

payments. The forms are pre-identified with the name and account number for persons who filed a declaration for the past

year and persons who may be required to make estimated payments. The forms are blank for persons requesting

estimated payment forms. An individual’s account number is their Social Security Number or the seven-digit number

assigned by the Income Tax Department. The account number for a corporation or partnership is their Federal Employer

Identification Number.

Estimated income tax payments may be made: 1) by check with estimated income tax payment voucher mailed to the

Department; 2) by a direct debit to the taxpayer’s bank account by completing the reverse side of the estimated payment

voucher and mailing it to the Department; or 3) by submitting a payment using the Individual Estimated Payments section

of the Department’s Income Tax Preparation tool ( )

DO NOT USE OR PHOTOCOPY ANOTHER TAXPAYER’S FORMS. If you do, your payment could be applied to the

wrong account. If forms were lost or never received, call (616) 456-3415 to request a blank set of forms or print them

from City’s website,

NOTE: Reminder notices will not be sent. Save this set of forms for use in making the remainder of this year’s

quarterly estimated payments.

WHO MUST MAKE A DECLARATION

A. Individuals and Unincorporated Businesses: Every resident or nonresident who expects taxable income from

which the city income tax will not be withheld must file a Declaration of Estimated Income Tax. A Declaration is not

required if the estimated tax is one hundred dollars ($100.00) or less. A husband and wife may file a joint Declaration.

B. Corporations: A corporation (including Subchapter S corporations) subject to the tax on all or part of its net profits

must file a Declaration of Estimated Income Tax. A Declaration is not required from corporations if the estimated tax

is two hundred fifty dollars ($250.00) or less.

C. Partnerships: A partnership which elects to pay the tax on behalf of its partners must file a Declaration of Estimated

Income Tax if the tax due from the partnership is expected to exceed one hundred dollars ($100.00). If the

partnership elects to pay the tax on behalf of the partners, a partner will not be required to file a declaration as an

individual unless the partner has other income on which the city income tax is expected to exceed one hundred

dollars ($100.00).

WHEN AND WHERE TO FILE A DECLARATION AND PAY ESTIMATED TAX

A. Calendar Year Taxpayers: The Declaration for a year must be filed on or before April 30 of the tax year.

B. Fiscal Year Taxpayers: The Declaration for a fiscal year must be filed within four (4) months after the beginning of

the fiscal year.

C. Payment of Estimated Tax: The estimated tax may be paid in full with the Declaration or paid in four (4) equal

quarterly installments. Calendar year installments are due on or before April 30, June 30, and September 30 of the

tax year and January 31 of the next year. Fiscal year installments are due on or before the end of the fourth, sixth,

ninth and thirteenth month after the beginning of the fiscal year. The first installment payment must accompany the

Declaration. If the Declaration is paid late in the year, previously missed payments must accompany the Declaration.

D. Where to Send Payments: The Declaration and quarterly payments shall be filed with the Grand Rapids Income

Tax Office, PO Box 347, Grand Rapids, MI 49501-0347.

CALCULATION OF ESTIMATED INCOME TAX

Calculate the estimated Grand Rapids income tax due using the Estimated Income Tax Computation Worksheet below.

ESTIMATED INCOME TAX COMPUTATION WORKSHEET

TAX YEAR _________

1. TOTAL GRAND RAPIDS INCOME EXPECTED

1.

2. EXEMPTIONS ($600 FOR EACH EXEMPTION)

2.

3. ESTIMATED GRAND RAPIDS TAXABLE INCOME (Line 1 less line 2)

3.

4. ESTIMATED GRAND RAPIDS TAX

Nonresident individuals enter .75% (.0075) of line 3.

All other taxpayers enter 1.5% (.015) of line 3.

4.

5. GRAND RAPIDS INCOME TAX TO BE WITHHELD

5.

6. OTHER CREDITS EXPECTED

6.

7. ESTIMATED TAX (Line 4 less lines 5 and 6)

7.

8. QUARTERLY PAYMENT AMOUNT (Line 7 divided by 4)

8.

Page 1 of 2 pages

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3