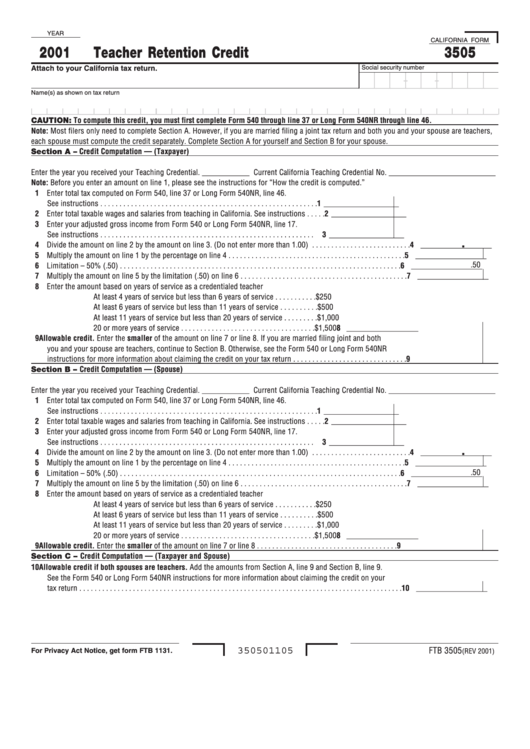

California Form 3505 - Teacher Retention Credit - 2001

ADVERTISEMENT

YEAR

CALIFORNIA FORM

2001

Teacher Retention Credit

3505

Attach to your California tax return.

Social security number

-

-

Name(s) as shown on tax return

CAUTION: To compute this credit, you must first complete Form 540 through line 37 or Long Form 540NR through line 46.

Note: Most filers only need to complete Section A. However, if you are married filing a joint tax return and both you and your spouse are teachers,

each spouse must compute the credit separately. Complete Section A for yourself and Section B for your spouse.

Section A – Credit Computation — (Taxpayer)

Enter the year you received your Teaching Credential. ____________ Current California Teaching Credential No. ___________________________

Note: Before you enter an amount on line 1, please see the instructions for “How the credit is computed.”

1 Enter total tax computed on Form 540, line 37 or Long Form 540NR, line 46.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 ___________________

2 Enter total taxable wages and salaries from teaching in California. See instructions . . . . . 2 ___________________

3 Enter your adjusted gross income from Form 540 or Long Form 540NR, line 17.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 ___________________

.

4 Divide the amount on line 2 by the amount on line 3. (Do not enter more than 1.00) . . . . . . . . . . . . . . . . . . . . . . . . . . 4 __________________

5 Multiply the amount on line 1 by the percentage on line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 __________________

.50

6 Limitation – 50% (.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 __________________

7 Multiply the amount on line 5 by the limitation (.50) on line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 __________________

8 Enter the amount based on years of service as a credentialed teacher

At least 4 years of service but less than 6 years of service . . . . . . . . . . . $ 250

At least 6 years of service but less than 11 years of service . . . . . . . . . . $ 500

At least 11 years of service but less than 20 years of service . . . . . . . . . $1,000

20 or more years of service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,500

8 __________________

9 Allowable credit. Enter the smaller of the amount on line 7 or line 8. If you are married filing joint and both

you and your spouse are teachers, continue to Section B. Otherwise, see the Form 540 or Long Form 540NR

instructions for more information about claiming the credit on your tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Section B – Credit Computation — (Spouse)

Enter the year you received your Teaching Credential. ____________ Current California Teaching Credential No. ___________________________

1 Enter total tax computed on Form 540, line 37 or Long Form 540NR, line 46.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 ___________________

2 Enter total taxable wages and salaries from teaching in California. See instructions . . . . . 2 ___________________

3 Enter your adjusted gross income from Form 540 or Long Form 540NR, line 17.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 ___________________

.

4 Divide the amount on line 2 by the amount on line 3. (Do not enter more than 1.00) . . . . . . . . . . . . . . . . . . . . . . . . . . 4 __________________

5 Multiply the amount on line 1 by the percentage on line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 __________________

.50

6 Limitation – 50% (.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 __________________

7 Multiply the amount on line 5 by the limitation (.50) on line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 __________________

8 Enter the amount based on years of service as a credentialed teacher

At least 4 years of service but less than 6 years of service . . . . . . . . . . . $ 250

At least 6 years of service but less than 11 years of service . . . . . . . . . . $ 500

At least 11 years of service but less than 20 years of service . . . . . . . . . $1,000

20 or more years of service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,500

8 __________________

9 Allowable credit. Enter the smaller of the amount on line 7 or line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Section C – Credit Computation — (Taxpayer and Spouse)

10 Allowable credit if both spouses are teachers. Add the amounts from Section A, line 9 and Section B, line 9.

See the Form 540 or Long Form 540NR instructions for more information about claiming the credit on your

tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 __________________

350501105

FTB 3505

For Privacy Act Notice, get form FTB 1131.

(REV 2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1