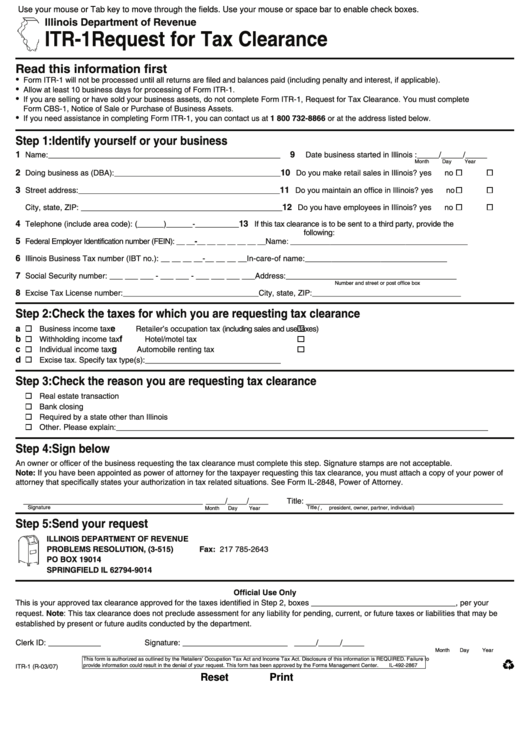

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

ITR-1 Request for Tax Clearance

Read this information first

•

Form ITR-1 will not be processed until all returns are filed and balances paid (including penalty and interest, if applicable).

•

Allow at least 10 business days for processing of Form ITR-1.

•

If you are selling or have sold your business assets, do not complete Form ITR-1, Request for Tax Clearance. You must complete

Form CBS-1, Notice of Sale or Purchase of Business Assets.

•

If you need assistance in completing Form ITR-1, you can contact us at 1 800 732-8866 or at the address listed below.

Step 1: Identify yourself or your business

1

9

Name: _____________________________________________________

Date business started in Illinois :_____/_____/_____

Month

Day

Year

2

10

Doing business as (DBA):______________________________________

Do you make retail sales in Illinois?

yes

no

3

11

Street address: ______________________________________________

Do you maintain an office in Illinois?

yes

no

12

City, state, ZIP: ______________________________________________

Do you have employees in Illinois?

yes

no

4

13

Telephone (include area code): (______)______-__________

If this tax clearance is to be sent to a third party, provide the

following:

5

Federal Employer Identification number (FEIN): __ __-__ __ __ __ __ __ __

Name: ________________________________________

6

Illinois Business Tax number (IBT no.): __ __ __ __-__ __ __ __

In-care-of name: ________________________________

7

Social Security number: ___ ___ ___ - ___ ___ - ___ ___ ___ ___

Address:_______________________________________

Number and street or post office box

8

Excise Tax License number:_______________________________

City, state, ZIP:__________________________________

Step 2: Check the taxes for which you are requesting tax clearance

a

e

Business income tax

Retailer’s occupation tax (including sales and use taxes)

b

f

Withholding income tax

Hotel/motel tax

c

g

Individual income tax

Automobile renting tax

d

Excise tax. Specify tax type(s):_______________________________

Step 3: Check the reason you are requesting tax clearance

Real estate transaction

Bank closing

Required by a state other than Illinois

Other. Please explain:_____________________________________________________________________________________

Step 4: Sign below

An owner or officer of the business requesting the tax clearance must complete this step. Signature stamps are not acceptable.

Note: If you have been appointed as power of attorney for the taxpayer requesting this tax clearance, you must attach a copy of your power of

attorney that specifically states your authorization in tax related situations. See Form IL-2848, Power of Attorney.

_________________________________________ _____/_____/_____

Title: _____________________________________________

Signature

Month

Day

Year

Title (i.e., president, owner, partner, individual)

Step 5: Send your request

ILLINOIS DEPARTMENT OF REVENUE

PROBLEMS RESOLUTION, (3-515)

Fax: 217 785-2643

PO BOX 19014

SPRINGFIELD IL 62794-9014

Official Use Only

This is your approved tax clearance approved for the taxes identified in Step 2, boxes _________________________________, per your

request. Note: This tax clearance does not preclude assessment for any liability for pending, current, or future taxes or liabilities that may be

established by present or future audits conducted by the department.

Clerk ID: ____________

Signature: ________________________ _____/_____/_____

Month

Day

Year

This form is authorized as outlined by the Retailers’ Occupation Tax Act and Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in the denial of your request. This form has been approved by the Forms Management Center.

IL-492-2867

ITR-1 (R-03/07)

Reset

Print

1

1