Form Wv/eft-6 - Electronic Funds Transfer Application For Payroll Service Companies

ADVERTISEMENT

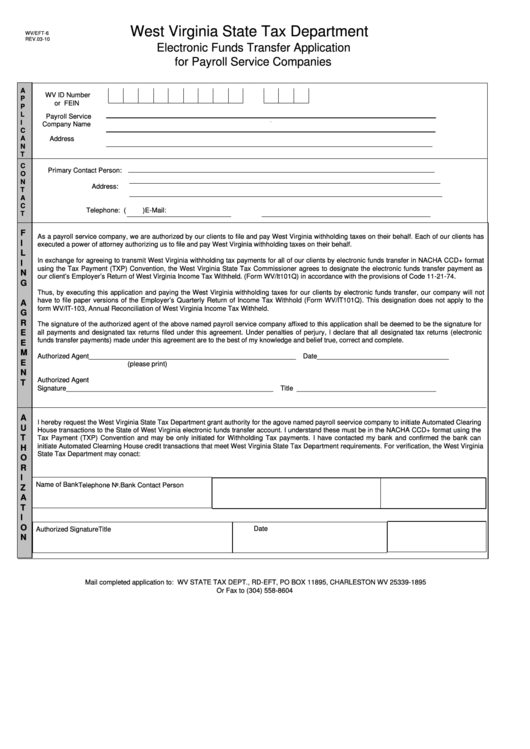

West Virginia State Tax Department

WV/EFT-6

REV.03-10

Electronic Funds Transfer Application

for Payroll Service Companies

A

WV ID Number

P

or FEIN

P

L

Payroll Service

I

Company Name

C

A

Address

N

T

C

Primary Contact Person:

O

N

Address:

T

A

C

Telephone: (

)

E-Mail:

T

F

As a payroll service company, we are authorized by our clients to file and pay West Virginia withholding taxes on their behalf. Each of our clients has

I

executed a power of attorney authorizing us to file and pay West Virginia withholding taxes on their behalf.

L

In exchange for agreeing to transmit West Virginia withholding tax payments for all of our clients by electronic funds transfer in NACHA CCD+ format

I

using the Tax Payment (TXP) Convention, the West Virginia State Tax Commissioner agrees to designate the electronic funds transfer payment as

N

our client’s Employer’s Return of West Virginia Income Tax Withheld. (Form WV/It101Q) in accordance with the provisions of Code 11-21-74.

G

Thus, by executing this application and paying the West Virginia withholding taxes for our clients by electronic funds transfer, our company will not

have to file paper versions of the Employer’s Quarterly Return of Income Tax Withhold (Form WV/IT101Q). This designation does not apply to the

A

form WV/IT-103, Annual Reconciliation of West Virginia Income Tax Withheld.

G

R

The signature of the authorized agent of the above named payroll service company affixed to this application shall be deemed to be the signature for

E

all payments and designated tax returns filed under this agreement. Under penalties of perjury, I declare that all designated tax returns (electronic

funds transfer payments) made under this agreement are to the best of my knowledge and belief true, correct and complete.

E

M

Authorized Agent

_______________________________________________________

Date

___________________________________

E

(please print)

N

Authorized Agent

T

Signature

_______________________________________________________

Title _____________________________________

A

I hereby request the West Virginia State Tax Department grant authority for the agove named payroll seervice company to initiate Automated Clearing

U

House transactions to the State of West Virginia electronic funds transfer account. I understand these must be in the NACHA CCD+ format using the

T

Tax Payment (TXP) Convention and may be only initiated for Withholding Tax payments. I have contacted my bank and confirmed the bank can

initiate Automated Clearning House credit transactions that meet West Virginia State Tax Department requirements. For verification, the West Virginia

H

State Tax Department may conact:

O

R

I

Name of Bank

Bank Contact Person

Telephone No.

Z

A

T

I

O

Date

Authorized Signature

Title

N

Mail completed application to: WV STATE TAX DEPT., RD-EFT, PO BOX 11895, CHARLESTON WV 25339-1895

Or Fax to (304) 558-8604

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1