Housing Enterprise Zone Investment Tax Credit Form

ADVERTISEMENT

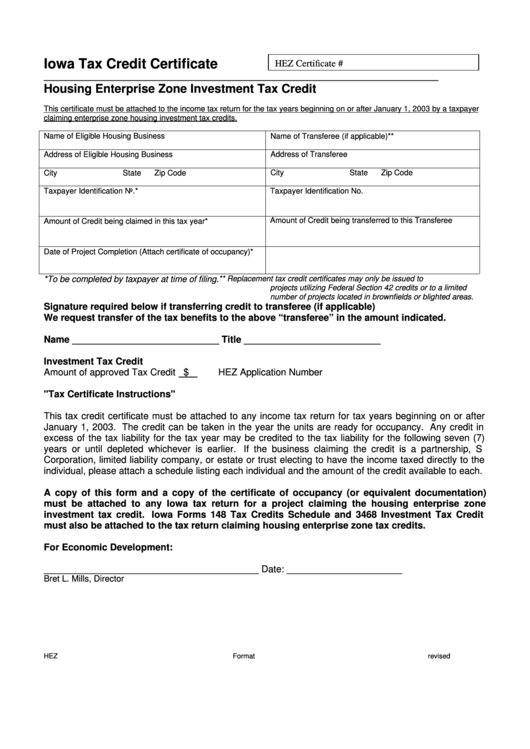

Iowa Tax Credit Certificate

HEZ Certificate #

___________________________________________________________________________________

Housing Enterprise Zone Investment Tax Credit

This certificate must be attached to the income tax return for the tax years beginning on or after January 1, 2003 by a taxpayer

claiming enterprise zone housing investment tax credits.

Name of Eligible Housing Business

Name of Transferee (if applicable)**

Address of Eligible Housing Business

Address of Transferee

City

State

Zip Code

City

State

Zip Code

Taxpayer Identification No.*

Taxpayer Identification No.

Amount of Credit being claimed in this tax year*

Amount of Credit being transferred to this Transferee

Date of Project Completion (Attach certificate of occupancy)*

*To be completed by taxpayer at time of filing.

** Replacement tax credit certificates may only be issued to

projects utilizing Federal Section 42 credits or to a limited

number of projects located in brownfields or blighted areas.

Signature required below if transferring credit to transferee (if applicable)

We request transfer of the tax benefits to the above “transferee” in the amount indicated.

Name ____________________________ Title __________________________

Investment Tax Credit

Amount of approved Tax Credit $

HEZ Application Number

"Tax Certificate Instructions"

This tax credit certificate must be attached to any income tax return for tax years beginning on or after

January 1, 2003. The credit can be taken in the year the units are ready for occupancy. Any credit in

excess of the tax liability for the tax year may be credited to the tax liability for the following seven (7)

years or until depleted whichever is earlier. If the business claiming the credit is a partnership, S

Corporation, limited liability company, or estate or trust electing to have the income taxed directly to the

individual, please attach a schedule listing each individual and the amount of the credit available to each.

A copy of this form and a copy of the certificate of occupancy (or equivalent documentation)

must be attached to any Iowa tax return for a project claiming the housing enterprise zone

investment tax credit. Iowa Forms 148 Tax Credits Schedule and 3468 Investment Tax Credit

must also be attached to the tax return claiming housing enterprise zone tax credits.

For Economic Development:

_________________________________________ Date: ______________________

Bret L. Mills, Director

HEZ

Format revised 3/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1