NEW YORK CITY DEPARTMENT OF FINANCE

PROPERTY TAX EXEMPTION UNIT

EXEMPTION FROM REAL ESTATE TAXATION FOR

F I N A N C E

PROPER TY OWNED BY NONPROFIT ORGANIZATIONS

NEW YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

A P P L I C A T I O N

nyc.gov/finance

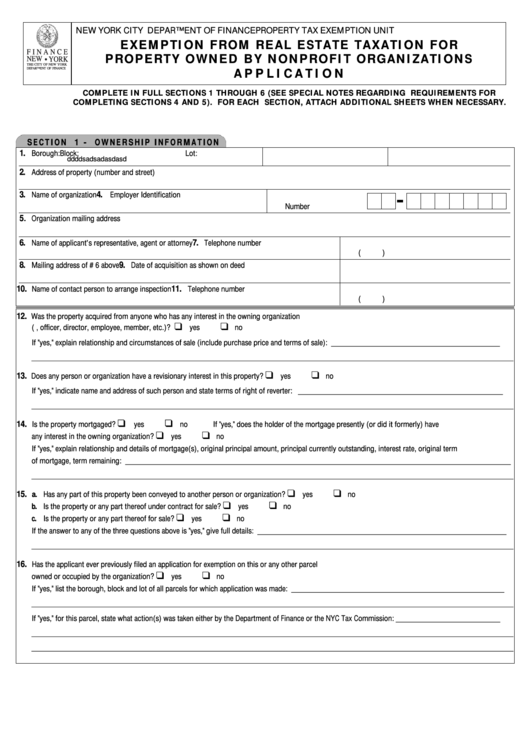

COMPLETE IN FULL SECTIONS 1 THROUGH 6 (SEE SPECIAL NOTES REGARDING REQUIREMENTS FOR

COMPLETING SECTIONS 4 AND 5). FOR EACH SECTION, ATTACH ADDITIONAL SHEETS WHEN NECESSARY.

S E C T I O N 1 - O W N E R S H I P I N F O R M A T I O N

1.

Borough:

Block:

Lot:

ddddsadsadasdasd

2.

Address of property (number and street)

3.

4.

Name of organization

Employer Identification

Number

5

. Organization mailing address

6.

7.

Name of applicant's representative, agent or attorney

Telephone number

(

)

8.

9.

Mailing address of # 6 above

Date of acquisition as shown on deed

10.

11.

Name of contact person to arrange inspection

Telephone number

(

)

12.

Was the property acquired from anyone who has any interest in the owning organization

(e.g., officer, director, employee, member, etc.)? ...................................................................................

yes

no

If "yes," explain relationship and circumstances of sale (include purchase price and terms of sale): __________________________________________

________________________________________________________________________________________________________________________

13.

Does any person or organization have a revisionary interest in this property?........................................

yes

no

If "yes," indicate name and address of such person and state terms of right of reverter: ___________________________________________________

________________________________________________________________________________________________________________________

14.

Is the property mortgaged? ............

yes

no

If "yes," does the holder of the mortgage presently (or did it formerly) have

any interest in the owning organization? .................................................................................................

yes

no

If "yes," explain relationship and details of mortgage(s), original principal amount, principal currently outstanding, interest rate, original term

of mortgage, term remaining: ________________________________________________________________________________________________

________________________________________________________________________________________________________________________

15.

a. Has any part of this property been conveyed to another person or organization? .............................

yes

no

b. Is the property or any part thereof under contract for sale? ..............................................................

yes

no

c. Is the property or any part thereof for sale? ......................................................................................

yes

no

If the answer to any of the three questions above is "yes," give full details: ______________________________________________________________

________________________________________________________________________________________________________________________

16.

Has the applicant ever previously filed an application for exemption on this or any other parcel

owned or occupied by the organization? ................................................................................................

yes

no

If "yes," list the borough, block and lot of all parcels for which application was made: _____________________________________________________

________________________________________________________________________________________________________________________

If "yes," for this parcel, state what action(s) was taken either by the Department of Finance or the NYC Tax Commission: __________________________

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

1

1 2

2 3

3 4

4 5

5