Use your 'Mouse' or 'Tab key' to move through the fields.

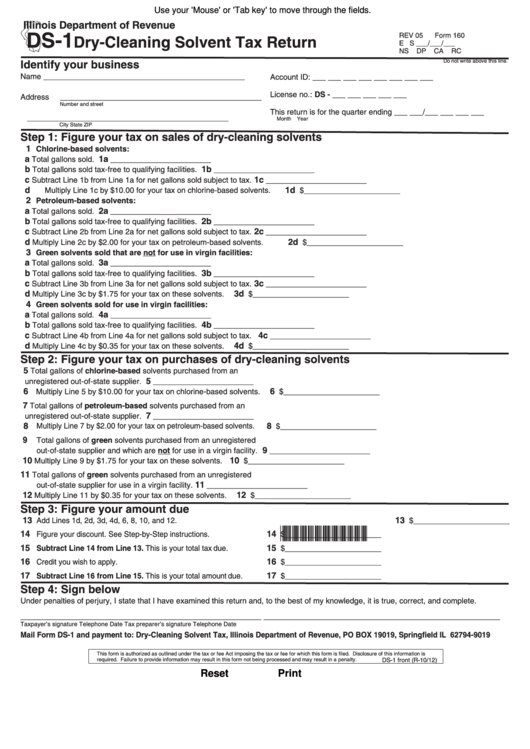

Illinois Department of Revenue

DS-1

REV 05 Form 160

Dry-Cleaning Solvent Tax Return

E S

___/___/___

NS DP CA RC

Identify your business

Do not write above this line.

Name

______________________________________________

Account ID: ___ ___ ___ ___ ___ ___ ___ ___

License no.: DS - ___ ___ ___ ___ ___

Address ______________________________________________

Number and street

This return is for the quarter ending ___ ___/___ ___ ___ ___

______________________________________________

Month

Year

City

State

ZIP

Step 1: Figure your tax on sales of dry-cleaning solvents

1

Chlorine-based solvents:

a

1a

Total gallons sold.

_______________________

b

1b

Total gallons sold tax-free to qualifying facilities.

_______________________

c

1c

Subtract Line 1b from Line 1a for net gallons sold subject to tax.

_______________________

d

1d

Multiply Line 1c by $10.00 for your tax on chlorine-based solvents.

$______________________

2

Petroleum-based solvents:

a

2a

Total gallons sold.

_______________________

b

2b

Total gallons sold tax-free to qualifying facilities.

_______________________

c

2c

Subtract Line 2b from Line 2a for net gallons sold subject to tax.

_______________________

d

2d

Multiply Line 2c by $2.00 for your tax on petroleum-based solvents.

$______________________

3

Green solvents sold that are not for use in virgin facilities:

a

3a

Total gallons sold.

_______________________

b

3b

Total gallons sold tax-free to qualifying facilities.

_______________________

c

3c

Subtract Line 3b from Line 3a for net gallons sold subject to tax.

_______________________

d

3d

Multiply Line 3c by $1.75 for your tax on these solvents.

$______________________

4

Green solvents sold for use in virgin facilities:

a

4a

Total gallons sold.

_______________________

b

4b

Total gallons sold tax-free to qualifying facilities.

_______________________

c

4c

Subtract Line 4b from Line 4a for net gallons sold subject to tax.

_______________________

d

4d

Multiply Line 4c by $0.35 for your tax on these solvents.

$______________________

Step 2: Figure your tax on purchases of dry-cleaning solvents

5

Total gallons of chlorine-based solvents purchased from an

5

unregistered out-of-state supplier.

_______________________

6

6

Multiply Line 5 by $10.00 for your tax on chlorine-based solvents.

$______________________

7

Total gallons of petroleum-based solvents purchased from an

7

unregistered out-of-state supplier.

_______________________

8

8

Multiply Line 7 by $2.00 for your tax on petroleum-based solvents.

$______________________

9

Total gallons of green solvents purchased from an unregistered

9

out-of-state supplier and which are not for use in a virgin facility.

_______________________

1 0

10

Multiply Line 9 by $1.75 for your tax on these solvents.

$______________________

11

Total gallons of green solvents purchased from an unregistered

11

out-of-state supplier for use in a virgin facility.

_______________________

1 2

12

Multiply Line 11 by $0.35 for your tax on these solvents.

$______________________

Step 3: Figure your amount due

1 3

13

Add Lines 1d, 2d, 3d, 4d, 6, 8, 10, and 12.

$______________________

*216001110*

14

14

Figure your discount. See Step-by-Step instructions.

$______________________

15

15

Subtract Line 14 from Line 13. This is your total tax due.

$______________________

16

16

Credit you wish to apply.

$______________________

17

17

Subtract Line 16 from Line 15. This is your total amount due.

$______________________

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

______________________________________________________

Taxpayer’s signature

Telephone

Date

Tax preparer’s signature

Telephone

Date

Mail Form DS-1 and payment to: Dry-Cleaning Solvent Tax, Illinois Department of Revenue, PO BOX 19019, Springfield IL 62794-9019

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is

DS-1 front (R-10/12)

required. Failure to provide information may result in this form not being processed and may result in a penalty.

Reset

Print

1

1